The U.S. labor market data released last week on Friday showed that the U.S. unemployment rate held firm at 3.7%, marking a 49-year low. The U.S. economy added 250k jobs during October beating estimates of 194k jobs.

However, the jobs for September were revised lower to 118k. Wage growth in the U.S. rose 3.1% on the year in October marking the most significant increase.

Meanwhile, Canada’s unemployment data was also released. The official data showed that Canada’s unemployment rate fell unexpectedly to 5.8%. However, the employment change rose just 11.2k which was below estimates of 12.7k.

The markets are looking to a quiet open today. The European trading session is expected to see only the release of Spain's unemployment change and the Eurozone Sentix investor confidence report.

In the UK, the services PMI report from Markit will be out. Economists polled forecast that the services sector could fall to 53.4 after registering 53.9 in the month before.

The NY trading session will see Markit's final services PMI coming out followed by the ISM non-manufacturing PMI. Estimates put non-manufacturing activity index to ease to 59.3 from 61.6 in September.

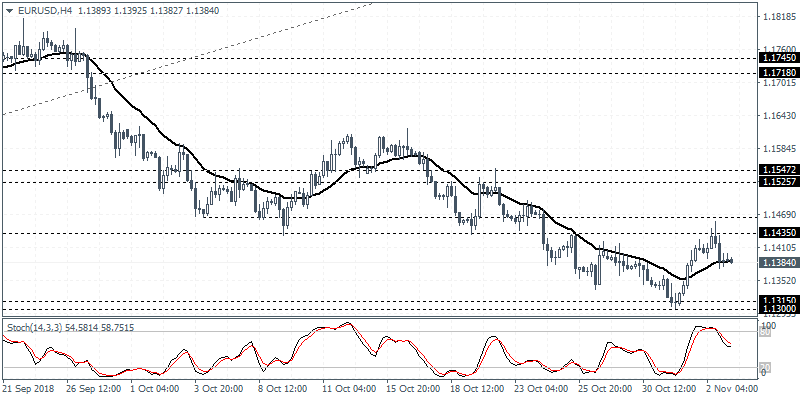

EURUSD intraday analysis

EURUSD (1.1384): The euro currency managed to rebound to the upside, but price action was stuck within the resistance level that was previously established. A quick reversal was therefore seen at 1.1435 - 1.1462 region. The EURUSD remains trading flat within the resistance level and the lower support level formed at 1.1315 - 1.1300. A breakout from this range is required for the currency pair to mark the next direction in the trend potentially. Further losses could be expected if the EURUSD falls below the support level.

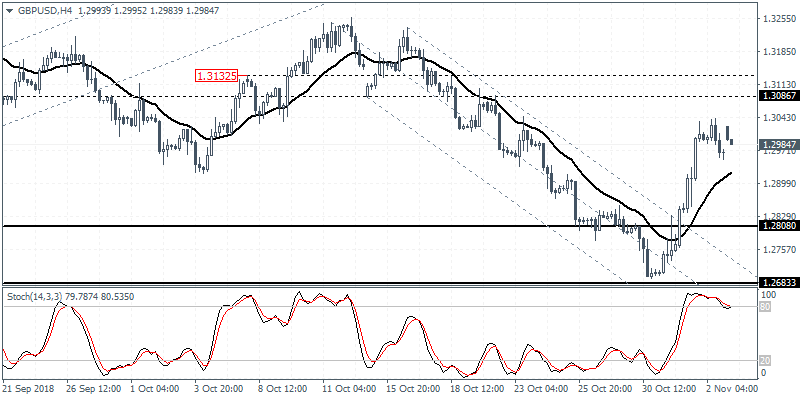

GBPUSD intraday analysis

GBPUSD (1.2984): The GBPUSD currency pair maintained strong gains, but Friday's price action saw the cable taking a breather. Price action was subdued as the GBPUSD retraced some of the gains from earlier in the week. The resistance level at 1.3087 remains a key level of interest. To the downside, support at 1.2808 is quite likely to hold out as support. If GBPUSD falls below 1.2808, then we expect to see a test of the lower support at 1.2683 level.

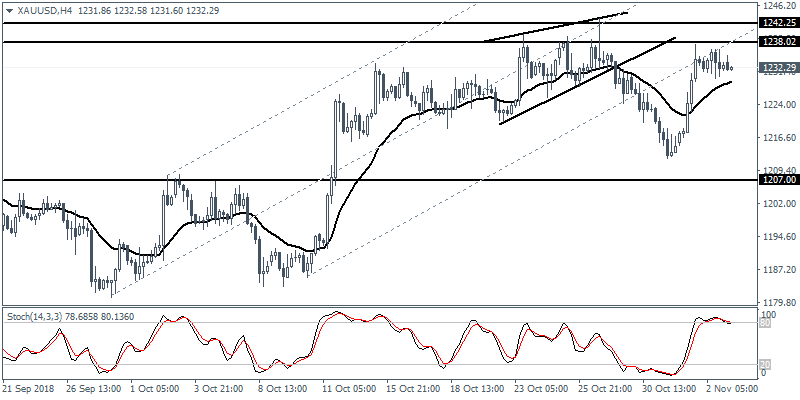

XAUUSD intraday analysis

XAUUSD (1232.29): Gold prices were seen mostly consolidating near the highs established on Thursday. Price action is trading below the previously established resistance level of 1238.02 region. As long as this resistance level holds, gold prices could remain trading subdued. Failure to retest the lower support at 1207 remains a key point of interest as a decline in the precious metal could see this level being tested.

This market forecast is for general information only. It is not an investment advice or a solution to buy or sell securities.

Authors' opinions do not represent the ones of Orbex and its associates. Terms and Conditions and the Privacy Policy apply.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange, you should carefully consider your investment objectives, level of experience, and risk appetite. There is a possibility that you may sustain a loss of some or all of your investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.