Crude oil remained in rout for the second straight day on the basis of the current inventory build within crude storage facilities. Subsequently, WTI CLF6 futures fell strongly and are currently trading around the $42.50/b level.

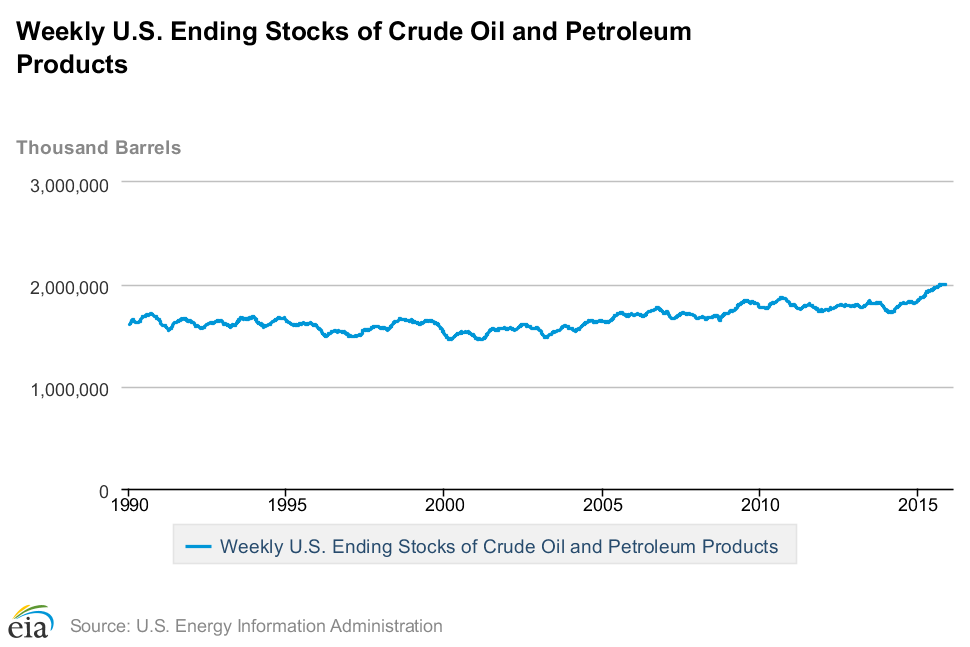

The impetus for the big move was a report by the U.S. Energy Information Administration announcing that crude oil inventory figures rose by 0.90 million barrels. Forecasts had the initial draw at 1.1 million barrels but the result still remained largely negative for oil traders and sent the commodity falling back towards the key $42.00 level. However, the downside is likely to be limited, at least in the short term, as much of the fall has been abated by long positions being taken around $42.00.

However, the inventory numbers are exceedingly bearish and mirror much of the recent supply pressures within global crude markets. Modelling undertaken earlier in the year by the EIA estimated that oil output would continue to drop by over 160,000kb/d throughout 2016. However, these estimations are in conflict with advanced modelling, developed by the Goldman Sachs commodity team, which forecasts growth of 145,000kb/d throughout the latter part of 2015 and into 2016.

The reality is that there are currently many competing interests amongst oil exporters which are clearly evident when you take into account Iran’s recent announcement that there is no requirement for them to consult with OPEC about increased production levels. Subsequently, the over-supply conundrum is likely to remain in the near term as OPEC countries are increasingly relying upon oil revenues to stump up their ailing foreign currency reserves.

In addition, any subsequent price rally is likely to be short term in nature given the risk of the move becoming self-defeating. Increasing oil prices will simply incentivise producers to clamour back into the market to restart production worsening any potential supply glut. Given the large numbers of rig stand downs and well shuttering that has occurred in 2015, the risk of that productive capacity re-entering the market is real.

Subsequently, until OPEC or the West blinks, and adjusts supply accordingly, low crude oil prices are here to stay for the medium term. Subsequently, we still view our price forecasting for crude as accurate with a price target of $41.00/b towards the end of 2015 and reducing to $37.00-$39.00/b by Q2, 2016.

Risk Warning: Any form of trading or investment carries a high level of risk to your capital and you should only trade with money you can afford to lose. The information and strategies contained herein may not be suitable for all investors, so please ensure that you fully understand the risks involved and you are advised to seek independent advice from a registered financial advisor. The advice on this website is general in nature and does not take into account your objectives, financial situation or needs. You should consider whether the advice is suitable for you and your personal circumstances. The information in this article is not intended for residents of New Zealand and use by any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Knight Review is not a registered financial advisor and in no way intends to provide specific advice to you in any form whatsoever and provide no financial products or services for sale. As always, please take the time to consult with a registered financial advisor in your jurisdiction for a consideration of your specific circumstances.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.