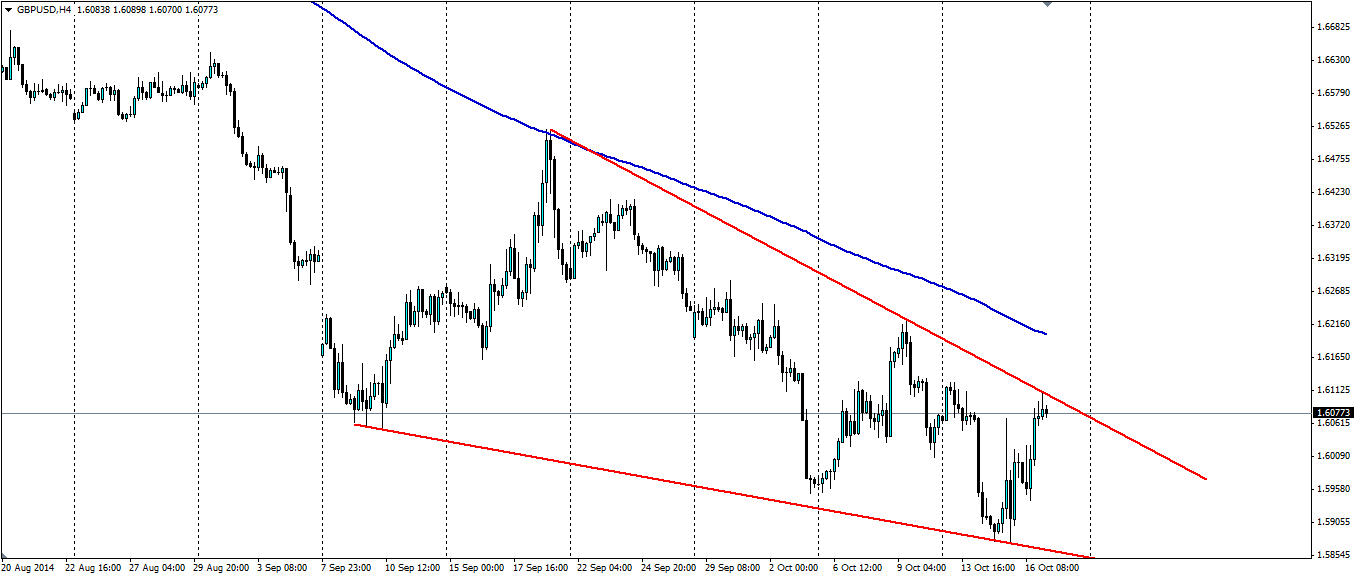

The Pound Sterling has had an abysmal run over the past 2 months but a large technical pattern could point to a possible change in fortunes in the form of a bullish breakout. A rejection off the top of the shape, however, suggests a continuation of the pattern.

The falling wedge pattern is one we generally find at the bottom of a bearish trend. As the buyers begin to stand their ground more and sellers become few and far between, the price consolidates. Each wave becomes smaller as the selling pressure becomes weaker until eventually there is an upside breakout of the shape and the buyers flood in. That’s the textbook example anyway.

In this case the bearish trend in the GBPUSD pair is justified as inflation in the UK weakens from 1.9% in July to the current 1.2%, making the likelihood of the Bank of England raising interest rates any time soon remote.

The US on the other hand has seen some very strong employment data which has underpinned the strength in the dollar. That strength has begun to waver recently as volatility in equity markets and fears of a slowdown in global growth begins to spill over into the FX markets.

We may see another wave towards the bottom of the wedge as the strong us data last night sinks in. US Unemployment claims fell from 287k to 264k, their lowest level since April 2000. The Philly Fed Manufacturing Index also came in at 20.7, ahead of forecasts at 19.9. All eyes will be on Yellen’s speech today and whether she is more or less dovish than expected.

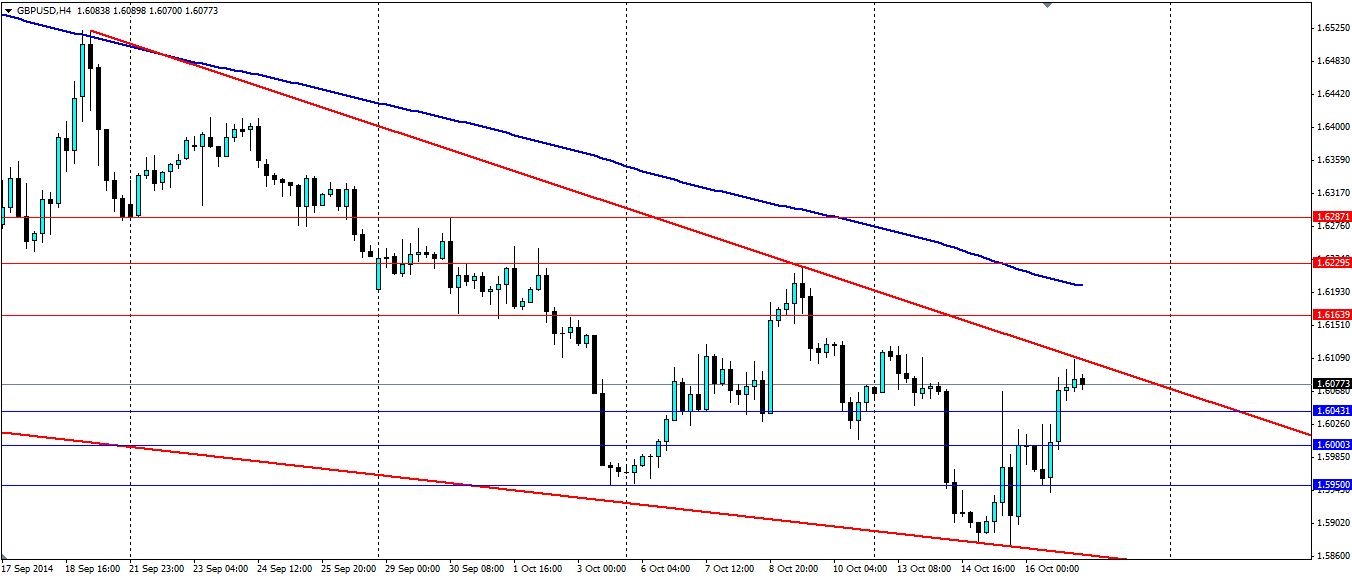

If we do see a breakout, look for resistance to be found at 1.6164, 1.6229 and 1.6287. Also, be wary of the 200 Moving Average on the H4 chart as this acts as dynamic resistance whenever the price comes in contact with it, as can be seen at the top of the wedge. The price looks to have just rejected off the upper level of the wedge, and a continuation of that rejection will look for support at 1.6043, 1.6000 and 1.5950. If it continues through those levels, the price will look to find dynamic support along the bottom of the wedge.

The GBPUSD pair has formed a large falling wedge on the H4 charts. This is generally a reversal signal, however, the price looks to have just rejected off the upper level and may form another wave within the wedge.

Forex and CFDs are leveraged financial instruments. Trading on such leveraged products carries a high level of risk and may not be suitable for all investors. Please ensure that you read and fully understand the Risk Disclosure Policy before entering any transaction with Blackwell Global Investments Limited.