The U.S. dollar pulled back on Wednesday amid a slight improvement in the emerging markets. Economic data was mostly quiet from the U.S.

Consumer prices in the UK advanced 2.7% on the year ending August 2018. This beat the median forecasts of a 2.4% increase. Core CPI also advanced 2.1% beating estimates of 1.8% increase.

Data from the U.S. saw housing starts rising at a modest pace last month. Housing starts rose 9.2% in August from the month before.

New Zealand's quarterly GDP report was released during the overnight trading session. The GDP advanced 1.0% during the three months ending June 2018. Economists were expecting a 0.8% increase during the period.

Later in the day, the Swiss National Bank will be holding its monetary policy meeting. The SNB is expected to leave its monetary policy unchanged at today's meeting.

The UK will be releasing the retail sales figures for the month. Forecasts show a 0.2% decline in retail sales following a 0.7% increase the month before.

The NY trading session will see the release of the Philly Fed manufacturing index. Activity is expected to show the index rising to 17.5.

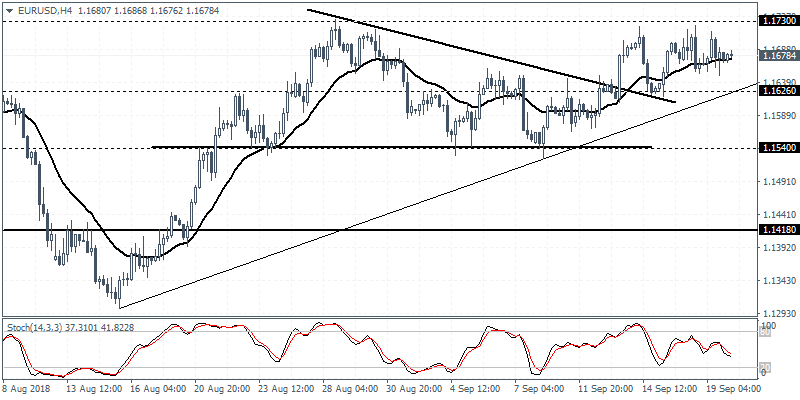

EURUSD intraday analysis

EURUSD (1.1678): The EURUSD currency pair was seen trading flat on Wednesday. Price action was seen stuck below 1.1730 resistance with brief attempts on an intraday basis. On the 4-hour chart, the EURUSD is seen trading slightly choppy as a result. The ranging price action could continue within the levels mentioned. A breakout from the range is however expected to set the direction in the trend in the near term.

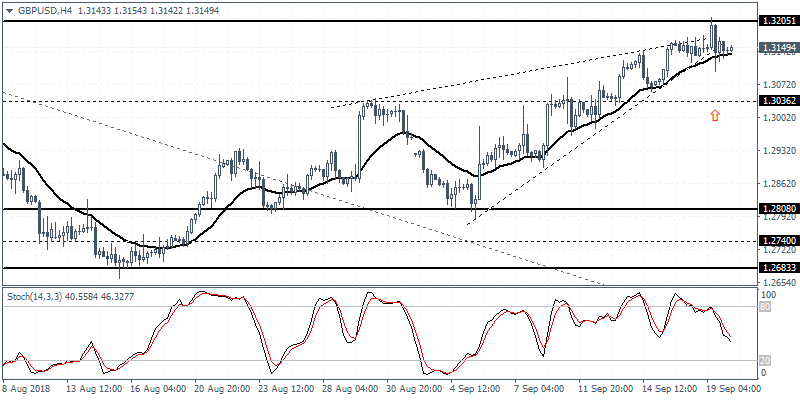

GBPUSD intraday analysis

GBPUSD (1.3149): The GBPUSD currency pair was seen briefly testing the resistance level at 1.3205 before easing back. We expect to see a solid retest of this level once again before price action could potentially post a pullback. The retest of the support at 1.3036 is likely to form. Establishing support at this level could put GBPUSD on track to breach the current resistance level at 1.3205.

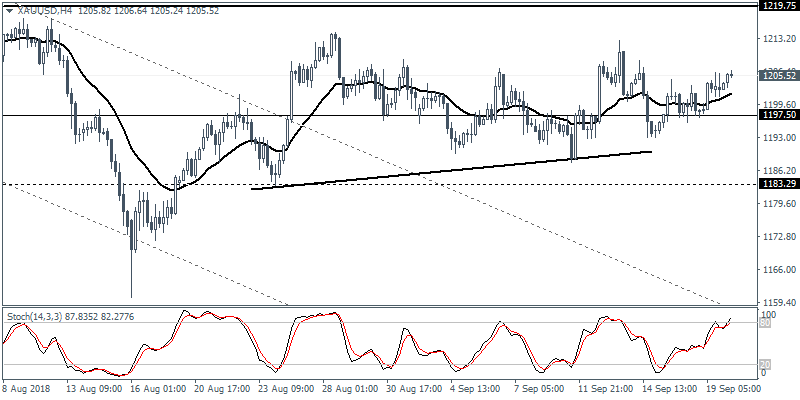

XAUUSD intraday analysis

XAUUSD (1205.52): Gold prices continue to consolidate above 1197.50 level of support. Price action remains broadly muted at this level. With gold trading above 1197.50, the sideways range is expected to continue. The upside resistance at 1219.75 is likely to cap any further gains. To the downside, we expect the support at 1197.50 to hold in the near term. A decline below this level could, however, post further losses pushing gold prices down to 1183.30 support.

This market forecast is for general information only. It is not an investment advice or a solution to buy or sell securities.

Authors' opinions do not represent the ones of Orbex and its associates. Terms and Conditions and the Privacy Policy apply.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange, you should carefully consider your investment objectives, level of experience, and risk appetite. There is a possibility that you may sustain a loss of some or all of your investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD holds below 1.0750 ahead of key US data

EUR/USD trades in a tight range below 1.0750 in the European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

GBP/USD consolidates above 1.2500, eyes on US PCE data

GBP/USD fluctuates at around 1.2500 in the European session on Friday following the three-day rebound. The PCE inflation data for March will be watched closely by market participants later in the day.

Gold clings to modest daily gains at around $2,350

Gold stays in positive territory at around $2,350 after closing in positive territory on Thursday. The benchmark 10-year US Treasury bond yield edges lower ahead of US PCE Price Index data, allowing XAU/USD to stretch higher.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.