XAU/USD pair – Hourly Chart

Gold prices in terms of US dollar (XAU/USD) was lifted on Tuesday by a series of weak US economic data and ended higher at 1293.40 levels, retracting from intraday high posted at 1297.64. Currently, the pair is seen trading subdued in a tight range at 1289 levels as traders brace for the US FOMC Statement later today. On the hourly chart, a cup and handle pattern is formed which clearly indicates an upside in the making. However, the pair may drop to hourly 50-DMA located at 1286 levels before bouncing off to test hourly 10-DMA placed at 1292 levels. A break above these levels may cause the XAU bulls to take full control to retest 1300 levels. An upward inching RSI at 62 levels also indicates bullish trend to continue. The XAU/USD pair is likely to remain elevated as long as it hold above the hourly 200-DMA located at 1285.85 levels.

XAU/EUR pair – Hourly Chart

Gold prices in terms of Euro (XAU/EUR) ended flat at 1137.70 levels on Tuesday, forming a doji in the daily chart as traders look for fresh direction ahead of the Fed meeting. Meanwhile on the hourly chart, the pair is seen consolidating between 1136-1139 levels with the hourly RSI flat at 50.51 levels. This clearly indicates that the pair is in search for fresh incentives amid lack of significant macro data releases in day ahead. The pair faces stiff resistance at hourly 50-DMA located at 1138.81 levels. A break above the hourly 50-DMA may take pair higher to retest 1150 levels. However, in case of a breach of 1136 levels, the pair may drown lower to 1129 levels. Overall, the pair is expected to remain lifted backed by a weaker Euro.

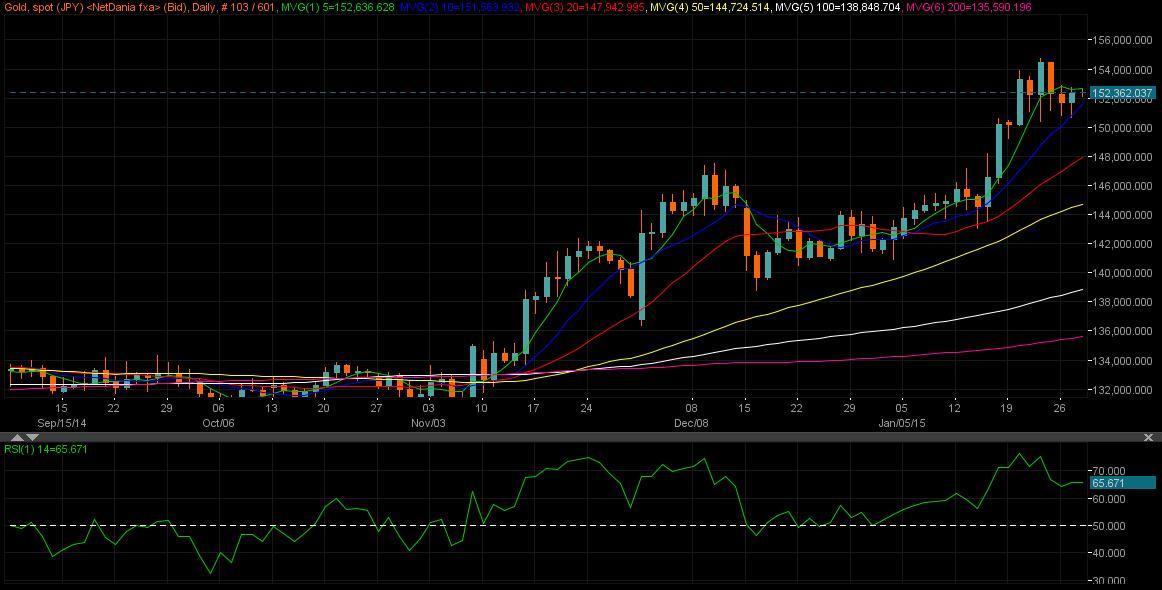

XAU/JPY pair – Daily Chart

Gold prices in terms of Japanese yen (XAU/JPY) ended higher on Tuesday at 152,339 levels as the yen continued its choppy trend versus the greenback. Currently, the pair is heading higher at 152,402 levels, having previously posted day’s low at 152,104 and day’s high at 152,590. On the daily chart, the pair finds immediate major resistance at 5-DMA located at 152,633 levels. The pair is likely to break this upside barrier and climb higher to retest 153,000 levels. The daily RSI at 65.60 also supports the case for a possible break through on the higher side. A failure to breach the 5-DMA, the pair may bounce-off to test the 10-DMA located at 151,582 levels.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD clings to gains near 1.0750 ahead of US jobs report

EUR/USD clings to modest gains at around 1.0750 after closing the previous two days in positive territory. Investors eagerly await April jobs report from the US, which will include Nonfarm Payrolls and Unemployment Rate readings.

GBP/USD advances to 1.2550, all eyes on US NFP data

The GBP/USD pair trades on a stronger note around 1.2550 amid the softer US Dollar on Friday. Market participants refrain from taking large positions as focus shifts to April Nonfarm Payrolls and ISM Services PMI data from the US.

Gold remains stuck near $2,300 ahead of US NFP

Gold price struggles to gain any meaningful traction and trades in a tight channel near $2,300. The Fed’s less hawkish outlook drags the USD to a multi-week low and lends support to XAU/USD ahead of the key US NFP data.

XRP edges up after week-long decline as Ripple files letter in reply to SEC’s motion

Ripple filed a letter to the court to support its April 22 motion to strike new expert materials. The legal clash concerns whether SEC accountant Andrea Fox's testimony should be treated as a summary or expert witness.

US NFP Forecast: Nonfarm Payrolls gains expected to cool in April

The NFP report is expected to show that the US economy added 243,000 jobs last month, sharply lower than the 303,000 job creation seen in March. The Unemployment Rate is set to stay unchanged at 3.8% in the same period.