Notorious:

In the lead up to tomorrow’s all important NFP number, last night saw the ADP Non-Farm Employment Change come in below expectation at 190K v the 204K expected. The July revision was also to the downside from 185k to now 177k.

CEO of ADP, Carlos Rodriguez:

“The job growth numbers for August improved slightly from July.”

“The employment gains for the month are in line with the year to date average.”

We’re now down to a 30% chance that the Fed makes their first move in September (this month now!). With last night’s ADP number as well as second tier Factory Orders missing the mark, it would be easier for the Fed to justify waiting if NFP does miss tomorrow. I get the feeling that the run of good numbers we’ve seen running into the month could be easily put on the back-burner if the most recent disappoints.

Last night also saw ‘bond guru’ Bill Gross labeling any move that the Fed now makes within the current market turmoil as “too little too late”.

From an investment outlook Wednesday for Denver-based Janus Capital Group:

“The ‘too late’ refers to the fact that they may have missed their window of opportunity in early 2015, and the ‘too little’ speaks to my concept of a new neutral policy rate which should be closer to 2% nominal, but now cannot be approached without spooking markets.”

Listening to someone like Bill Gross is questionable, but the headlines love him so we have to take notice.

Australian GDP also came in at 0.2% v the 0.4% expected in a miss that was expected after the Trade Balance data we saw on Tuesday.

AUD/USD Hourly:

The Aussie dollar briefly poked its head through the psychologically important 70c level on the poor GDP number, but the break wasn’t sustained.

Just remember that the weekly support level that we have been watching hasn’t been cleanly broken and now we’ve tested 0.7000, we could easily ping straight back up from here.

On the Calendar Thursday:

CNY Bank Holiday

AUD Retail Sales m/m

AUD Trade Balance

GBP Services PMI

EUR Minimum Bid Rate

EUR ECB Press Conference

CAD Trade Balance

USD Trade Balance

USD Unemployment Claims

USD ISM Non-Manufacturing PMI

Chart of the Day:

“Victory over Japan Day is the day on which Japan surrendered in World War II, in effect ending the war.”

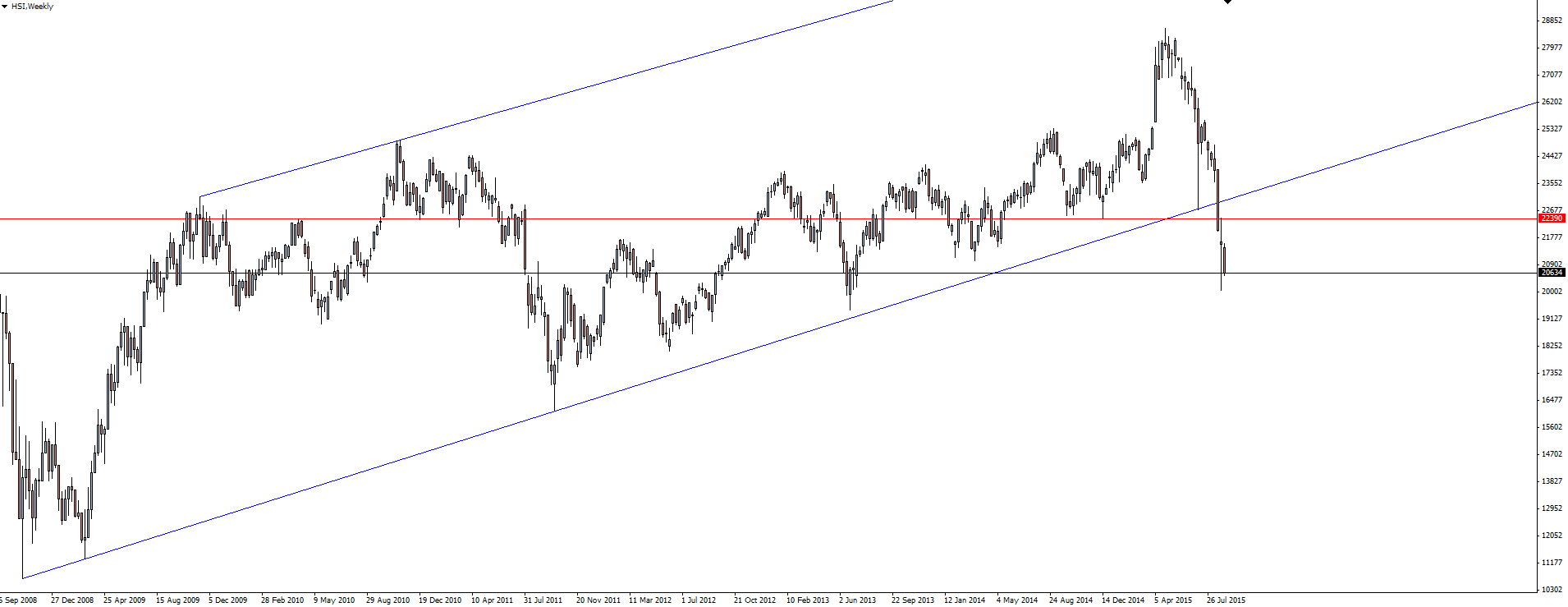

HSI Weekly:

Well China picked a good day to go on holiday. Boy is that one ugly looking chart!

After the solid Hang Seng bullish channel dating back to 2008, the party looks to have finally come to an end, with an ugly breakout and close below support.

In addition to the website disclaimer below, the material on this page prepared by Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently, any person acting on it does so entirely at their own risk. The expert writers express their personal opinions and will not assume any responsibility whatsoever for the forex trading account of the reader. We always aim for maximum accuracy and timeliness, and Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.sary.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.