It has been a relatively rocky ride for the venerable Cable over the past few weeks as the talk of a BREXIT continues to impact the currency. However, despite some of the recent selling, the pair is firmly within the grips of a consolidation pattern that could see some dramatic moves in the week ahead.

Undertaking a technical analysis of the Cable’s 4-Hour chart yields some potentially interesting clues for the week ahead. It is readily apparent that the currency pair has largely been trapped within a slightly bearish consolidating channel since the middle of March. Although the pair has reacted sharply to a range of external shocks, including increased talk of a BREXIT, price action has remained within a relatively tight range. However, some sharp recent selling has seen the pair trend towards the bottom of the range which could indicate a strong move ahead.

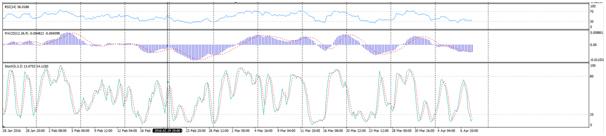

In fact, the technical indicators are showing some interesting signals as the RSI Oscillator remains relatively flat, near over-sold territory, despite the recent price declines. Subsequently, there is some divergence between the indicator and price action that could be indicating a reversal of the short term trend. In confluence with RSI, the stochastic oscillator is also deep within oversold territory which lends further credence to the argument for a short term reversal.

Subsequently, there is plenty of scope for the entry of a long position above the key 1.4170 resistance level. Alternatively, a break below the 1.40 handle would indicate a sharp push towards the bottom of the channel is likely. However, be aware of any short side move as the Risk/Reward ratio is not advantageous.

Ultimately, the Cable’s forward trend is likely to wait upon the UK Manufacturing Production results before making a strong move. However, given the recent collapse in the pair’s value, the downside might be relatively limited. Subsequently, the most likely scenario is a sideways consolidation at the current level before a challenge of the 1.4170 resistance level.

Risk Warning: Any form of trading or investment carries a high level of risk to your capital and you should only trade with money you can afford to lose. The information and strategies contained herein may not be suitable for all investors, so please ensure that you fully understand the risks involved and you are advised to seek independent advice from a registered financial advisor. The advice on this website is general in nature and does not take into account your objectives, financial situation or needs. You should consider whether the advice is suitable for you and your personal circumstances. The information in this article is not intended for residents of New Zealand and use by any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Knight Review is not a registered financial advisor and in no way intends to provide specific advice to you in any form whatsoever and provide no financial products or services for sale. As always, please take the time to consult with a registered financial advisor in your jurisdiction for a consideration of your specific circumstances.

Recommended Content

Editors’ Picks

AUD/USD stalls ahead of Reserve Bank of Australia’s decision

The Australian Dollar registered minuscule gains compared to the US Dollar as traders braced for the Reserve Bank of Australia monetary policy meeting. A scarce economic docket in the United States and a bank holiday in the UK were the main drivers behind the “anemic” AUD/USD price action. The pair trades around 0.6624.

USD/JPY extends recovery above 154.00, focus on Fedspeak

The USD/JPY pair trades on a stronger note around 154.10 on Tuesday during the Asian trading hours. The recovery of the pair is supported by the modest rebound of US Dollar to 105.10 after bouncing off three-week lows.

Gold rises as US job slowdown dampens Treasury yields

Gold price rallied close to 1% on Monday, late in the North American session, bolstered by an improvement in risk appetite due to increased bets that the US Federal Reserve might begin to ease policy sooner than foreseen. The XAU/USD trades at around $2,320 after bouncing off daily lows of $2,291.

TON crosses $200 million in Total Value Locked as its network integration continues to scale

In a recent development, the TON network surpassed $200 million in total value locked on Monday after seeing a major boost through The Open League reward program.

RBA expected to leave key interest rate on hold as inflation lingers

Interest rate in Australia will likely stay unchanged at 4.35%. Reserve Bank of Australia Governor Michele Bullock to keep her options open. Australian Dollar bullish case to be supported by a hawkish RBA.