The BoJ blindsided the market with more stimulus during the last quarter and a win in the snap election for Abe means four more years of Abenomics.

GROWTH EXPECTATIONS:

Japan has fallen into a technical recession according to the latest figures released in December. Final GDP for Q3 2014 was rather disappointing at -0.5%. This is on the back of a -1.8% contraction in Q2. The weak GDP figures came after private and public investment figures weakened, but are not expected to lead to a deep recession. Not surprisingly, the Bank of Japan (BoJ) has halved its own growth estimate for this fiscal year from 1.0% to 0.5%.

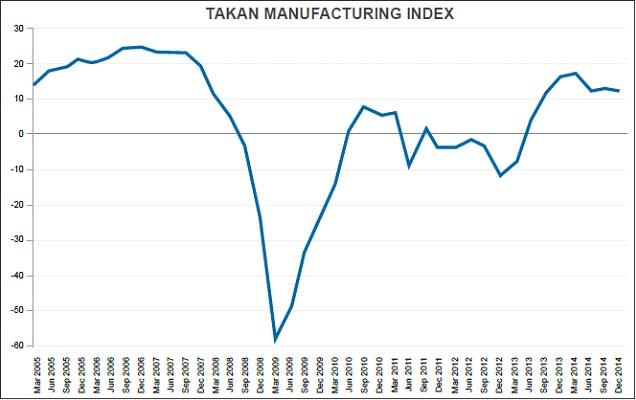

The Tankan Manufacturing Index was released in mid- December and disappointed the market by falling back from 13 to 12. This is certainly not as low as the negative readings seen over the past couple of years, however, has come down from earlier this year and is reflective of the current economic situation in Japan. The Tankan Non- Manufacturing Index fared a bit better as it rose from 13 to 16, but is also lower than a year ago.

The unemployment rate has fallen back to the recent low of 3.5%, which is one of the few positive signs out there for the Japanese Economy. The manufacturing PMI is another that has remained consistently positive at 52.1.

MONETARY POLICY:

There was plenty of action on the Monetary Policy front for Japan as a second round of stimulus was released at the end of October, which caught the market completely off guard. Bank of Japan (BoJ) Governor Kuroda announced an expansion to the mammoth ¥60T Quantitative Easing programme by a further ¥20T. The effect was further pain for the Yen as it pushed through the 120.00 level against the USD.

The other big news in Japan was the snap election in December 14th which Prime Minister Shinzo Abe called for. He comfortably won, even expanding his majority, resulting in four more years of Abenomics. The easy money and a weak Yen can be expected for some time yet.

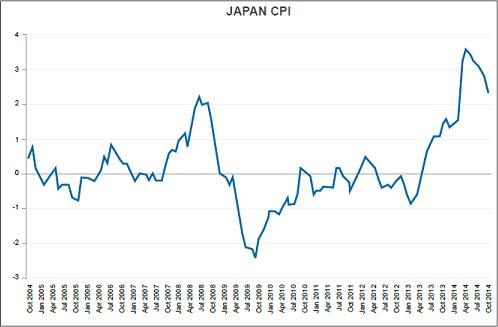

Inflation has been a disappointment for the BoJ over the quarter and partly explains the surprise second round of stimulus. CPI has fallen from 3.2% y/y in October to 2.4% in December. Final GDP price index has also followed suit with a slight dip from 2.1% y/y to 2.0%. While both of these are above the 2017 target of 2.0% inflation, there is concern the drop will continue.

FISCAL POLICY:

Following the December 14 election win by Abe, he has kept good on his election promise by announcing a ¥3.5T spending package to aid growth. The stimulus package will provide low income households with fuel subsidies and will support funding for small firms.

A second hike in the sales tax that had been scheduled to come into effect on 1st April 2015 has been postponed to April 2017. Prime Minister Abe believes the recovery is not robust enough to absorb the rise. This would have seen the sales tax rise from 8% to 10%, which would have come on the back of the hike in April 2014 from 5% to 8%.

FX OUTLOOK:

The announcement of another round of stimulus sent shockwaves through the markets and saw the Yen depreciate sharply against the USD. The move saw the Yen smash through the 110 level and extend all the way to a 6-year high of 121.80. There is some concern in the market that the Yen depreciated too far and too fast, however, it has since pulled back slightly.

From here, we may see a period of ranging as we saw after the announcement of the first stimulus package almost two years ago. A consolidation of the USDJPY within the current range is the most likely scenario, however, any further stimulus from the BoJ will likely push out the recent highs and lead to a continuation of the bullish movement.

EQUITY OUTLOOK:

The Nikkei 225 has seen big gains thanks to the large depreciation in the Yen and the inverse correlation the two have. This correlation is likely to continue and any further stimulus will certainly have a bullish effect on the Nikkei 225 as cheap capital looks for a home. If the Yen looks to range, watch for the Nikkei to follow suit.

Forex and CFDs are leveraged financial instruments. Trading on such leveraged products carries a high level of risk and may not be suitable for all investors. Please ensure that you read and fully understand the Risk Disclosure Policy before entering any transaction with Blackwell Global Investments Limited.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.