Asian Session Morning:

You may have noticed a slight re-naming of our morning blog this week. We are still letting the Vantage FX News Centre evolve naturally and the name and format is just a natural progression of the idea.

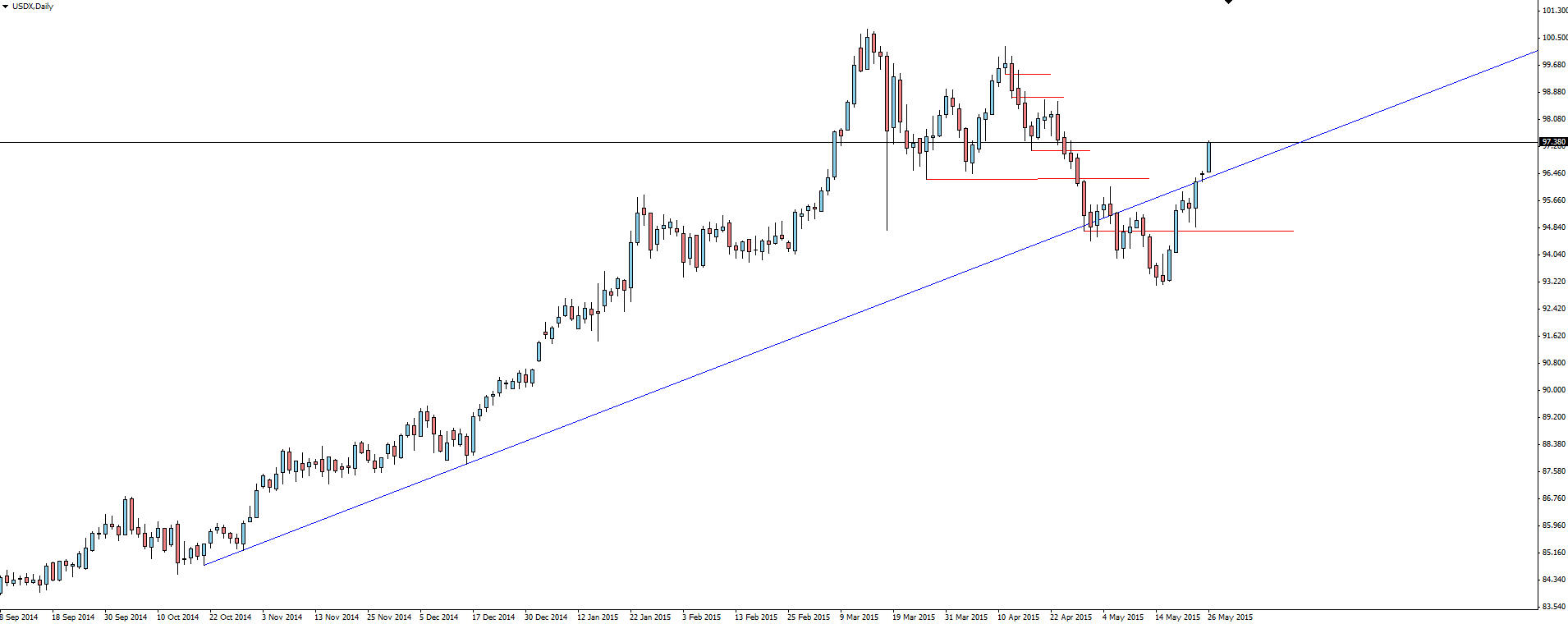

US Durable Goods Orders beat expectations to the upside overnight, pushing the USDX back inside it’s previously broken trend line and on target for new highs again. The Durable Goods print came in with a 1.0% jump on expectations, helping to confirm that the Fed was justified in not putting as much weigh on any Q1 economic slowdown.

USDX Daily:

The data dependent line has been repeated over and over throughout the Q1 slowdown and the market loves these sorts of prints actually backing up the talk and confirming that the Fed actually does have the foundation that it needs to begin raising rates.

With things starting to quickly unravel in Greece, there is now no hope that the government will be able to reach it’s upcoming repayment requirements. This heaps more pressure on an already unstable coalition government with yet another parliament re-shuffle likely. This would allow new reforms to pass parliament, taking yet more money from an already strangled nation but avoiding the uncertainty of elections or an exit from the Eurozone.

On the Calendar Today:

Each of the notes on the Asian Session portion of the calendar are 2nd tier data but worth keeping an eye on none the less.

Greece will surely be top of the agenda at the G7 Meetings today in Germany while the major Central Bank risk comes out of Canada with their Rate Statement to finish the evening.

Wednesday:

JPY Monetary Policy Meeting Minutes

USD FOMC Member Lacker Speaks

AUD RBA Deputy Gov Lowe Speaks

AUD Construction Work Done

USD G7 Meetings

CAD BOC Rate Statement

CAD Overnight Rate

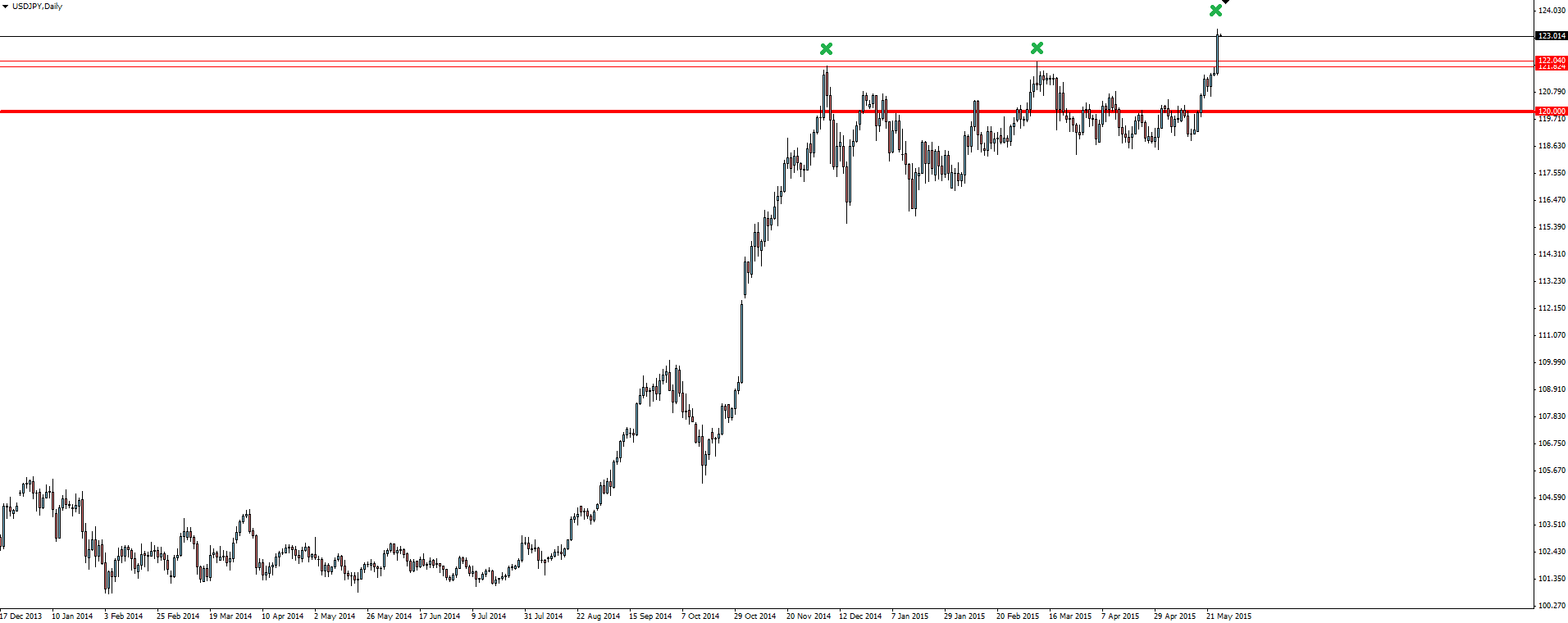

Chart of the Day:

The idea was that two touches of resistance wasn’t able to reject price off the level and the third was likely to be the strew that broke the camels back and breakout.

USD/JPY Daily:

Price really didn’t mess around when it got there either, hitting stops and momentum carrying the breakout through. A Core Durable Goods beat a bit later in the night kept the rally pushing through and the daily candle basically closed on it’s highs.

In addition to the website disclaimer below, the material on this page prepared by Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently, any person acting on it does so entirely at their own risk. The expert writers express their personal opinions and will not assume any responsibility whatsoever for the forex trading account of the reader. We always aim for maximum accuracy and timeliness, and Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.sary.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0750 to start the week

EUR/USD trades in positive territory above 1.0750 in the European session on Monday. The US Dollar struggles to find demand following Friday's disappointing labor market data and helps the pair hold its ground.

GBP/USD edges higher toward 1.2600

Following Friday's volatile action, GBP/USD pushes higher toward 1.2600 on Monday. Soft April jobs report from the US and the modest improvement seen in risk mood make it difficult for the US Dollar to gather strength.

Gold rebounds above $2,310 after downbeat NFP data, eyes on Fedspeak

Gold price trades in positive territory above $2,310 after closing the previous week in the red. The weaker-than-expected US employment data have boosted the odds of a September Fed rate cut, hurting the USD and helping XAU/USD find support.

Addressing the crypto investor dilemma: To invest or not? Premium

Bitcoin price trades around $63,000 with no directional bias. The consolidation has pushed crypto investors into a state of uncertainty. Investors can expect a bullish directional bias above $70,000 and a bearish one below $50,000.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.