Have you heard traders talk about a rip your face off type move? Well that right there was everyone’s collective face getting ripped off.

The following SP500 charts tell you all you need to know about the type of moves we saw last night while the Dow Jones Industrial Average was at one stage down more than 1000 points! To put that in perspective, the Dow has NEVER, yes NEVER traded in a daily range that hit the 1000 point mark. Rip your face off!

SP500 Daily:

With markets opening the week in Asia extra thin, emotions were running wild. When markets trade on emotion, things can get out of control quickly and that’s exactly what we saw once we hit US pit open.

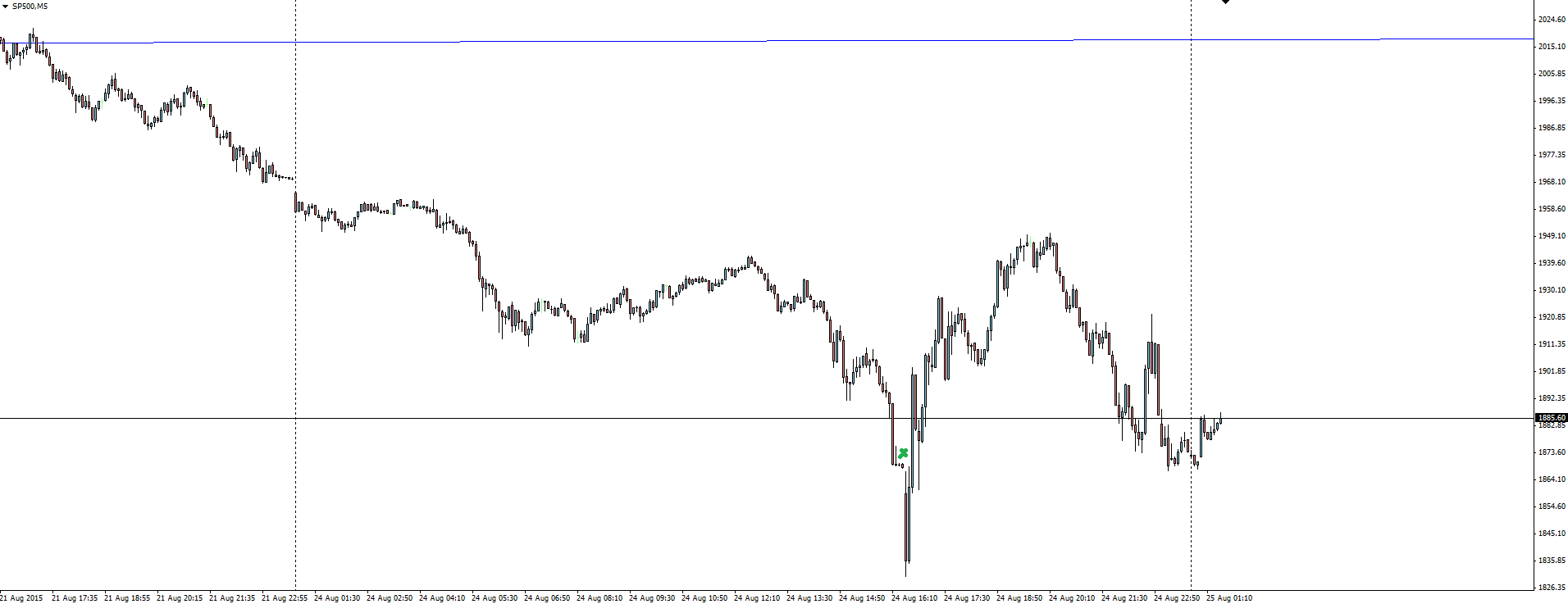

SP500 5 Minute:

The market even hit ‘limit down’ levels after falling as much as 7% from its opening price. When a market goes limit down, it is essentially the exchange hitting a circuit breaker to halt trade and let some of the emotion and dare I say it, the HFT algos cool their boots before the spiral gets out of control.

This is not something that is implemented lightly, with the last time the limit down level was hit being during the GFC.

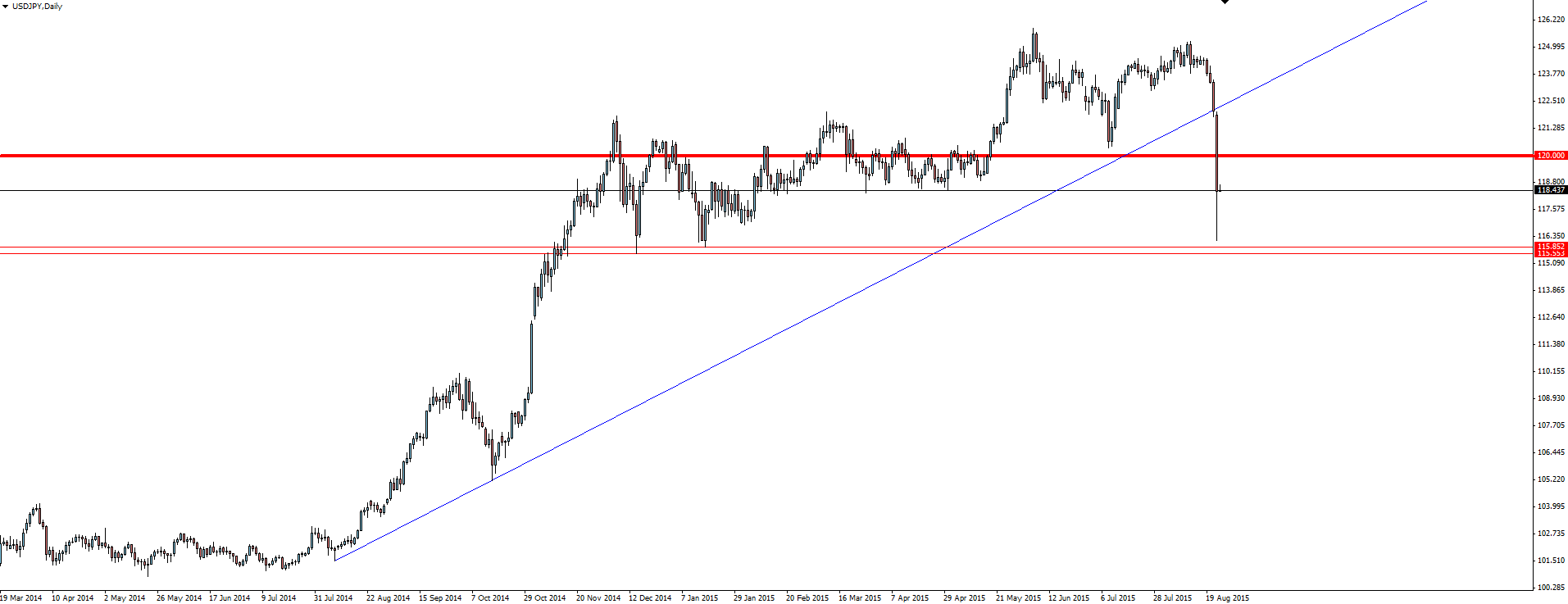

USD/JPY Daily:

These rip your face off moves weren’t just confined to stock indices, with Forex markets feeling the full, volatile force of drops too. We’re going to go through some of the charts in the Technical Analysis section of the Vantage FX News Centre later today, so keep an eye on Twitter for updates.

In the mean time for effect, take a look at that USD/JPY daily candle which dropped SIX HUNDRED PIPS on the day, plunging through handle after handle.

So What Now?: Well now that Black Monday has come and gone, what happens next? Is it over, or is that only just the beginning? We’re not going to take this blog down the doom and gloom ZeroHedge path (although obviously doom and gloom seems to earn quite the following!) but do you really want to be putting your hand out to try to catch this falling knife now?

The media outlets are blaming the slowdown in China as the catalyst that kicked off the market rout. It’s debatable why, but what is certain is that there is a massive crisis of confidence in the markets which wont subside after just a single day.

Things have calmed down in early Asian trade, but I’ll use the analogy of the calm water being sucked out to sea before a tsunami. Stay on your toes.

On the Calendar Tuesday:

NZD Inflation Expectations q/q

EUR German Ifo Business Climate

USD CB Consumer Confidence

Today’s event risk isn’t so much about date releases on the calendar but the different market opens, namely the Chinese stock market open, London Open and NY Pit Open. Check your calendar in your local timezone if you are taking positions around these times.

In addition to the website disclaimer below, the material on this page prepared by Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently, any person acting on it does so entirely at their own risk. The expert writers express their personal opinions and will not assume any responsibility whatsoever for the forex trading account of the reader. We always aim for maximum accuracy and timeliness, and Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.sary.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.