Apparently catching up with the rest of the world in the field of automated “algorithmic” trading, commodity traders are rapidly adopting Artificial Intelligence as a new tool to determine market price direction.

For many years, commodity traders relied on fundamental data, market rumors, and pure trader instinct to navigate their markets. However, with computerization, and in particular, the Internet, the world is a much smaller and faster moving place. Traders who could move trends on rumor and run markets to take out buy and sell stops have seen their profit margins dwindling. Now, rather than looking for gutsy traders willing to “have a go”, commodity companies are now more inclined to hire mathematical and computer whiz kids to sit around their trading desks. Market flow is now taking a backroom position to pattern recognition and artificial intelligence.

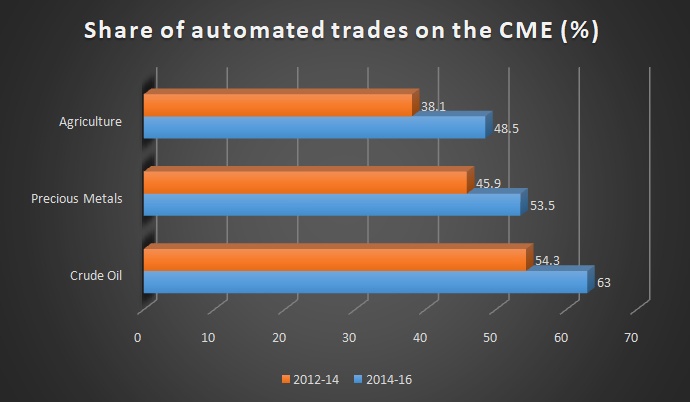

Automated trading is on the rise in the commodities markets, with increases extending to 25% in some financial futures sectors, like grains and oilseeds, in the years 2014-2016. This is a direct result of shrinking margins, following the immediate dissemination of news, weather reports, and online cargo tracking. In the past, commodity traders easily saw profits in excess of 50%.Those profits have been halved, forcing them to look for other methods to make gains.

Algo-trading is increasing in the commodity markets

Trading is now driven by computer geeks, with dealing rooms looking for young people with PhDs in physics and mathematics. These young men and women are hired to sift through banks of historical prices in an attempt to find patterns within the charts. The data is then fed back into the computer, and forecasts are made for future price movements, which are then assessed for profitability.

Many traditional commodity firms have declared that the “new trading” is producing results, and that profits are back on the rise. On the downside, such algorithmic trading also has an effect on futures prices, making hedging a more difficult task. In spite of that, automated commodity contract trading is growing rapidly. Indeed, some traders are forming partnerships with algorithmic funds that specialize in “quant”, or quantitative trading.

But the road to full automation is not an easy one. There is still great resistance to fully handing over trading decisions to robots. Many old traders are wary of taking trading decisions out of the hands of humans, and they’re probably right. However, these computerized tools do have intrinsic value, and in the hands of experienced traders who can follow the old adages of cutting losses short and running profits, the overall trading strategy can only be enhanced.

Merrill Lynch, who performed extensive computer optimization programs back in the 1970s, found that patterns could be identified in specific markets. However, when those patterns were applied to future market movement, invariably those programs lost money. This was possibly due to the error of assuming that any financial market is like a giant human brain that can learn from its successes and failures. Any person who has traded in the market will know that markets can change direction in an instant for reasons that only become apparent weeks or months later. This type of behavior is difficult to program. Merrill Lynch’s conclusion was that computer technical analysis is particularly helpful when tracking market price movement and for giving buy and sell signals, but this trading activity must be conducted in parallel with solid money management.

All essays, research and information found above represent the analysis and opinion of Leverate only. As such it may prove wrong and be a subject to change without notice. Opinions and analysis were based on data available to the author of the respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Leverate does not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Leverate is not a Registered Securities Advisor. By reading Leverate’s reports you fully agree that they will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investment trading and speculation in any financial markets may involve risk of loss.e risk of loss.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.