RBA Preview:

RBA Tuesday! Although there isn’t much chance that Stevens will pull the trigger on another cut to fresh record lows, the accompanying statement and the wording that the bank provides will be key to how the Aussie Dollar reacts.

Cash rate futures have priced in only a 9% chance that the RBA will cut rates to fresh 1.75% lows this afternoon in Sydney, and this sentiment is backed up by the Reuters economist survey, with only 1 out of the 22 forecasting a cut. Yes, there is always 1 or 2 looking to get their name up in lights for taking a contrarian view. Wouldn’t it be interesting to know which of these economists are actually taking an AUD/USD position into the decision on the back of their surveyed opinion!

So what should we be looking out for in the accompanying statement?:

The line of ‘further depreciation in the AUD seems both likely and necessary’ has grown tired, and at these levels it could almost be seen as fair value. I say almost because I don’t know if Stevens will want to undo all his hard work by saying this and having the AUD rally hard on the back of it. The market would surely take that as a signal of a bottom.

The other major economic talking point around the Australian economy has been what is the ideal growth rate? Meaning the level keeping unemployment and inflation in an ideal band. For a long time, this ideal number for growth has been 3% but with this number not having been reached for the last 6 years, Stevens brought up the idea of potentially downgrading the RBA’s growth forecast. This is where I’ve seen a few questions asked around the fact that this could be a catalyst to actually continue to cut rates on.

Just remember that as always, the Sydney housing market remains a huge thorn in the side of the RBA when debating whether cutting rates on a slowing economy will be healthy overall. This theme has been put onto the back-burner a little bit but it’s effect on their decision making is not to be underestimated.

Let’s now take a look at the charts:

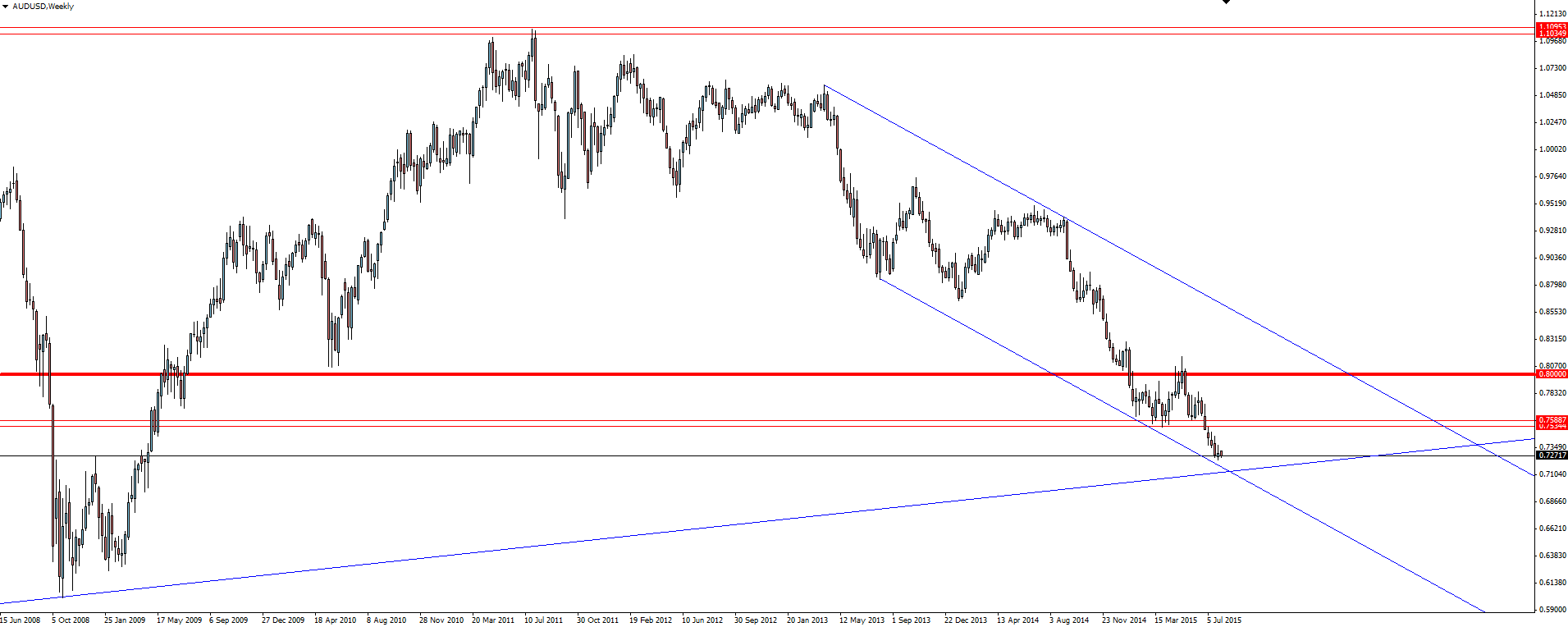

AUD/USD Weekly:

We’ve been watching the above weekly level where we have a confluence of support from the long term bullish weekly trend line and the short term bearish channel. This level really is key and another huge reason why this level around 70c is seen as ‘fair value’.

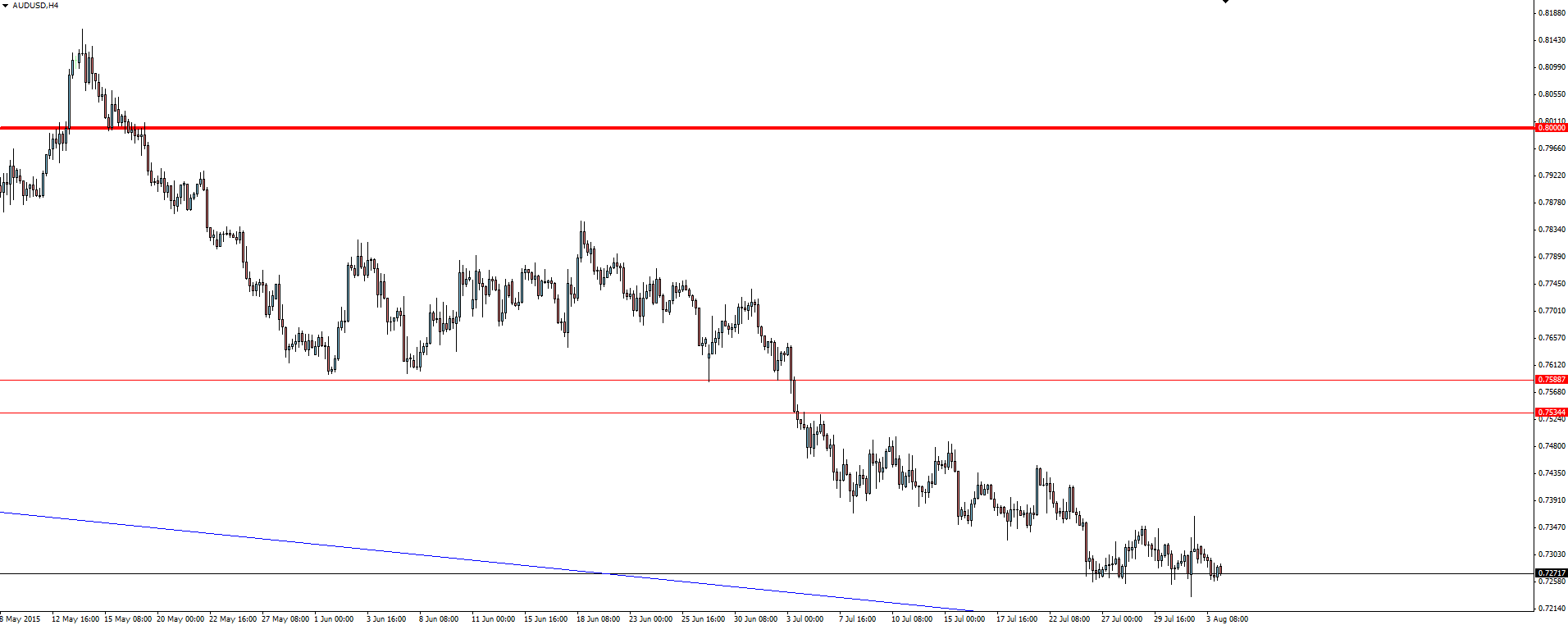

AUD/USD 4 Hourly:

The 4 hourly chart shows the way that price has been stepping down inside it’s bearish channel. The break of support and then the retest almost to the pip on 4 hourly wicks is textbook price behaviour in a strong bearish trend.

Aussie Data Dump:

Just remember that before the RBA decision at 2.30pm Sydney time, we have a flurry of data releases in the morning.

“AUD Retail Sales m/m (0.5% expected, 0.3% previously)”

“AUD Trade Balance (-3.06B expected, -2.75B previously)”

In addition to the website disclaimer below, the material on this page prepared by Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently, any person acting on it does so entirely at their own risk. The expert writers express their personal opinions and will not assume any responsibility whatsoever for the forex trading account of the reader. We always aim for maximum accuracy and timeliness, and Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.sary.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.