The New Zealand Dollar had a relatively mixed week as the pair saw a negative sentiment from the sharp decline in NZD CPI to -0.5% as well as some buoyancy from the poor US jobless Claims figures. Ultimately, the Kiwi Dollar ended the week gaining around 50 pips. Moving forward, the NZD appears to be faltering and could challenge the supportive 64 cent handle in the coming days as the RBNZ’s OCR decision falls due.

The week ahead is likely to be critical for the pair as it faces a slew of US economic data as well as the important Reserve Bank of New Zealand decision upon interest rates. Given the recent fall in NZ CPI the meeting is likely to be a live one where a 25bps cut may be considered. Given the recent sharp fall in CPI, the RBNZ is under pressure to act to support the economy. Subsequently, look for plenty of volatility around the decision especially if there is an easing bias inherent in the minutes.

As the prices of crude oil and dairy products continue to tumble there has been renewed pressure upon New Zealand inflation. The recent fall in the NZ CPI is largely down to the recent cheap oil and dairy prices, however there are some concerning signs of a slowing NZ domestic economy. Subsequently, the upcoming Reserve Bank meeting is likely to be lively with plenty of sentiment changing material contained within the minutes. Therefore, expect to see lots of swing within NZDUSD prices as the market digests the latest round of jawboning from the RBNZ Governor.

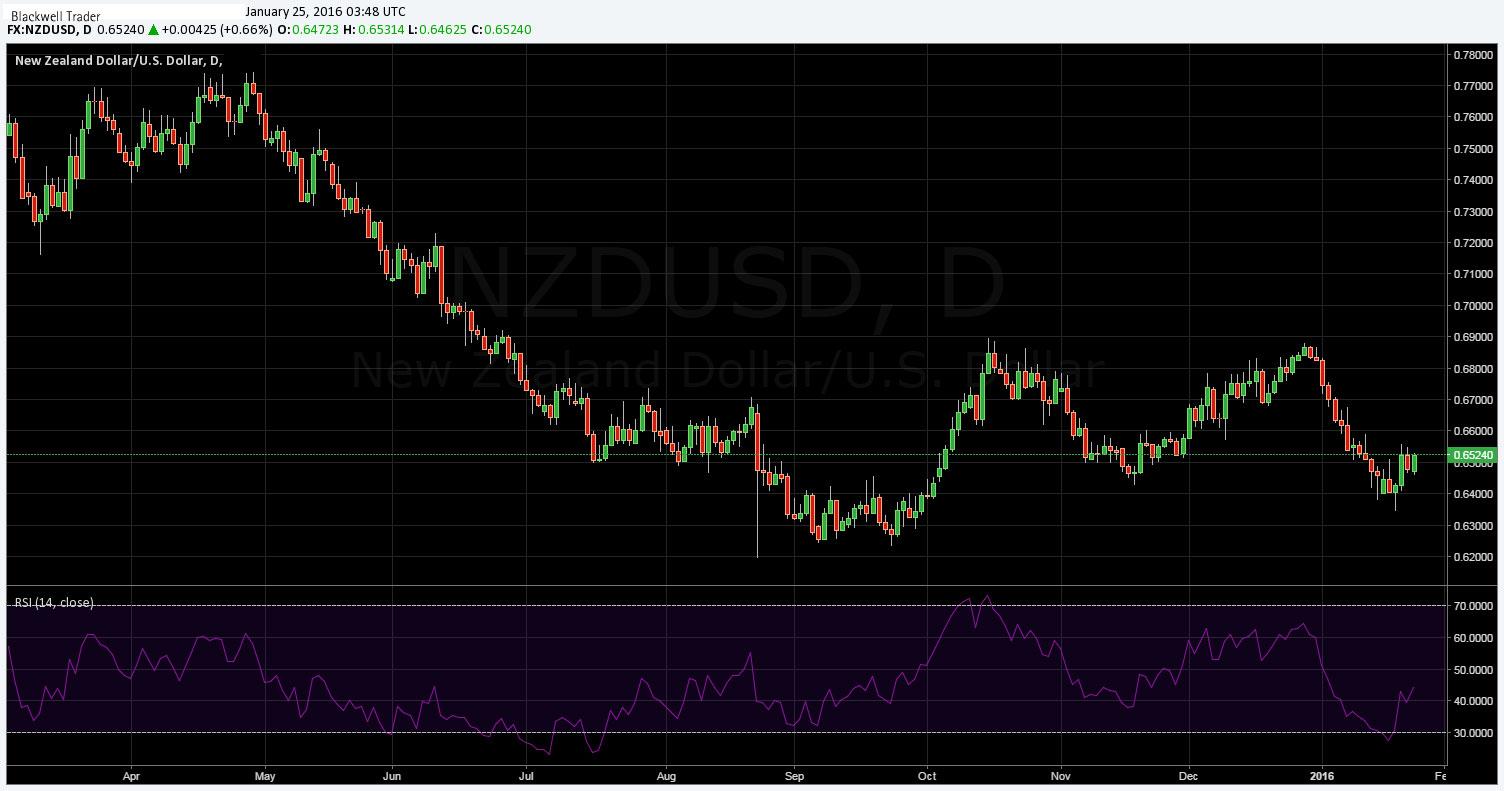

From a technical perspective, the NZD’s price action remains capped within a relatively wide consolidation channel. The moving averages also remain relatively bearish whilst RSI appears to have dipped slightly within neutral territory. It’s likely that the pair will challenge the key supportive zone around the 64 cent handle in the coming days but the current position of the pair lends itself more to a neutral bias until a strong trend is observed. Support is found at 0.6400 and 0.6234. Resistance is found at 0.6557, 0.6706, and 0.6898.

Ultimately, predicting Central Bank monetary policy action requires a deft understanding of their mandate along with some significant skill in crystal ball analysis. Subsequently, monitor your positions closely with a particular view to the short side.

Risk Warning: Any form of trading or investment carries a high level of risk to your capital and you should only trade with money you can afford to lose. The information and strategies contained herein may not be suitable for all investors, so please ensure that you fully understand the risks involved and you are advised to seek independent advice from a registered financial advisor. The advice on this website is general in nature and does not take into account your objectives, financial situation or needs. You should consider whether the advice is suitable for you and your personal circumstances. The information in this article is not intended for residents of New Zealand and use by any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Knight Review is not a registered financial advisor and in no way intends to provide specific advice to you in any form whatsoever and provide no financial products or services for sale. As always, please take the time to consult with a registered financial advisor in your jurisdiction for a consideration of your specific circumstances.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.