This is an event-laden week for capital markets, with a few central banks expected to bare teeth when it comes to their own monetary policy decisions (RBA, BoE and ECB). Already in overnight action, the holiday-thinned market in Asia has been trading with a negative slant. They have not been helped by the world's second largest economy official PMI coming in at a six-month low (50.5) and their non-manufacturing at a two-year low (53.3). So far this year, the accumulation of a number of softer Chinese reports is beginning to worry more investors, as they hover over that sell button. Obviously regional questions have again pressurized the Nikkei - shaving another -2%, following on from the Dow's -1% loss last Friday.

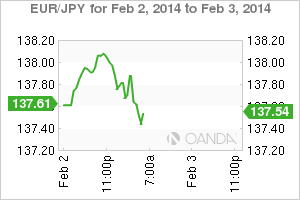

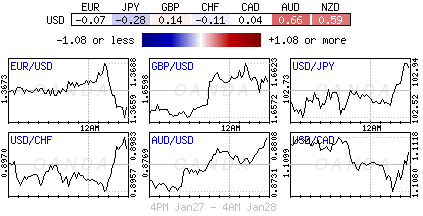

Within the forex space, the yen and the dollar continue to hold onto that strong safety bid, while the 18-member single currency trades within sight of its two-month low. The Emerging Market currencies continue to dominate risk sentiment – as the Turkish lira (TRY) and South African (ZAR) remain under selling pressure. To bring a fitting end to what's expected to be a volatile forex week will be the North Americas January's job's report. Both Canada and the US December's headline left a nasty aftertaste, this time the market is ruling that out. Is the market going to be caught flatfooted like last time?

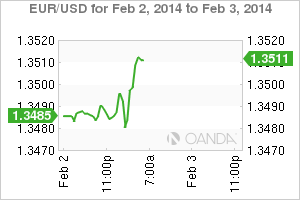

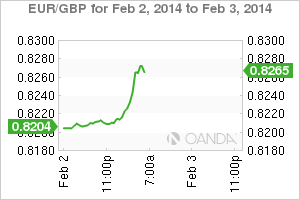

The investors favorite traded currency pair, the EUR/USD, does not get intimidated that easily. Four-year ago it took the threat of a Greek sovereign default to bring the single currency to 'one' knee. A couple of years later it was an inconclusive Greek election outcome that temporarily crippled its progress. Today, it’s the threat of Eurozone deflation and what Draghi and company are willing to do about it that has the EUR on the back foot. With inflationary pressures subsiding in January for the Euro-zone, investors are already beginning to price in an easing bias as they expect the ECB to act at some point down the road. The majority so far do not expect any direct ECB action come Thursday, however, the ECB have know to surprise – last Novembers rate cut was outside the ECB's quarterly forecast round.

A percentage of the market is anticipating the ECB to cut its main refinancing rate by -15bp to a record low of +0.10%, and the interest rate on the deposit facility by -10bp to negative territory come Thursday. Even if Draghi and his fellow policy makers do not carry through with these actions, the risks to the EUR still remain very much uneven. The mere fact that Draghi and company will have to remain dovish (for low inflation sake) and the potential indication of a policy response (in the future) should be held over to Draghi's press conference.

The risk of a rate cut by the ECB is not the only concern for the single-currency. The rumor that the Bundesbank might support stopping the "weekly sterilization" of the ECB's legacy bond portfolio is also weighing on the currency. That is draining the excess liquidity that is pumped into the system by the ECB. Using a sterile policy has allowed "the ECB to claim that no Fed style QE program was ever initiated." To discontinue would increase market liquidity initially and provide some downward pressure on money market products. More importantly, market perception of QE may change – investors "could interpret it as a sign that QE is less controversial to Euro-policy makers than previously assumed." No matter what, Draghi and company will have to maintain their fancy footwork to keep the EUR's fall within an orderly trading range.

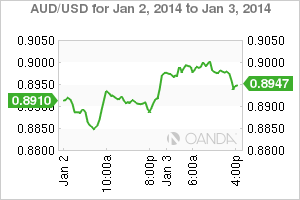

Before the EUR's center stage performance on Thursday, the RBA and governor Stevens are this week's first central bank act to show their hand later this evening. While the majority of investors do not expect the Governor to change the current cash rate (+2.50%), there is a belief that the RBA could possibly remove any residual easing bias in its policy statement. If so, this will immediately lead the rates market to begin pricing in a "future" rate hike. This year was always going to be dominated by 'rate divergence' – there is no need to "follow thy leader anymore." The 'new' leader is now Janet Yellen at the Fed. Policy makers are prepping themselves to turn off or slow down their own liquidity taps without disturbing their own country's tenuous growth. The Australian economy has shown signs of recovery of late, with record low interest rates continuing to provide the spark for the housing sector. It’s the mining sector that continues to drag on the economy. Obviously, the AUD 's price fall over the last 12-months has been able to somewhat artificially cushion their economy to threats.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0750 to start the week

EUR/USD trades in positive territory above 1.0750 in the European session on Monday. The US Dollar struggles to find demand following Friday's disappointing labor market data and helps the pair hold its ground.

GBP/USD edges higher toward 1.2600

Following Friday's volatile action, GBP/USD pushes higher toward 1.2600 on Monday. Soft April jobs report from the US and the modest improvement seen in risk mood make it difficult for the US Dollar to gather strength.

Gold rebounds above $2,310 after downbeat NFP data, eyes on Fedspeak

Gold price trades in positive territory above $2,310 after closing the previous week in the red. The weaker-than-expected US employment data have boosted the odds of a September Fed rate cut, hurting the USD and helping XAU/USD find support.

Addressing the crypto investor dilemma: To invest or not? Premium

Bitcoin price trades around $63,000 with no directional bias. The consolidation has pushed crypto investors into a state of uncertainty. Investors can expect a bullish directional bias above $70,000 and a bearish one below $50,000.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.