Geopolitical concerns over ongoing tensions in North Korea and Iran, in which another round of nuclear negotiations with Western nations yielded no result, and news of an easing of Chinese inflation fears have given the energy and industrial metals a small boost.

The easing of inflationary pressure in China, which is primarily due to a sharp reduction in the cost of food, has lowered the risk for a tightening of monetary policy. Such tightening could have triggered a reduction in demand for key commodities such as oil and industrial metals. Any potential for a war with North Korea or increased tensions in the Middle East carries the risk of disrupting the supply of oil, thereby helping to keep it supported at a time of reduced demand and ample supply.

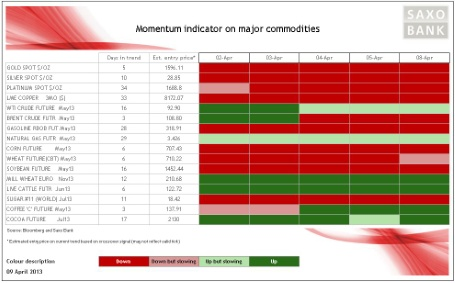

Despite these supporting factors, momentum across most of the major commodities remains negative as growth expectations have eased, grain supplies will more than cover global demand ahead of the harvest this autumn and industrial metals have seen a pick-up in supply as new production has become available. Precious metals are struggling as US equities have bounced from last week's sell-off following the disappointing job report, while ETP holdings continued to be reduced.

WTI Crude looks set to join Brent Crude in showing negative momentum in what has been a delayed reaction to the sell-off witnessed last week. Elsewhere, wheat prices, which suffered the least during the Easter cull, have also recovered the fastest due to concerns about the US winter crop. The concerns eased overnight, with crop ratings now beginning to improve following what has been a very harsh winter due to drought and little snow cover to protect them from the cold.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of US jobs report

EUR/USD stays in a consolidation phase above 1.0700 after closing the previous two days in positive territory. Investors eagerly await April jobs report from the US, which will include Nonfarm Payrolls and Unemployment Rate readings.

GBP/USD advances to 1.2550, all eyes on US NFP data

The GBP/USD pair trades on a stronger note around 1.2550 amid the softer US Dollar on Friday. Market participants refrain from taking large positions as focus shifts to April Nonfarm Payrolls and ISM Services PMI data from the US.

Gold remains stuck near $2,300 ahead of US NFP

Gold price struggles to gain any meaningful traction and trades in a tight channel near $2,300. The Fed’s less hawkish outlook drags the USD to a multi-week low and lends support to XAU/USD ahead of the key US NFP data.

XRP edges up after week-long decline as Ripple files letter in reply to SEC’s motion

Ripple filed a letter to the court to support its April 22 motion to strike new expert materials. The legal clash concerns whether SEC accountant Andrea Fox's testimony should be treated as a summary or expert witness.

US NFP Forecast: Nonfarm Payrolls gains expected to cool in April

The NFP report is expected to show that the US economy added 243,000 jobs last month, sharply lower than the 303,000 job creation seen in March. The Unemployment Rate is set to stay unchanged at 3.8% in the same period.