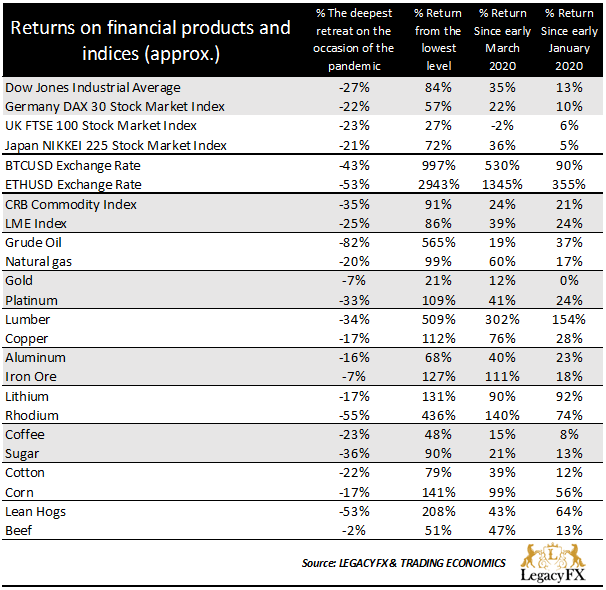

Despite the dramatic effects of the pandemic on the global economy, societies and businesses around the world, stock markets, financial products and commodities have recovered from the shockwaves of the pandemic crisis. In fact, not only have they recovered, but now many commodities, financial products and markets are expanding to new all-time highs. Indeed, while at the beginning of March 2020, when Covid 19 was declared a pandemic, there was a significant drop in prices for stock indices, financial products and commodities, their prices then recovered, thus creating satisfactory or even spectacular returns. As shown in the table below, even for commodities such as crude oil, which due to the global lockdown, its price fell sharply and lost more than 80% of its value, assuming that someone has maintained his position in this commodity since the beginning of the crisis, since March 2020, today records positive returns of about 19%. Even more impressive are the returns for some products, such as cryptocurrencies and products such as Lumber, Lithium, Rhodium, which also recorded significant losses due to the pandemic, but then recovered. Now their prices are not only at pre-pandemic levels, but at historically high levels thus offering excellent returns.

But these high returns to many investors and traders cause concern and perhaps anxiety as they occur at a time when the global economy and entrepreneurship, societies, and the labour market are still in crisis while it seems that everyone is trying to find their footsteps. Indeed, given that the health crisis is not over and that the crisis, even after its end, will leave significant "wounds" on the economy, society and businesses, the big question mark is whether the return of prices to pre-pandemic levels, but also at much higher levels can be justified.

To find justification, we may first need to accept that times have changed. In fact, we have already passed at a time that to evaluate the rise or fall of a price, we need a new approach of valuation in order to focus on the causes that indicate a value in the light of the following steps.

Step No1. large number of causes

We are now in an era where a single cause or a small number of causes, no matter how important they are, are not enough to guarantee a constant and steady rise in prices and growth, of markets, products, or commodities. The truth is that a small number of causes have never been able to keep prices in products, market indices, and commodities, on rising. However, today more than ever to keep prices rising there is a need for many causes. The more reasons, the better for the constant rise in prices. Thus, for example, the larger number of foundation and technical indicators that indicate movement in a particular direction, the stronger the movement and that direction.

Step No 2. diversification and interconnection of causes

We must look at if the causes that indicate the movement and the direction are diversified. The more diverse the causes, the better. At the same time, in addition to differentiation, one cause has to be interconnected with another cause, in a manner that should act as a complement and/or additive to the other cause. Thus, for example, the more diverse the fundamental and technical indicators that lead a direction and movement of a market, a product, or a commodity, and the more these indicators are interconnected in a way that one indicator is complementary and/or in addition to other indicators, the stronger the movement and the direction of this movement.

Step No3. coordination to a common purpose.

Beyond the large number, diversification, and interconnection of causes that indicate the movement and direction of a movement, to assess whether the direction and the movement are confirmed, we should look if the causes are coordinated in a way that they can serve a common purpose. If so, then the movement and direction of a market, a commodity, or a product is indeed confirmed. Thus, if in a large set of fundamental or technical indicators there is differentiation and interconnection between them that suggests the direction and movement of a market, a product, or a commodity, this is confirmed when these indicators are coordinated in a way that, it is served a common purpose.

Today most markets, products, and commodities seem to follow the above steps. Indeed, today there are many different causes that drive markets, products, and commodities. Causes, that for example, relate to macroeconomic policy decisions, where the policy of low-interest rates is applied globally. Causes that underscore the need to address global issues such as climate change policies. Causes related to the explosion of technology where, for example, innovation to solve global issues plays a key role. The above is a minimal example of causes where one cause acts complementary, but also additive to the other. Above all, all causes are coordinated to serve common purposes.

In this sense, the current direction of markets, commodities and financial products remains and is expected to remain strong.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. The Article/Information available on this website is for informational purposes only, you should not construe any such information or other material as investment advice or any other research recommendation. Nothing contained on this Article/ Information in this website constitutes a solicitation, recommendation, endorsement, or offer by LegacyFX and A.N. ALLNEW INVESTMENTS LIMITED in Cyprus or any affiliate Company, XE PRIME VENTURES LTD in Cayman Islands, AN All New Investments BY LLC in Belarus and AN All New Investments (VA) Ltd in Vanuatu to buy or sell any securities or other financial instruments in this or in in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction. LegacyFX and A.N. ALLNEW INVESTMENTS LIMITED in Cyprus or any affiliate Company, XE PRIME VENTURES LTD in Cayman Islands, AN All New Investments BY LLC in Belarus and AN All New Investments (VA) Ltd in Vanuatu are not liable for any possible claim for damages arising from any decision you make based on information or other Content made available to you through the website, but investors themselves assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other Article/ Information on the website before making any decisions based on such information or other Article.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.