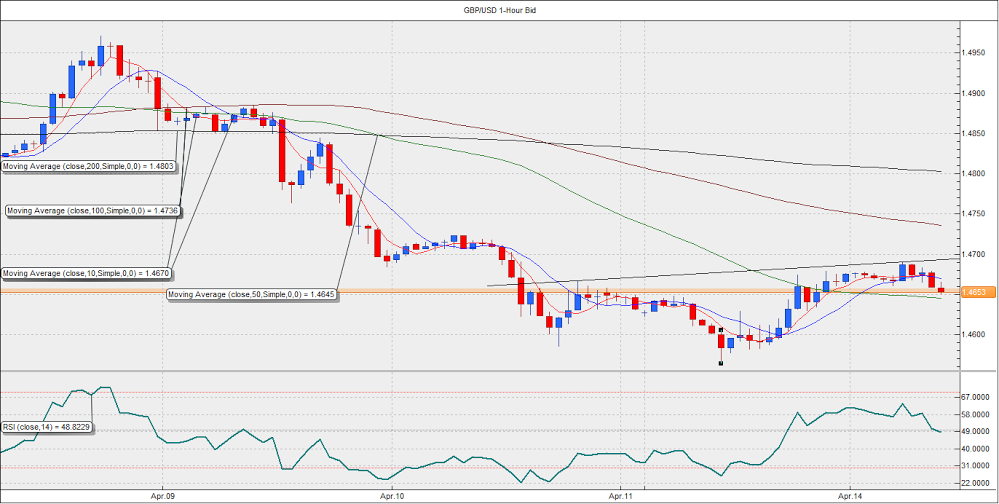

GBP/USD Analysis: Inverted head and shoulder in progress ahead of CPI report

The GBP/USD pair fell to a 5.5 year low of 1.4564 on Monday before recovering to 1.4650-1.4680 levels. The Pound was volatile despite the absence of a major market moving data out of the UK or the US. As for today, we have the UK CPI report for March, which could show the headline inflation figure as well as the core inflation figure remained unchanged. In February, the CPI year-on-year had dipped to zero, while the core inflation had eased to 1.2% from 1.4%. The Pound could take another hit today, in case the inflation prints below forecasts. On the other hand, actual figures matching estimates or better-than-expected figures could help GBP/USD rise above 1.47 levels. Moreover, the inflation figure is likely to overshadow the employment number. A weak inflation print, coupled with the drop in employment would be highly bearish for the GBP.

On the hourly charts, we see an inverted head and shoulder formation under progress, with the neckline resistance currently seen at 1.47. We also see bullish RSI divergence on the daily chart. Trading at 1.4656, the pair appears well supported at the hourly 50-MA located at 1.4645. In case the pair, manages to sustain above the same during the early European session, we could see GBP/USD rise to the neckline level of 1.47. A break above the same opens doors for Inverted Head and Shoulder target of 1.4836. However, the immediate gains are likely to be capped around 1.4736 (hourly 100-MA) -1.4750. On the other hand, a break below 1.4634 could see the pair re-test 1.46-1.4564 levels.

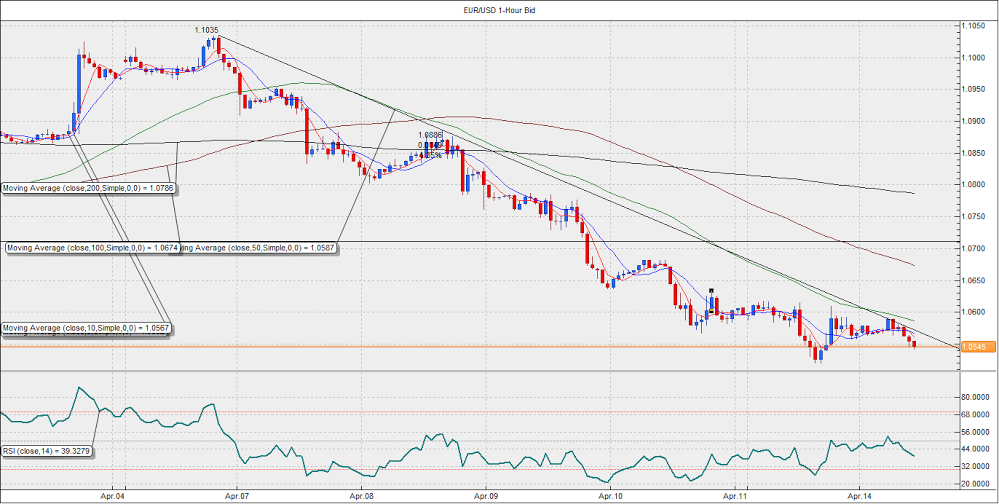

EUR/USD: Some stability after six consecutive sessions of losses

The pair fell for the sixth consecutive session on Monday, printing an intraday low of 1.0519, before finishing at 1.0570 levels. Greece issue once again weighed over the shared currency. The losses in the EUR/USD appear capped around 1.05 levels today, even though the data in the Eurozone is expected to show a contraction in the industrial activity in February. Moreover, the pair has fallen sharply ahead of the ECB meeting. Draghi is expected to sound upbeat regarding the recent economic data – especially the PMI surveys. With the ECB’s QE just one-month old, there is no need for the bank to turn more dovish. Thus, losses ahead of the ECB appear to be overdone and the pair could see a correction.

On the charts, we see the pair failed near 1.06 in the Asian session today, after which the EUR was offered once again. At 1.0547, the pair is indicating losses for the seventh straight session, with the daily RSI bearish at 35.26. On the hourly chart, the falling trend line is intact, although the pair is inching loser to a breakout. Given the bearish RSI on the hourly as well as four hourly charts, the immediate gains in the pair could be capped around 1.06-1.0634. Overall the pair is likely to trade in the range of 1.05-1.06 today. A break below 1.05 exposes 1.0461, while the pair may not last long enough above 1.06 levels.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD awaits RBA Meeting Minutes for direction

The AUD/USD pair retreated from above 0.6700 and trades around 0.6670 early in Asia, following clues from Gold price in the absence of other news. Australia will publish Westpac Consumer Confidence and RBA Minutes early on Tuesday.

EUR/USD consolidates ahead of 1.0900

The EUR/USD pair failed to grab speculative interest’s attention on Monday and consolidated at around 1.0860. Federal Reserve officials keep flooding the news, but so far, failed to spur some action.

Gold retreated from record highs, maintains the upward bias

Gold rose sharply at the beginning of the week on escalating geopolitical tensions and touched a new all-time high of $2,450. With market mood improving modestly, XAU/USD erases a majority of its daily gains but manages to hold above $2,400.

Ethereum poised for high volatility as SEC may ‘slow play S-1s’ filings

Ethereum's (ETH) price movement on Monday reveals traders' uncertainty following Grayscale CEO's departure and expectations that the Securities & Exchange Commission (SEC) would deny applications for spot ETH ETFs this week.

Signed into law: Alabama abolishes income taxes on Gold and Silver

On May 14, 2024, Alabama Governor Kay Ivey signed a bill that removes all income taxes on capital gains from the sale of gold and silver, enabling the state to take an important step forward in reinforcing sound money principles.