The GBP/USD pair rallied to a high of 1.5467 on Friday on the back of a broad based weakness in the USD. The weaker-than-expected US personal spending and income data led to profit taking on the USD longs ahead of the weekend and month-end closing.

Focus on UK PMI and US ISM manufacturing

The UK October final manufacturing PMI could become a reason for further rally in the GBP/USD pair in case the headline figure stays around or manages to print higher than the previous figure of 51.5. The details of the report could throw a light on how the new export orders have reacted to fresh drop in the EUR/GBP pair following ECB’s hint at more easing in December. Sterling strength is hurting export activity and is also responsible for the disinflationary effect. An upbeat headline figure, but a sharp drop in the new export orders index could cap gains in Sterling.

Later in the day, the US ISM manufacturing figure would be watched out by the markets. More than the headline figure, the traders are likely to take cues from the employment sub index. Sustained growth in manufacturing sector employment could push up 2-yr treasury yield and lead to USD strength.

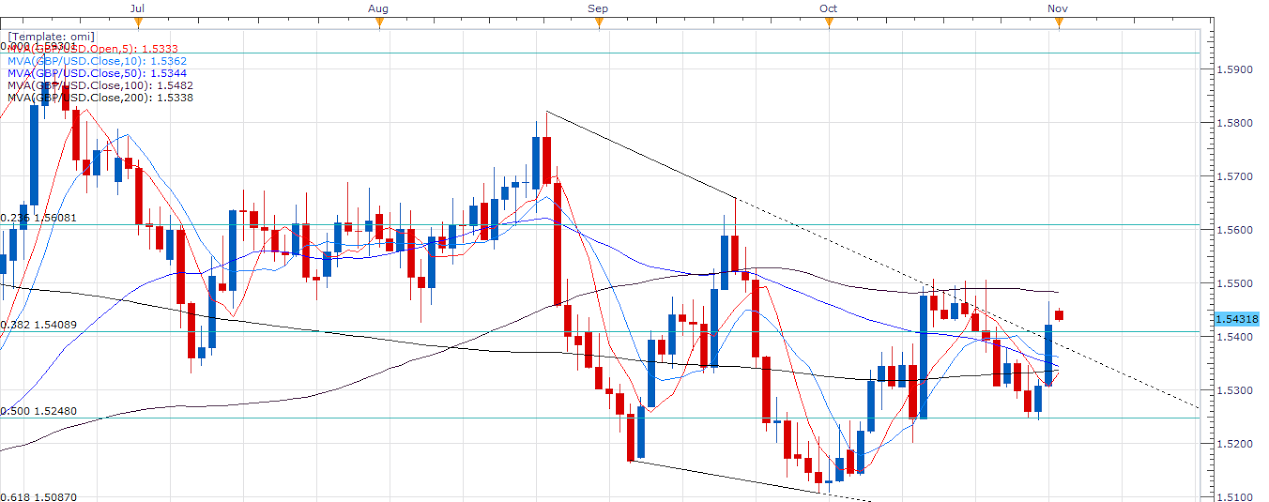

Technicals – Falling channel breached on the upside

Sterling’s close at 1.5421 on Friday confirmed the upside breakout from the falling channel seen on the daily chart. It also marked a daily close above 1.5409 (38.2% of Apr-Jun rally). However, 100-DMA has acted as a stiff resistance since Oct 14 to Oct 22, thus, bulls are likely to wait for a daily close above the same. Nevertheless, the pair could test 1.5477 (100-DMA) – 1.55 today, in case it manages to hold above 1.5409 in early European session. On the other hand, an hourly close below 1.5409 could increase the risk in favour of sell-off to 1.5383 (trend line support).

EUR/USD Analysis: Re-test of 50% Fib amid weak stock markets

The EUR/USD pair spiked to an intraday high of 1.1072 on Friday as the release of downbeat US economic reports triggered a profit taking on the Fed-driven USD longs ahead of the month-end closing. However, the gains above 1.10 were quickly erased and the pair ended last week and the last month at 1.10 levels.

Focus on EZ PMIs and stock markets

An improvement in the Eurozone final manufacturing PMI for October can be expected after the ECB President Draghi hinted at more easing in December. Markets would be more interested to see if the German activity held up well amid increasing signs of a slowdown in China.

The action in the equity markets could have more influence on the EUR/USD pair than the domestic data. The Asian equities turned risk averse today after the Caixin China manufacturing, purchasing managers index, marked the eighth-straight month of contraction. An official gauge of Chinese factory activity contracted unexpectedly in October. The weak data is likely to keep Germany’s DAX weak. The mining heavy UK’s FTSE is also expected to suffer losses. Consequently, the EUR/USD pair could make another attempt at 1.1088 (50% of Mar-Aug rally).

Technicals – Recovery on bullish RSI divergence continues

The technical correction triggered by bullish RSI divergence on the 4-hr chart is likely to continue today. Euro could make another attempt at 1.1088 (50% of Mar-Aug rally) once the immediate resistance at 1.1040 is taken out. A break above 1.1088 would expose 1.11 (rising trend line resistance). Only a daily close above the same would mean short-term bullishness. On the other hand, a failure to sustain above 1.10 may lead to a sell-off to sub 1.09 levels.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD dips below 0.6600 following RBA’s decision

The Australian Dollar registered losses of around 0.42% against the US Dollar on Tuesday, following the RBA's monetary policy decision to keep rates unchanged. However, it was perceived as a dovish decision. As Wednesday's Asian session began, the AUD/USD trades near 0.6591.

EUR/USD lacks momentum, churns near 1.0750

EUR/USD cycled familiar levels again on Tuesday, testing the waters near 1.0750 as broader markets look for signals to push in either direction. Risk appetite was crimped on Tuesday after Fedspeak from key US Federal Reserve officials threw caution on hopes for approaching rate cuts from the Fed.

Gold wanes as US Dollar soars, unfazed by lower US yields

Gold price slipped during the North American session, dropping around 0.4% amid a strong US Dollar and falling US Treasury bond yields. A scarce economic docket in the United States would keep investors focused on Federal Reserve officials during the week after last Friday’s US employment report.

Solana FireDancer validator launches documentation website, SOL price holds 23% weekly gains

Solana network has been sensational since the fourth quarter (Q4) of 2023, making headlines with a series of successful meme coin launches that outperformed their peers.

Living vicariously through rate cut expectations

U.S. stock indexes made gains on Tuesday as concerns about an overheating U.S. economy ease, particularly with incoming economic reports showing data surprises at their most negative levels since February of last year.