Market update: Huge level in copper

Morga stanley market timing indicator

The Morgan Stanley Market Timing Indicator has reached the most bearish reading on record.

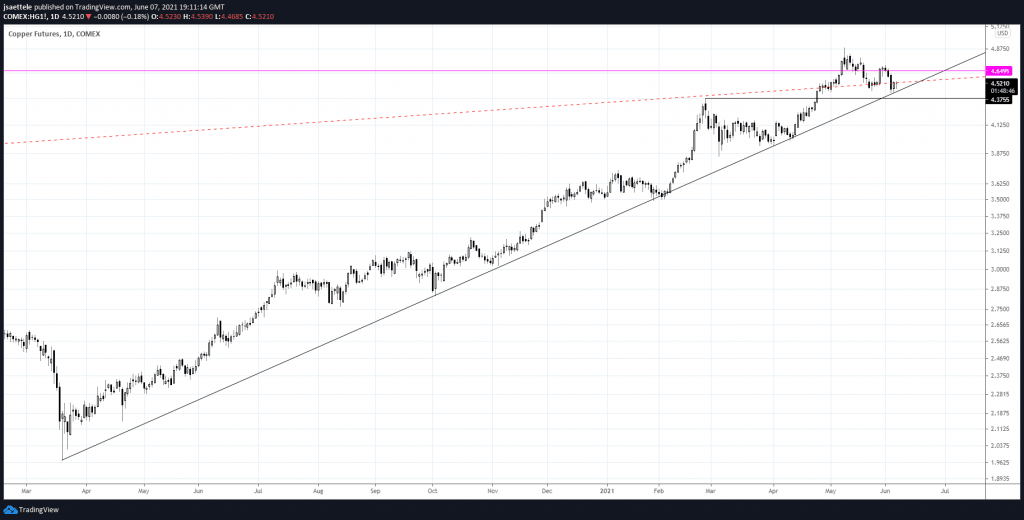

Copper futures daily

Copper is at 14+ month trendline support. A break below would indicate a significant behavior change and usher in the largest decline since the rally started in March 2020. The long term picture is below.

5/24 – After trading to an all time high 2 weeks ago, copper put in a weekly reversal candle. Price followed through on the downside last week as well. This raises the specter of a massive failure after the move above the 2011 high. A close up view is below.

Copper futures weekly

USDollar 4 hour

USDOLLAR traded into the upside level of interest and turned sharply lower. Most of the rally from the May low has been retraced. Even so, nothing regarding the idea of a massive consolidation bottom since January has changed. 11655 remains proposed support. COT positioning is stretched to the downside and indicates elevated reversal risk (see below).

6/2 – Like Friday, USDOLLAR tried breaking out today. Also like Friday, price was slammed lower as U.S. trading got under way. Still, price has broken above the trendline from the April high so maybe the buck finally ‘surprises’ to the upside. If it does, then the next level of upside interest is 11770.

USD positioning (COT)

USD/CNH weekly

USDCNH made a weekly J-Spike last week. This is the 2nd signal since 2013 when price is at a 3 year extreme (high/low). The only other signal was the bearish one in September 2019…which nailed the top. Near term, watch for 6.3740s support (see below).

USD/CNH 4 hour

USD/JPY 4 hour

USDJPY failed at the line off of the 2018 and 2020 highs again last week. A break below 109.00 would suggest that a top is in place. Proposed resistance is the high volume level from NFP at 109.75.

EUR/JPY daily

EURJPY has turned down just ahead of the noted 134.30. The lower wedge line is about 132.00 but 133.60 should provide resistance if a top is in place. This level is defined by the 200 hour average and a well-defined horizontal pivot (see below).

5/20 – EURJPY action since the October low has taken the form of a wedge. The rally stalled this week after taking out the September 2018 high but I’m wondering if we get a final spike into 134.30, which is both the 61.8% retrace of the decline from the 2014 high and 2 equal legs up from the 2020 low. A close-up view is below.

EUR/JPY hourly

Author

Scandinavian Markets Research Team

Scandinavian Capital Markets

Scandinavian Capital Markets' Research Team boasts world-renowned, professional market analysts and traders with proven track records in the markets and as business leaders.