The British Pound strengthened on Tuesday, taking the GBP/USD pair to an intra day high of 1.48, before settling at 1.4770. The UK inflation rate in March stayed at Zero levels for the second consecutive month, despite which the pair managed to sustain above 1.46. Consequently, the pair rallied after a weaker-than-expected US advance retail sales number hit the wires. The downward revision of the US growth forecasts by the International Monetary Fund (IMF) further strengthened the Pound. However, in my view the rally could be utilized to initiate fresh sell trades on Pound, as the USD could make a comeback since a 2015 rate hike is still on the table. Meanwhile, the prospects of BOE delaying the rate hike to 2016 are increasing each day. The March PMI reports showed, companies were concerned about the strength of the British Pound against the Euro. Election uncertainty is also very much intact. Plus inflation has stayed at zero levels for two consecutive months. Hence., there is little reason for BOE to push for a rate hike this year. Consequently, a fresh selling interest can be anticipated anywhere at/above 1.48. If the Greece issue flares up today, the selling in the EUR/GBP cross could help cable. However, such an event would see money flowing into US Treasuries, thereby keeping the demand for the USD relatively higher.

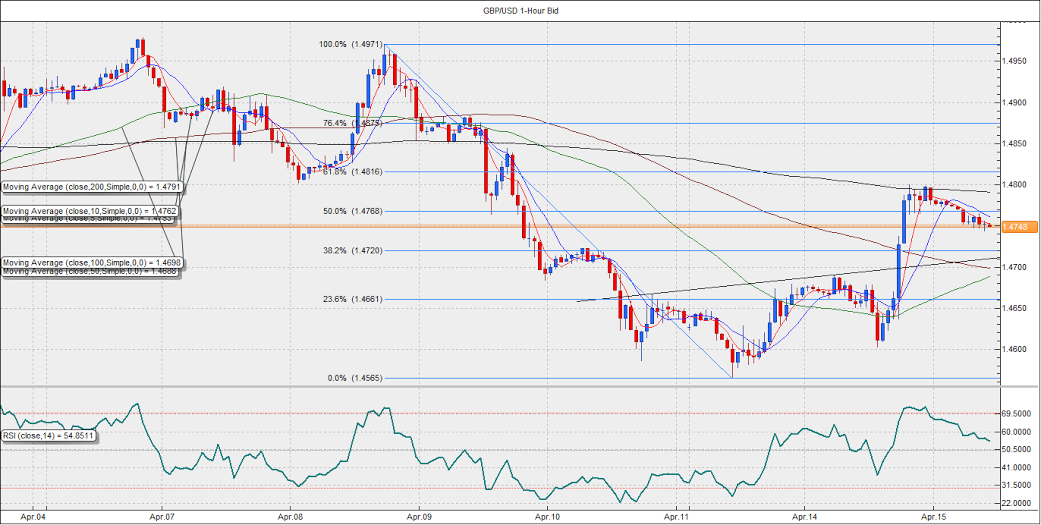

On the hourly chart, we see the pair breached the inverted head and shoulder formation, which opened doors for a target of 1.4830-1.4850. However, the gains have been capped at hourly 200-MA currently positioned at 1.4791. The rejection at 1.4790-1.48 pushed the pair below 1.4768 (50% Fib retracement of 1.4971-1.4565), although the pair appears to have stabilized around 1.4750 levels. Given, the bullish RSI divergence on the daily charts, we could see another attempt at 1.48 levels. A break above the same could open doors for 1.4850. On the other hand, failure to break above 1.48 could see a fresh selling interest.

EUR/USD Forecast: Another attempt at 1.07 possible

The EUR/USD finally saw a recovery on Tuesday as the economic data releases out of the Eurozone and the US diverged in favor of the shared currency. Eurozone Industrial production jumped 1.1% in February, easily beating the market’s 0.4% forecast. However, it made little difference to the EUR by itself. The real boost came from a weaker-than-expected advance retail sales data and downward revision of US growth forecasts by the IMF. The pair rose to a intraday high of 1.0703. However, Greece issue still remains intact. The IMF warned that the negotiations are falling apart but Greece was quick to deny the risk of a default. According to “EU officials,” they most likely will not approve Greek reforms when they meet on April 24 and that the earliest they could reach a deal will be at the May 11 meeting. However, Greece needs funds before May 1 as the IMF loans are due on May 1. Thus, possibility of Greece defaulting on its loans has increased multifold. Consequently, the shared currency could see its gains being capped around 1.07.

The European Central Bank (ECB) meeting is not expected to provide any major surprises today. If anything, Mario Draghi will use this opportunity to talk about the initial impact of Quantitative Easing including improvements in data, a weaker currency and lower interest rates. Consequiently, we may see the pair re-test 1.07.

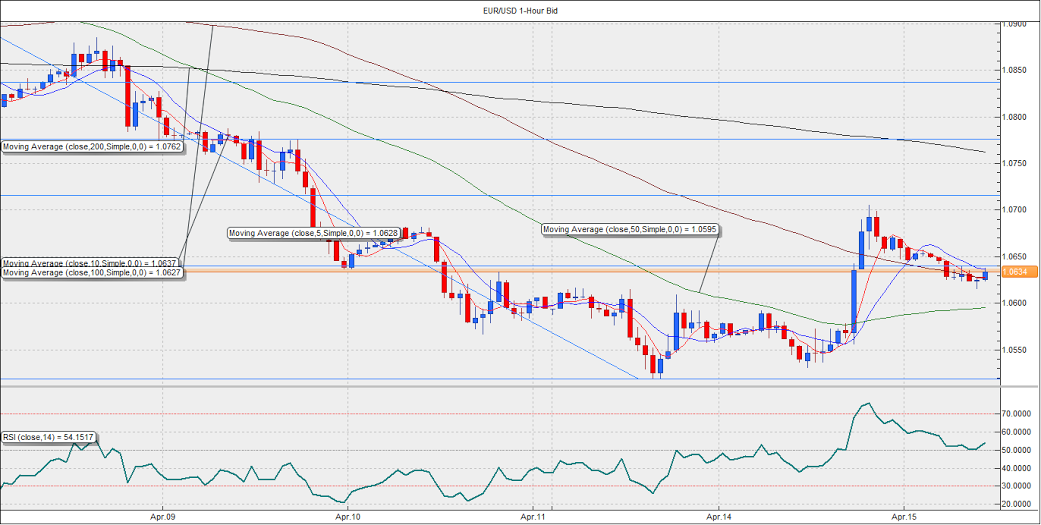

On the charts, we see the pair trading below 1.0641 (23.6% Fib retracement of 1.1033-1.0519), with the hourly RSI bullish at 54.00. A break above the same could push the pair higher to 1.07 levels. On the contrary, failure to rise above 1.0641 could push the pair down to hourly 50-MA at 1.0595. However, the gains on Tuesday have confirmed bullish RSI divergence on the daily chart. Thus, likelihood of the pair moving higher to 1.07 is more.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.