Nasdaq tests bulls’ commitment

NAS 100 heads towards important support

The tech index retreats as investors continue to rotate out of growth-sensitive stocks. A dead cat bounce to 13800 has met stiff selling pressure, turning the former support into a resistance.

The nosedive below the temporary support level at 13400 is an indication that the short side has gained the upper hand.

12880 is a critical support from the daily chart as a bearish breakout could initiate a reversal in the medium term.

On the upside, the index may see a limited rebound while the RSI recovers into the neutrality area.

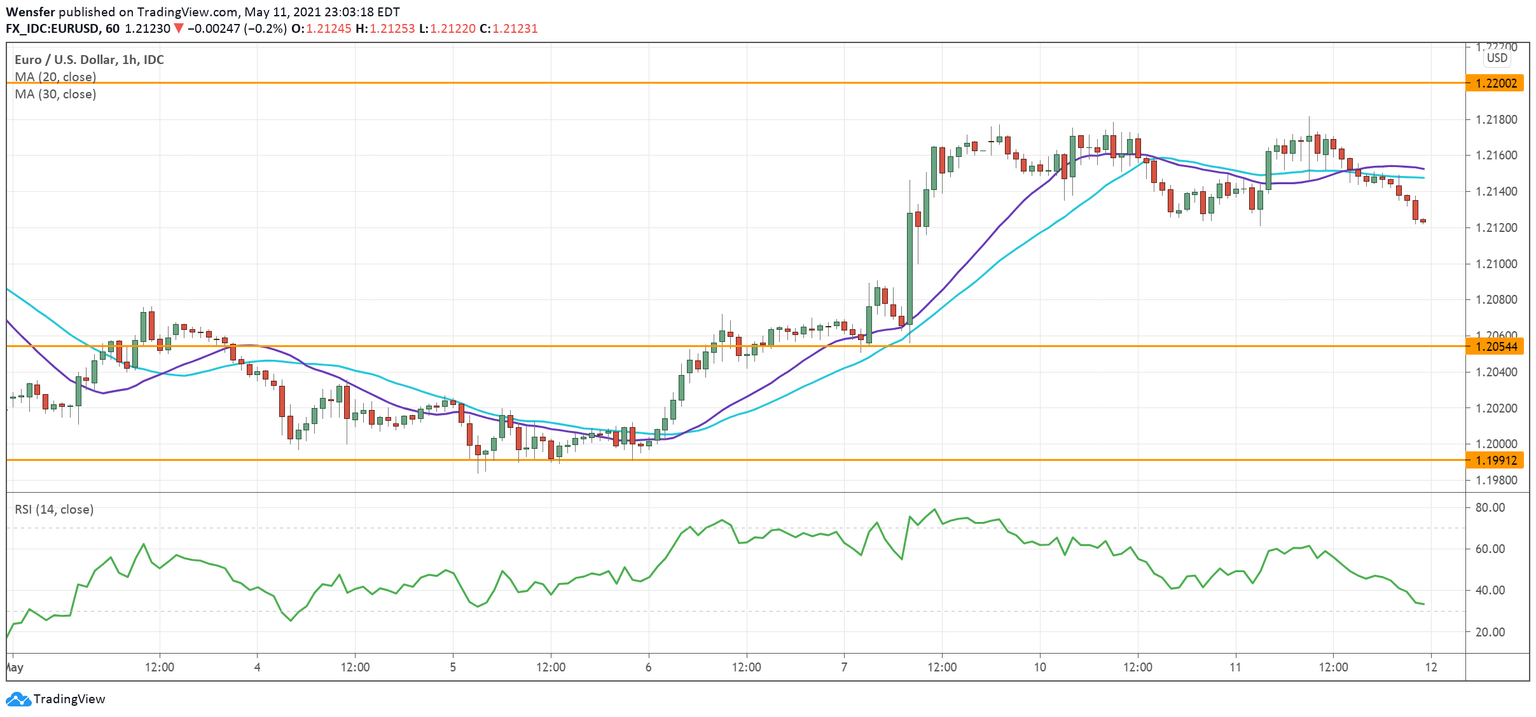

EUR/USD tests major resistance

The US dollar consolidates as traders await inflation data later today.

The price is currently hovering under the daily supply zone around 1.2200. A breakout would confirm the bullish MA and put the euro back on track towards 1.24.

However, the pair could be vulnerable to the downside as an overbought RSI indicates overextension. 1.2055 is the immediate support should there be a lack of momentum buyers.

Further down, 1.1990 near the 30-day moving average is a critical level to keep short-term sentiment upbeat.

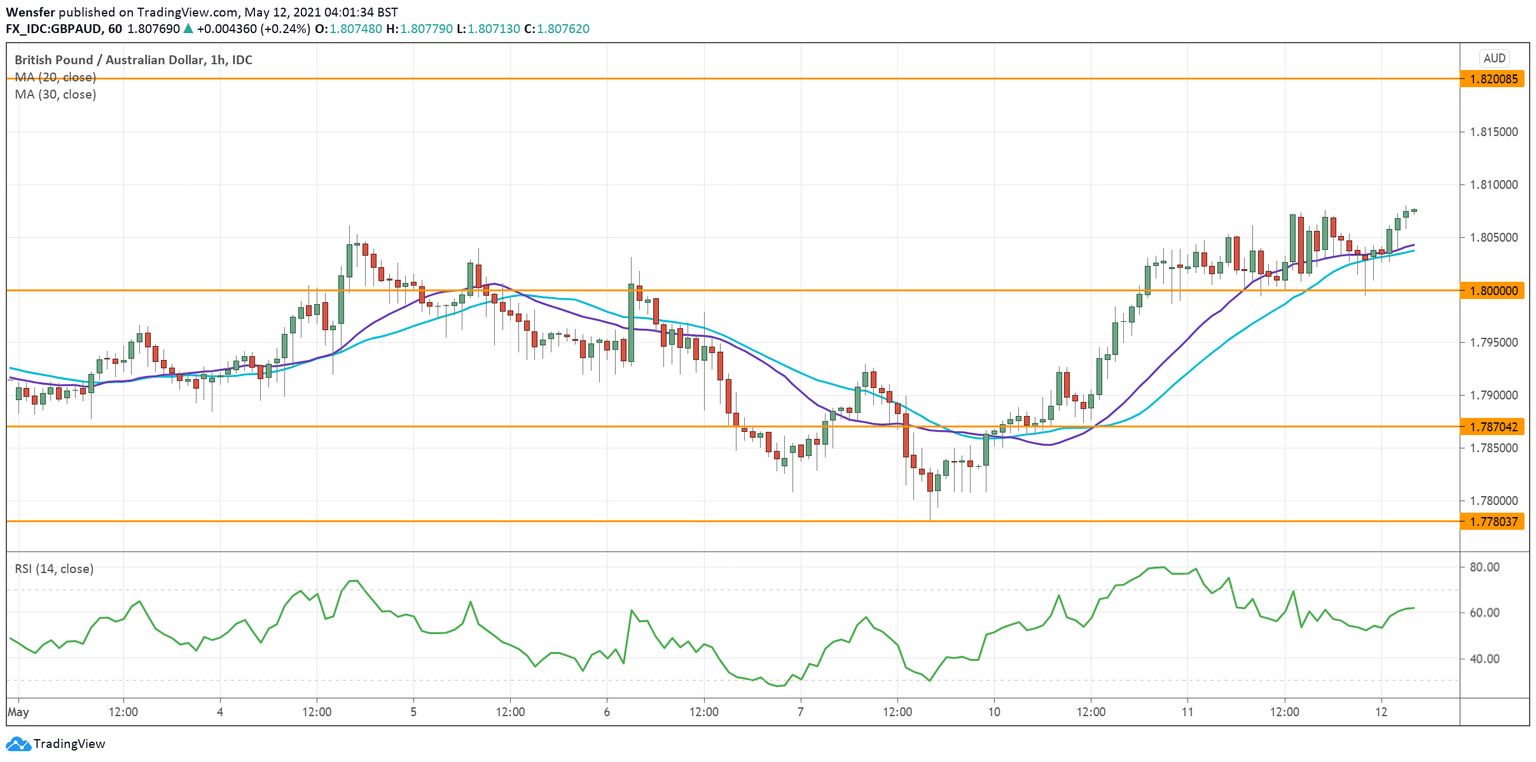

GBP/AUD breaks above double top

The Australian dollar softens as commodity prices pull back. The pair has been grinding up steadily from its support base at 1.7780.

The latest breakout above 1.8060 has shifted the action to the upside after two previous failed attempts.

1.8200, a major resistance level on the daily chart would be the next on the list. Its breach could reverse the pound’s misfortune and turn the thirteen-month-long downtrend around.

In the meantime, a retracement on the back of an overbought RSI may meet buying interest around 1.8000.

Author

Jing Ren

Orbex

Jing-Ren has extensive experience in currency and commodities trading. He began his career in metal sales and trading at Societe Generale in London.