Nikkei May Return to 2018 Highs?

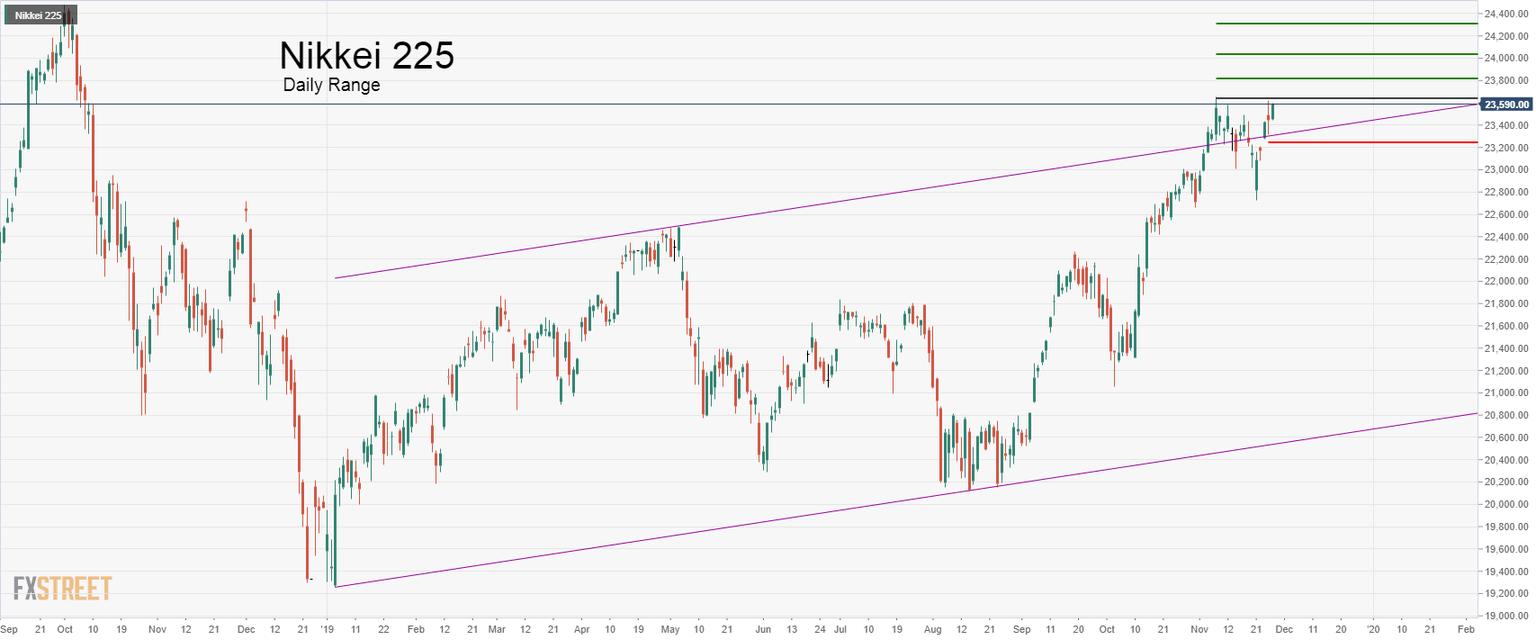

The Japanese index Nikkei 225 continues consolidating at the top of an ascending channel, which has been progressing since the Christmas 2018 low. In this article, we will comment on our arguments for positioning on the long side.

1. Fundamental traders could maintain their upward vision in Nikkei, supported by the continuation of the quantitative facilitation program by the Bank of Japan (BoJ). On the other hand, the upward sentiment persists in the global equity markets.

2. Price action continues to maintain skyward pressure in the upper trendline of the ascending channel.

3. If the price rises and closes above 23,606 points, Nikkei would activate our position on the buy-side. The target of our conservative scenario is located at 23,828 points. If the Japanese index continues with the forecasted rally, the next target levels are 24,023 points and 24,297 points.

4. The bullish scenario will be invalid if Nikkei closes below 23,243 points, or if the price fails to close above 23,606 points.

5. Geopolitical uncertainties could mark the risk of the bullish scenario. For example, the trade negotiations between the United States and China. We have to remember that December 15 is an important date for the "phase one" agreement in which, if it is not signed, the United States Government could apply new additional tariffs to China.

Trading Plan Summary

Entry Level: 23,606 pts.

Protective Stop: 23,243 pts.

1st Profit Target: 23,828 pts.

2nd Profit Target: 24,023 pts.

3rd Profit Target: 24,297 pts.

Author

EagleFX Team

EagleFX

EagleFX Team is an international group of market analysts with skills in fundamental and technical analysis, applying several methods to assess the state and likelihood of price movements on Forex, Commodities, Indices, Metals and