With huge announcements from both the Federal Reserve and the European Central Bank in the coming weeks, the normally uneventful Thanksgiving holiday period and weeks leading up to Christmas have the potential to get VERY interesting.

With the US Dollar rallying on the expectation that the Fed will hike and the Euro still in decline as markets now start to factor is a proposed 2 tier deposit rate which would see larger depositors charged more, the brave new world is nearly upon us!

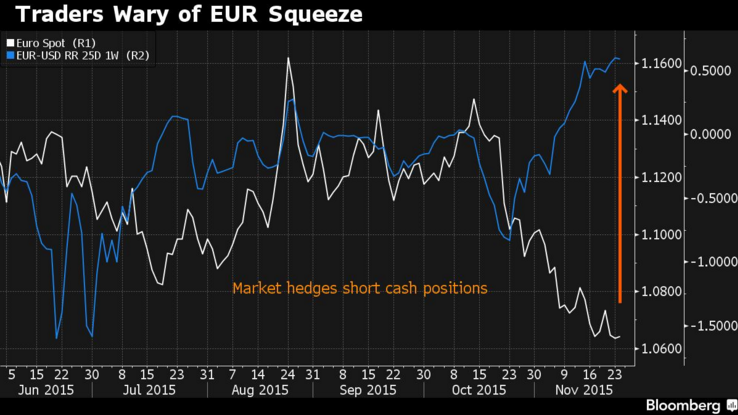

In my morning reading, I came across the following Bloomberg chart in a Vassilis Karamanis article.

The chart shows that 1-week 25d risk reversal, a gauge of market positioning and sentiment, is now really starting to divert from the EUR/USD spot price. This is because traders are wary of a squeeze over the Thanksgiving holiday period and have been hedging their risk. Something we have been trying to anticipate recently too.

EUR/USD Daily:

The technicals still highlight the above risk, with price continuing to test the top of our marked support zone.

EUR/USD Hourly:

Zooming into the hourly chart shows added short squeeze potential, with the lows being taken out before being rejected equally as hard. If price can break out of the short term bearish channel then things could get interesting.

After setting out arguments for trading in both directions, I’m really interested in discussing which side is the more favourable play from a risk:reward point of view. Leave a comment in the form below or give @VantageFX a mention on Twitter.

On the Calendar Thursday:

NZD Trade Balance

AUD Private Capital Expenditure q/q

USD Bank Holiday

“Thanksgiving Day is a national holiday celebrated in Canada and the United States as a day of giving thanks for the blessing of the harvest and of the preceding year.”

Chart of the Day: While EUR/USD fell to fresh lows, today’s chart of the day looks at its inversely correlated sister, USD/CHF.

Last Wednesday, we took a look at the Swissy and whether this was your pre-pop opportunity to get long.

USD/CHF Daily:

Well overnight, once again USD/CHF popped to new highs, climbing to its highest level in 5 years.

USD/CHF 4 Hourly:

The 4 hourly just highlights the runaway train that this pair currently is thanks to the SNB’s monetary policy. On an unreal tear!

EUR/USD or USD/CHF: Where does the greater opportunity lay?

In addition to the website disclaimer below, the material on this page prepared by Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently, any person acting on it does so entirely at their own risk. The expert writers express their personal opinions and will not assume any responsibility whatsoever for the forex trading account of the reader. We always aim for maximum accuracy and timeliness, and Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.sary.