The week ahead is likely to be volatile for Gold but the question remains as to what extent a potential US rate hike has already been priced in.

Gold came under pressure early in the week as FOMC member Bullard’s speech further fuelled the case for a rate hike. In addition, US Core Retail Sales and PPI were also buoyant at 0.4% and 0.3% m/m respectively. Subsequently, Gold was sold off strongly as capital fled the metal for other safe havens. However, the slide was arrested by a weaker than expected US Unemployment Claims result at 282k (270k exp) and the metal managed to finish the week at $1074.44 an ounce.

Looking ahead, Gold is facing a volatile week as the US Federal Reserve is set to ponder the state of the Federal Funds Rate on Wednesday. The central bank has been largely tipped to raise the benchmark rate by 25bps which would see the metal under significant pressure. Subsequently, expect to see plenty of sharp swings in the lead up to the news release.

In addition, most participants within the market agree that the risk of a 25bps rate rise has already been priced in and that subsequently there shouldn’t be a large rout following the release. However, that would largely rely upon gold remaining in stable equilibrium which is debateable considering some of the capital flows and swings of the past few days. Subsequently, expect to see the metal experience some sharp volatility before recommencing its long term bear trend.

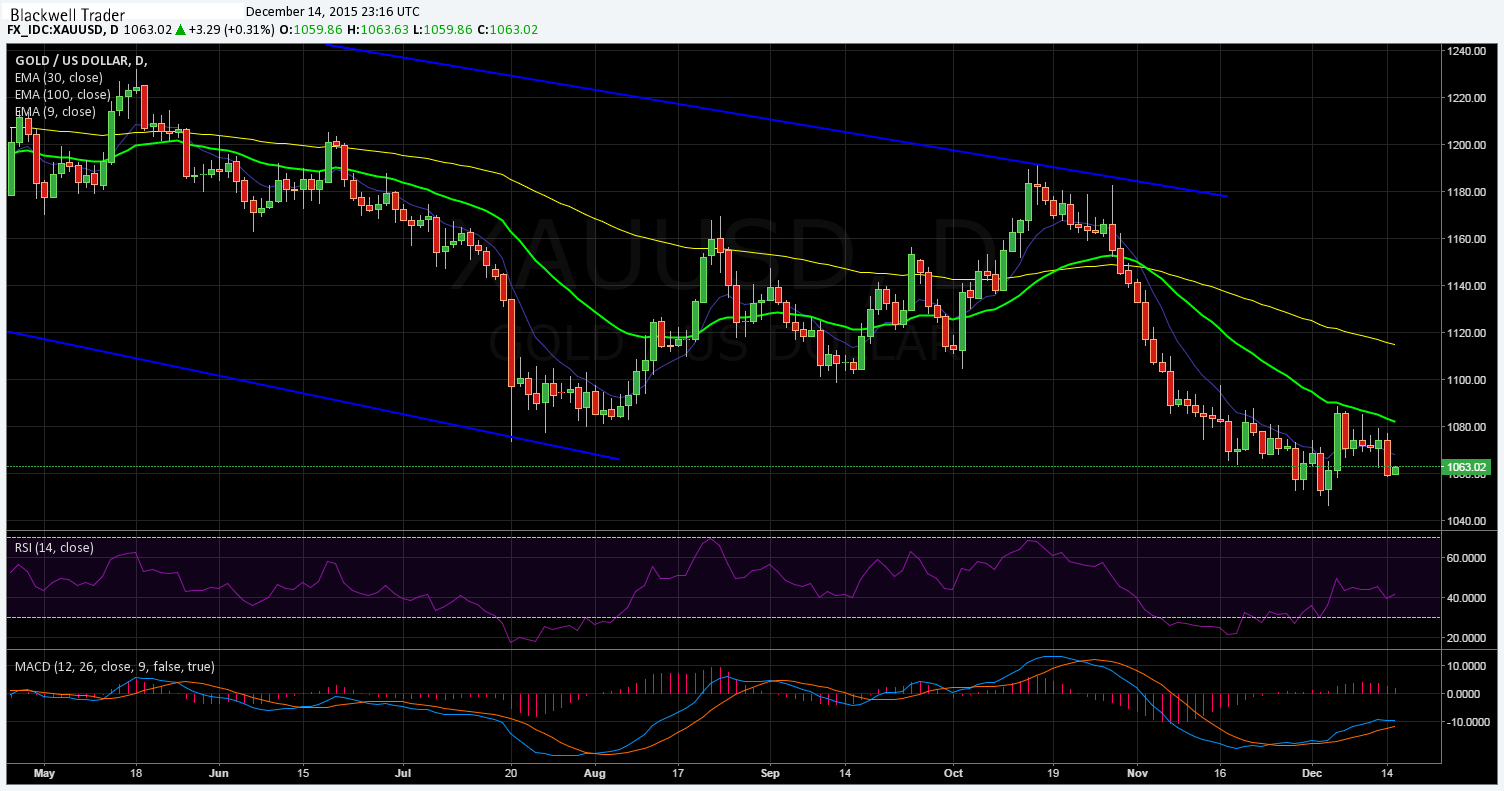

From a technical perspective, Gold remains trapped within a bearish channel that has been capping the price action. The metal also remains depressed and well below the 100 and 30 EMA’s whilst RSI remains flat within neutral territory. Given the strong volatility expected around the FOMC decision, and the difficulty in managing that downside risk, our bias remains neutral. Support is currently in place for the pair at $1072.11, $1045.96, and $1035.55. Resistance exists on the upside at $1097.63, $1191.38, and $1233.71.

Risk Warning: Any form of trading or investment carries a high level of risk to your capital and you should only trade with money you can afford to lose. The information and strategies contained herein may not be suitable for all investors, so please ensure that you fully understand the risks involved and you are advised to seek independent advice from a registered financial advisor. The advice on this website is general in nature and does not take into account your objectives, financial situation or needs. You should consider whether the advice is suitable for you and your personal circumstances. The information in this article is not intended for residents of New Zealand and use by any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Knight Review is not a registered financial advisor and in no way intends to provide specific advice to you in any form whatsoever and provide no financial products or services for sale. As always, please take the time to consult with a registered financial advisor in your jurisdiction for a consideration of your specific circumstances.

Recommended Content

Editors’ Picks

AUD/USD dips below 0.6600 following RBA’s decision

The Australian Dollar registered losses of around 0.42% against the US Dollar on Tuesday, following the RBA's monetary policy decision to keep rates unchanged. However, it was perceived as a dovish decision. As Wednesday's Asian session began, the AUD/USD trades near 0.6591.

EUR/USD edges lower to near 1.0750 after hawkish remarks from a Fed official

EUR/USD extends its losses for the second successive session, trading around 1.0750 during the Asian session on Wednesday. The US Dollar gains ground due to the expectations of the Federal Reserve’s prolonging higher interest rates.

Gold wanes as US Dollar soars, unfazed by lower US yields

Gold price slipped during the North American session, dropping around 0.4% amid a strong US Dollar and falling US Treasury bond yields. A scarce economic docket in the United States would keep investors focused on Federal Reserve officials during the week after last Friday’s US employment report.

Solana FireDancer validator launches documentation website, SOL price holds 23% weekly gains

Solana network has been sensational since the fourth quarter (Q4) of 2023, making headlines with a series of successful meme coin launches that outperformed their peers.

Living vicariously through rate cut expectations

U.S. stock indexes made gains on Tuesday as concerns about an overheating U.S. economy ease, particularly with incoming economic reports showing data surprises at their most negative levels since February of last year.