The silver market has seen some surprising bullish activity as of late, and this may last for a little while longer given the recent dovish minutes from the last meeting.

However, I would be surprised to see more support in the market especially for the bulls, and we only have to look at the recent US economic data; especially for unemployment. JOTLS Job Openings are a 4.83M (exp 4.71M) and Unemployment Claims came in at 287k (exp 295K). Solid results in the labour market, and for the US economy. But what is most important is that the FED will be taking notice of the strong job market and Yellen for some time has been telling the market to expect rate rises sooner rather than later.

Yes, world markets have had a downgrade in growth forecasts, but if the US starts to pick up more steam it will likely carry global markets. Which will in turn lead to Yellen lifting rates sooner and forcing the speculators out of metals who are feeding of the recent dovish comments.

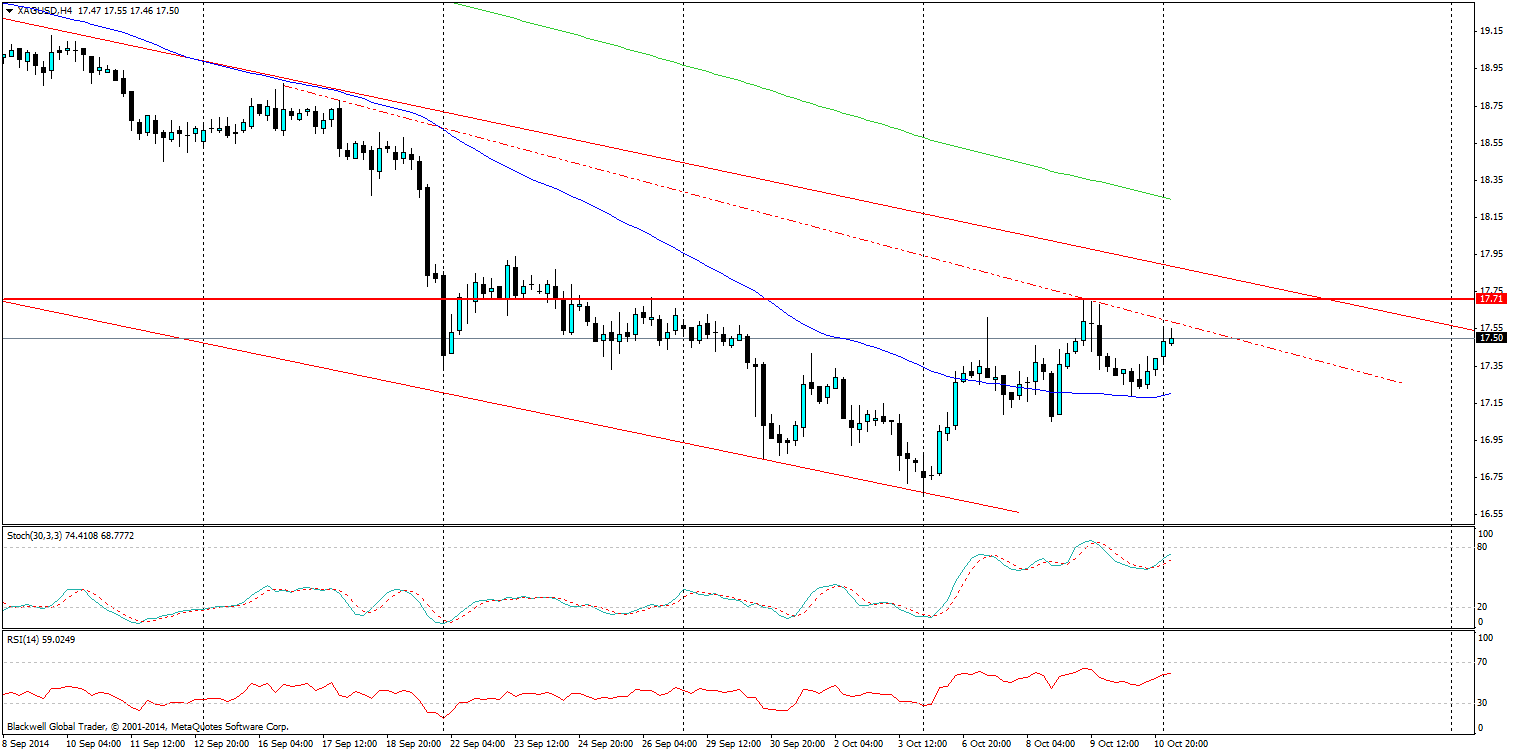

Looking at the technical aspect of silver, it’s quite clear there is a nice trend line on the H4 which starts back in early September. As a trader it has had a few key tests, including during Yellen’s comments and managed to hold! So I will be looking to play of touches and use the 50 day MA as an exit point in the current market.

If this fails, look for resistance at 17.71. A break through this level would signal bullish movement and a need to reassess current patterns in the market.

I will be looking for the bears who are still in the market and still have the momentum to swipe silver lower. If anything, more positive US data could be the catalyst this week to really help push out lower lows.

Recommended Content

Editors’ Picks

EUR/USD holds steady near 1.0800 ahead of key events

EUR/USD stays in a consolidation phase at around 1.0800 early Tuesday after closing in positive territory on Monday. Market participants await ZEW sentiment data from Germany and the EU, producer inflation data from the US and Fed Chairman Powell's speech.

GBP/USD trades at around 1.2550 after UK jobs data

GBP/USD struggles to build on Monday's gains and hovers around 1.2550 in the European session on Tuesday. The data from the UK showed that the Unemployment Rate edged higher to 4.3% in the three months to March as forecast, failing to trigger a reaction.

Gold price edges higher ahead of US PPI data, Fed’s Powell speech

The gold price (XAU/USD) rebounds despite the consolidation of the US Dollar (USD) on Tuesday. The upside of yellow metal might be limited as traders might wait on the sidelines ahead of key US inflation data this week.

Ethereum knocking at support’s door

Crypto market capitalisation rose 0.8% over the past 24 hours to 2.2 trillion, but growth exceeded 2% for most of the period. However, it dipped at the start of active European trading, temporarily returning to levels of a day ago.

Entering a crucial run of data for financial markets

We are entering a crucial period for financial markets and forecasters as Americans' near-term inflation expectations rise again. Upcoming reports on the CPI and PPI for April, along with new data on retail sales and industrial production, will provide valuable insights.