Last week was the first real opportunity for Janet Yellen to stamp some of her authority on global Capital Markets. In her first managed FOMC meet, the Fed continued its modest taper, and probably more significantly, reduced its unemployment threshold guidance from its +6.5%. None of these moves truly surprised the market. It was what she said in her post rate press discussion that had Capital Markets sit up and take note. For some time the Fixed Income market has been waiting for a good enough reason to price in yield differentials. The gyration of US yield products has had more to do with the supply and demand for safe haven purposes rather than the fundamentals of the US economy. A slip of the tongue or not, it seems that the Fed very much wants to get back to basics after Yellen suggested the Fed would consider hiking rates as soon as six-months after the end of QE3 - the US could be hiking as early as this time next year.

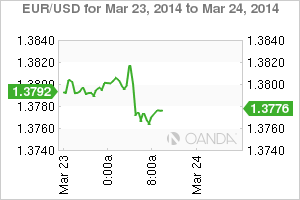

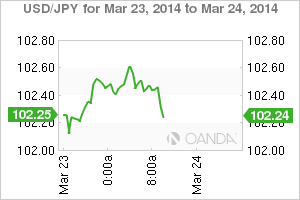

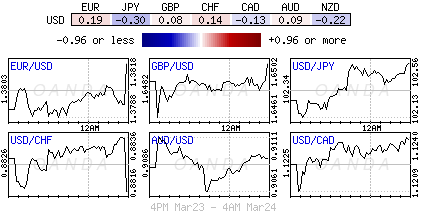

Yellen's verbal forward guidance has certainly led to many having to recalibrate their portfolio position. Is the era of a low rate environment close to an end? Like all good Central Bankers Yellen was emphatic that markets should not make "strict interpretations" and reiterated that the first rate hike is highly data-dependent and will reflect a "balanced judgment" about prospects both for labor market slack and inflation pressure. As to be expected, US bond traders have aggressively been selling the middle and short-end of the US curve. Fed fund futures for next year are now fully pricing in at least a +50bps increase in rates by mid-summer. The forex market could see the dollar gain more support this week as US yields have the potential to back up even further with the pressure of FI supply. The rate market needs to take down +$96B in US 2's, 5's and 7-year product this week. This will obviously be a challenge and recent Fed rhetoric is reason enough to front run all three issues. Yellen's 'new' stance has had the EUR and Yen predominately on the back foot, a theme that's expected to gather further backing in the medium term.

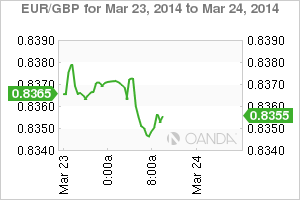

The 18-member single currency was able to gather some brief support from this morning's stronger flash French PMI's (51.9), however Gallic support was limited as three German flash readings missed their mark and has sent the EUR back down and through the psychological €1.3800 level and towards last weeks lows. The EUR's move has been aided further by macro and Scandinavian interest, which have been the main sellers of the currency so far this morning in Europe. Even the techie traders have lost some of their patience with the EUR, especially after the false break happened to clear stops above the 21-DMA (1.3815-20) and then retreated. The sale of EUR/crosses is likely to be rather popular this week as persistent dovish ECB chatter is fuelling expectations that the ECB would ease next month.

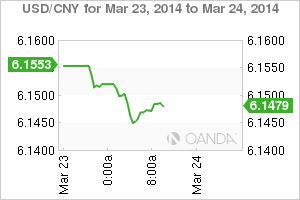

China flash manufacturing PMI happened to hit an 8-month low (48.1) and produce its third consecutive contraction in overnight trading. It's a tad strange, one would have expected the markets to come under more pressure with the miss, however investors seem to be enamored with the rhetoric that Beijing may be about to launch a series of "new" policy measures to stabilize growth. To date, their currency has now given back all of last years gains as the PBoC lets the currency weaken further to curb hot-money inflows. Last week, policy makers widened its daily Yuan trading band from +1% to +2%. However, in the overnight session the PBoC set a slightly stronger Yuan midpoint for the first time in five opportunities.

The safe haven Yen has started this week under pressure against its G7 partners. It seems that the market is cautiously optimistic that the geopolitical tensions between Russia and the west will not get any worse. Contradictory signals from Moscow on retaliation against the wests economic sanctions seems to be giving the safe-haven bears some breathing space. Event risk premium that was applied ahead of the weekend is slowly being unwound as we commence a new workweek stateside.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

AUD/USD dips below 0.6600 following RBA’s decision

The Australian Dollar registered losses of around 0.42% against the US Dollar on Tuesday, following the RBA's monetary policy decision to keep rates unchanged. However, it was perceived as a dovish decision. As Wednesday's Asian session began, the AUD/USD trades near 0.6591.

EUR/USD edges lower to near 1.0750 after hawkish remarks from a Fed official

EUR/USD extends its losses for the second successive session, trading around 1.0750 during the Asian session on Wednesday. The US Dollar gains ground due to the expectations of the Federal Reserve’s prolonging higher interest rates.

Gold wanes as US Dollar soars, unfazed by lower US yields

Gold price slipped during the North American session, dropping around 0.4% amid a strong US Dollar and falling US Treasury bond yields. A scarce economic docket in the United States would keep investors focused on Federal Reserve officials during the week after last Friday’s US employment report.

Solana FireDancer validator launches documentation website, SOL price holds 23% weekly gains

Solana network has been sensational since the fourth quarter (Q4) of 2023, making headlines with a series of successful meme coin launches that outperformed their peers.

Living vicariously through rate cut expectations

U.S. stock indexes made gains on Tuesday as concerns about an overheating U.S. economy ease, particularly with incoming economic reports showing data surprises at their most negative levels since February of last year.