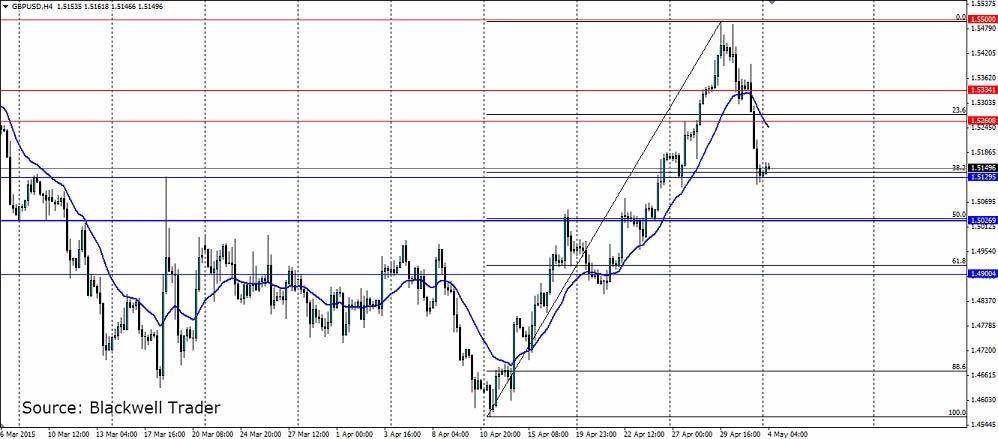

The pound saw a sharp correction at the end of last week which retraced back to the 38.2% Fibonacci line. If this gives way, the 50% line will prove tougher to break, as it has acted as a pivot point before.

The market shrugged off the UK GDP figures which were a big miss early on in the week. Q1 2015 GDP came in at 0.3% q/q, down from 0.6% the previous quarter. US dollar selling ensured the pound was still bid higher. The Cable came unstuck later on in the week as the Manufacturing PMI fell from 54.4 to 51.9 and the US dollar was seen as a good buy.

The Construction and Services PMIs are both due early this week and the market will be eagerly awaiting the result of the UK general election on the 7th May. Both Labour and the Conservatives are even on 34% each, which will likely lead to a hung parliament. The market will likely be volatile as each new poll is released leading into the election.

The chart shows just how large that sell off was as it erased all of the gains made in the first half of the week and retraced back to the 38.2% Fibonacci level. The Stochastic Oscillator shows the momentum certainly on the bearish side as it moves from oversold at pace. We could see a push down to the 50% Fib level as the market gains volatility ahead of the election, but watch for the 100 day MA in between. A cross of the 20 EMA over the 100 day SMA could provide a bit of bullish pressure as the market see an end to the long term bearish trend.

Resistance for the GBPUSD pair is found at 1.5260, 1.5334 and 1.5500. Support can be found near the current level at 1.5129, with further support at the 50% Fib level at 1.5026, and 1.4900. The 50% level looks like it will be a sticking point for the price and will make a good target for any short term shorts out there.

Forex and CFDs are leveraged financial instruments. Trading on such leveraged products carries a high level of risk and may not be suitable for all investors. Please ensure that you read and fully understand the Risk Disclosure Policy before entering any transaction with Blackwell Global Investments Limited.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.