Crowdsourcing Hype

Robots and artificial Intelligence will destroy 5.1 million jobs by 2020 says a study on the "Future of Jobs".

Crowdsourcing was one of the big factors noted in the study.

My comment last Friday was "I suspect crowdsourcing is one of those things with huge potential that never really flies because there is no money in it for anyone."

More accurately, I should have said "no net money for anyone but the promoters".

This weekend, readers emailed a series of article on a cwowdsourcing that I had not seen.

Crowdsourced Zano Implodes

Please consider the January 18 Media.Com article How Zano Raised Millions on Kickstarter and Left Most Backers with Nothing.

The gist of the story is one of Zano, a drone-maker that sought to raise $190,000 to put a prototype into production. The company raised millions but the drones could not fly.

Said one person involved: “I unpacked my Zano and tried to fly it indoors, as I guess most people did. It really didn’t go very well at all, banging into the wall. So I took it down to a local park and tried to fly it there. After 10 or 15 seconds, it would just go off and do its own thing, zipping off sideways until it got out of range. Basically, it was just awful. The video was pretty poor quality too.”

The promotional videos displayed smooth, professional shots.

"As [with] any commercial video, people are going to edit out the takes that aren’t as good.”

The article notes "UK market analyst firm Juniper Research predicts that that investments made in technology via crowdfunding platforms will increase sevenfold from an estimated $1.1 billion last year to $8.2 billion by 2020. If we want a democratic, open, freely accessible alternative to banks and venture capitalists, then we will have to accept occasional failures like Zano along with runaway successes like Pebble, Oculus Rift, and Veronica Mars."

Media.Com concludes with some sobering bullet points ...

Financial pressures led the creators to ship Zano units that they knew were not ready, and additionally to favour pre-order customers in the hope of receiving additional revenues.

The liquidation is proceeding in a professional manner, but is unlikely to result in any refund, however small, to any Kickstarter backer.

I do not believe that the creators possessed the technical or commercial competencies necessary to deliver the Zano as specified in the original campaign.

Kickstarter, and other crowdfunding platforms, should reconsider the way that they deal with projects involving complex hardware, massive overfunding, or large sums of money. There should be better mechanisms to identify weak projects before they fund, as well as new processes to provide mentorship, support and expert advice to newly-funded projects.

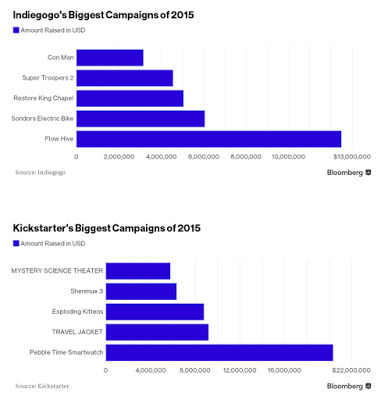

Bloomberg reports on the Biggest Crowdfunding Campaigns of 2015, cleverly commenting "no the Greek Bailout did not make the list".

Exploding Kittens and Russian Roulette

I confess. I never heard of "Exploding Kittens" or anything else the crowds are funding.

“Exploding Kittens is a highly strategic kitty-powered version of Russian Roulette. Players take turns drawing cards until someone draws an exploding kitten and loses the game. The deck is made up of cards that let you avoid exploding by peeking at cards before you draw, forcing your opponent to draw multiple cards, or shuffling the deck,” wrote the creators in the official webpage. “So if you’re into card games or laser beams or weaponized enchiladas, please help us make this game a reality. We think you’ll love it as much as we do,” they added.

Expect More Beanie Babies

Maybe the crowds can identify popular games in advance, maybe not. But when it comes to serious applications, any expectation that crowdsourcing will be a disruptive force seems silly.

The crowds also brought us Beanie Babies and Pet Rocks. Expect more of the same.

I commented on truly disruptive processes in Fourth Industrial Revolution: Robots, Artificial Intelligence Will Destroy 5.1 Million Jobs by 2020.

This material is based upon information that Sitka Pacific Capital Management considers reliable and endeavors to keep current, Sitka Pacific Capital Management does not assure that this material is accurate, current or complete, and it should not be relied upon as such.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.