Nasdaq at record high ahead of US Fed

The day ahead

Despite the strong finish for US tech stocks yesterday, that pushed the Nasdaq Comp index to all-time highs, today's trading session looks set to be another subdued one ahead of the Fed meeting. The US dollar gained some ground against the Euro, cable, and Japanese Yen, however we expect the greenback to come under further pressure in the short term. Although medium term, we find it difficult not to see USD outperforming as the US economy leads the recovery and the Fed leads the hiking cycle. Commonwealth countries such as Australia, New Zealand, and Canada shouldn’t be far behind but slow vaccine roll outs in Australia and New Zealand and a bad second wave of the virus in Canada should keep their central banks cautious.

In the short term the powerful march higher in industrial metals means it is unwise to fade AUD here, although we did top out ahead of April 20th high of 0.7816 yesterday. Month end models are signalling strong USD selling at the end of this week so makes sense to wait and see how that plays out.

OPEC+ will meet again this week. The meeting may be moved a day earlier to Tuesday according to a delegate. We're not expecting any changes to their plans but to slowly bring supply back. The alliance aims to restore about 2 million barrels a day over the next three months, roughly a quarter of the output currently off-line.

Earlier this morning, China’s Huarong was downgraded by Fitch but the concerns over the state backed distressed-debt manager seem to have stopped feeding into broader risk sentiment.

USDJPY bouncing back strong overnight after Bank of Japan warned of "high uncertainty" and as US yields are yet to move much higher. A move back above 1.6% in the US 10-yr before will be bullish to the USDJPY over the medium-term.

Our forecasts of Key FX trading pairs, stock indices, gold, and oil

EUR/USD

The Euro drifted below the 50-period SMA after testing a 2-month high yesterday following the release of a disappointing IFO sentiment number in Germany. a move below the 1.2070 support level may trigger an acceleration to the downside with the 200-period SMA around 1.2025 as target. However, the main trend is still up according to the daily chart, with a trade through the 1.2110 resistance to signal a resumption of the uptrend.

GBP/USD

The British Pound keeps struggling to go back up above 1.3915 on very light trading volume, as it is going to be a quiet week on the economic calendar front. However, the 50-period moving average is still acting as support, and the US dollar is expected to come under further pressure in the short term, therefore a sustained move beyond 1.3915 will push prices back to the 1.40 key pivotal level.

USD/JPY

The Dollar/Yen broke back above the ¥108 level which is a bullish sign at least for the short-term, after the Bank of Japan warned of “high uncertainty” earlier this morning at its quarterly outlook report. Although the BOJ slightly revised up its growth forecast, it maintained its short-term interest rate target at -0.1% and that for 10-year bond yields around zero. The next resistance and target for USDJPY is the ¥108.65 level.

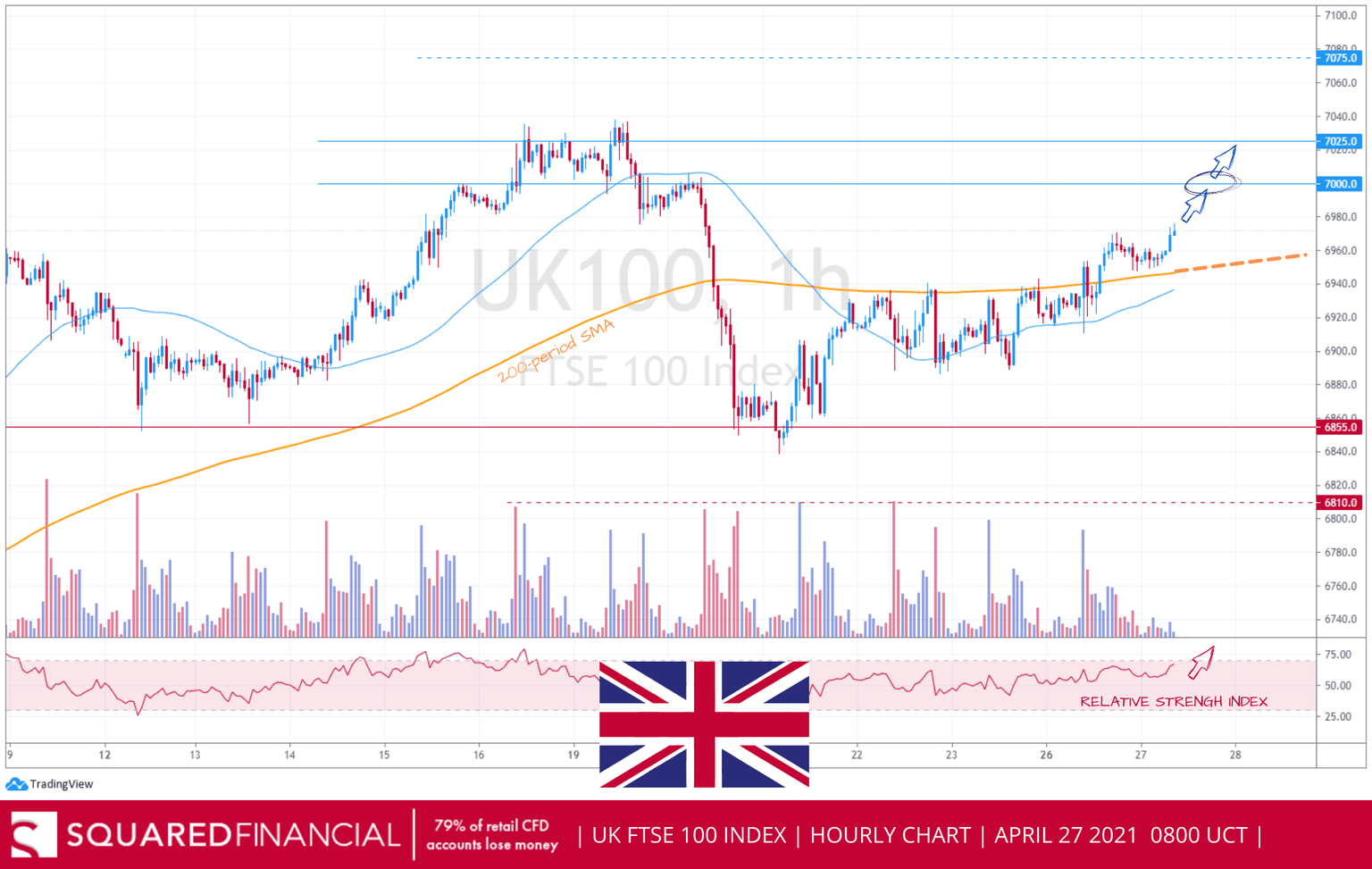

FTSE100

The FTSE100 index managed to break back above the 200-period moving average, after the London-headquartered but Asia-focused HSBC bank reported profits in all regions, with oil major British Petroleum expected to also report later today. If the results are good, we expect stocks in London to push higher and the footsie to retest the 7000-level and 7025 in extension.

DOW JONES

The Dow Jones Industrial Average remains indecisively stuck in the same consolidation range, despite the Nasdaq Composite index closing at record highs yesterday, fueled by tech stocks, as investors await a deluge of corporate earnings this week. The US monthly house price index is due later today, although we don’t expect the Dow to react much as traders remain cautious ahead of the FOMC meeting tomorrow.

DAX30

The German DAX has done very little with technical traders cautiously waiting for a breakout above the 15360 resistance or below the 200-period moving average around 15270 for further direction.

Gold

Gold hit our support/resistance levels, bouncing off the 200-period SMA with short term technical indicators favoring further upside with 1780 resistance now turned support as nearest target. Strong risk-on sentiment dominating equity markets after upbeat earnings should keep the yellow metal under pressure ahead of tomorrow’s Fed meeting.

USoil

WTI Crude hit our support target at $60.75 in yesterday’s session, only to climb back above the $62 handle in early trade today after the OPEC+ technical committee raised its forecast for 2021 demand growth, despite warnings of resurging Covid-19 in India, Japan, and Brazil. All eyes on OPEC+ monthly ministerial meeting tomorrow, with agreement to start adding back supply beginning May. An hourly close above $62.50 will open the door to higher prints with $63.35 as closest resistance target.

Author

Rony Nehme

SquaredFinancial

Rony has over twenty years of experience in financial planning and professional proprietary trading in the equity and currency markets.