If you’ve been watching the New Zealand dollar, you have certainly been taken for a ride on the NZDUSD and AUDNZD. Both pairs have seen a large amount of volatility in the previous 24 hours, and it has been due to a number of key factors.

Yesterday’s reassessment from the NZ treasury had a sour taste for the government, as they downgraded the surplus. The NZ economy will still reach a surplus, but it will be much less than expected, and in turn growth will likely be affected overall.

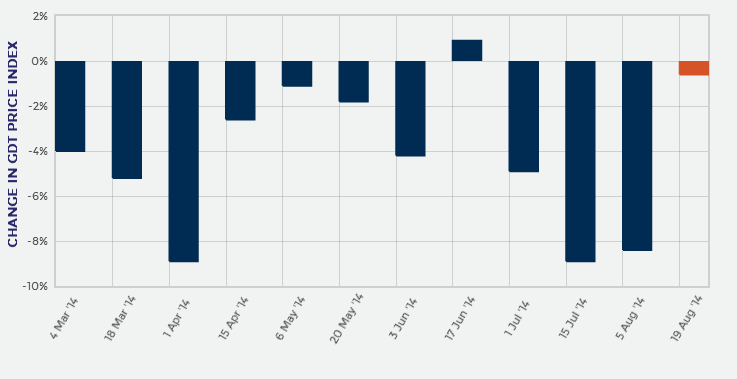

On top of yesterday's woes the dairy auction overnight showed a slight drop in milk prices. This drop was not heavy though like previous drops, which will have some positive effects on the primary sector. However, it’s still a drop and many are still concerned of further drops in NZ’s largest export sector.

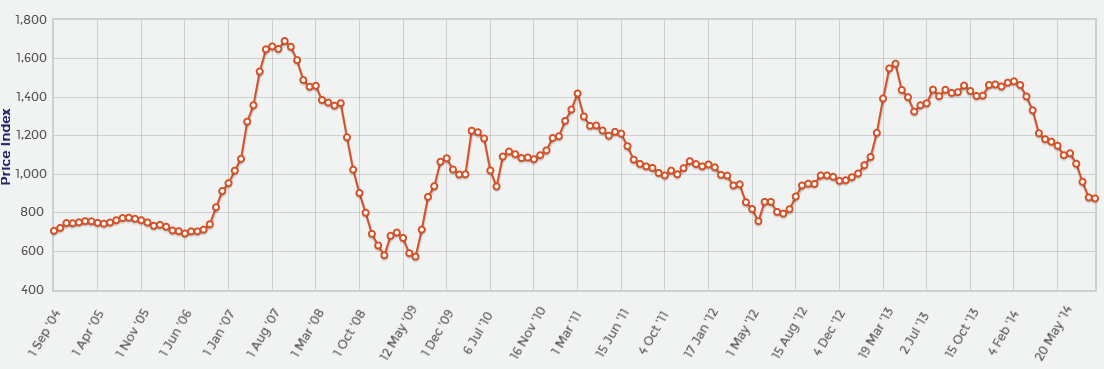

When we look at the overall index the drop is small at 0.3%, but when we look at the index itself, we can see that the fall has been quite heavy over the last year. However, yesterday’s drop so far looks to be a slowing as it nears the 800 level of the index, and we may see support there.

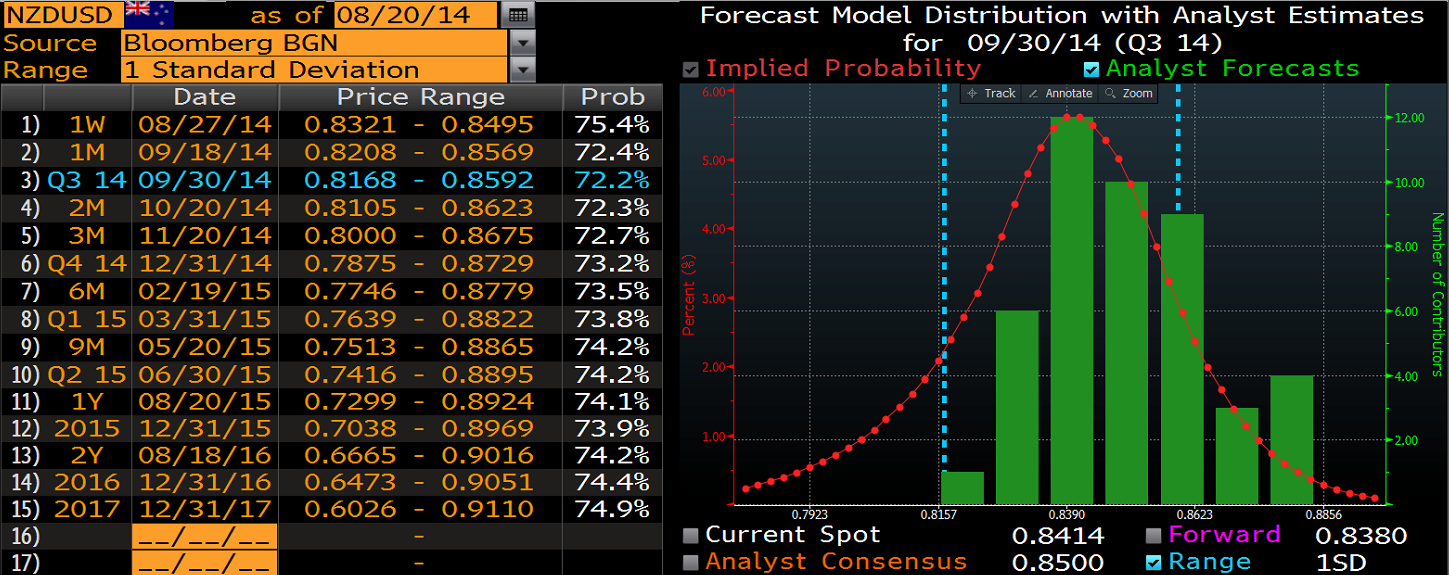

So as a result we now see the NZD in a precarious position, and markets are eyeing up further falls in the long run as a result of yesterday’s downturn in surplus predictions. A quick glance at FX forecasting model from Bloomberg shows a declining outlook for the NZD in the short term, with long term views that the NZD could fall further in the current market climate.

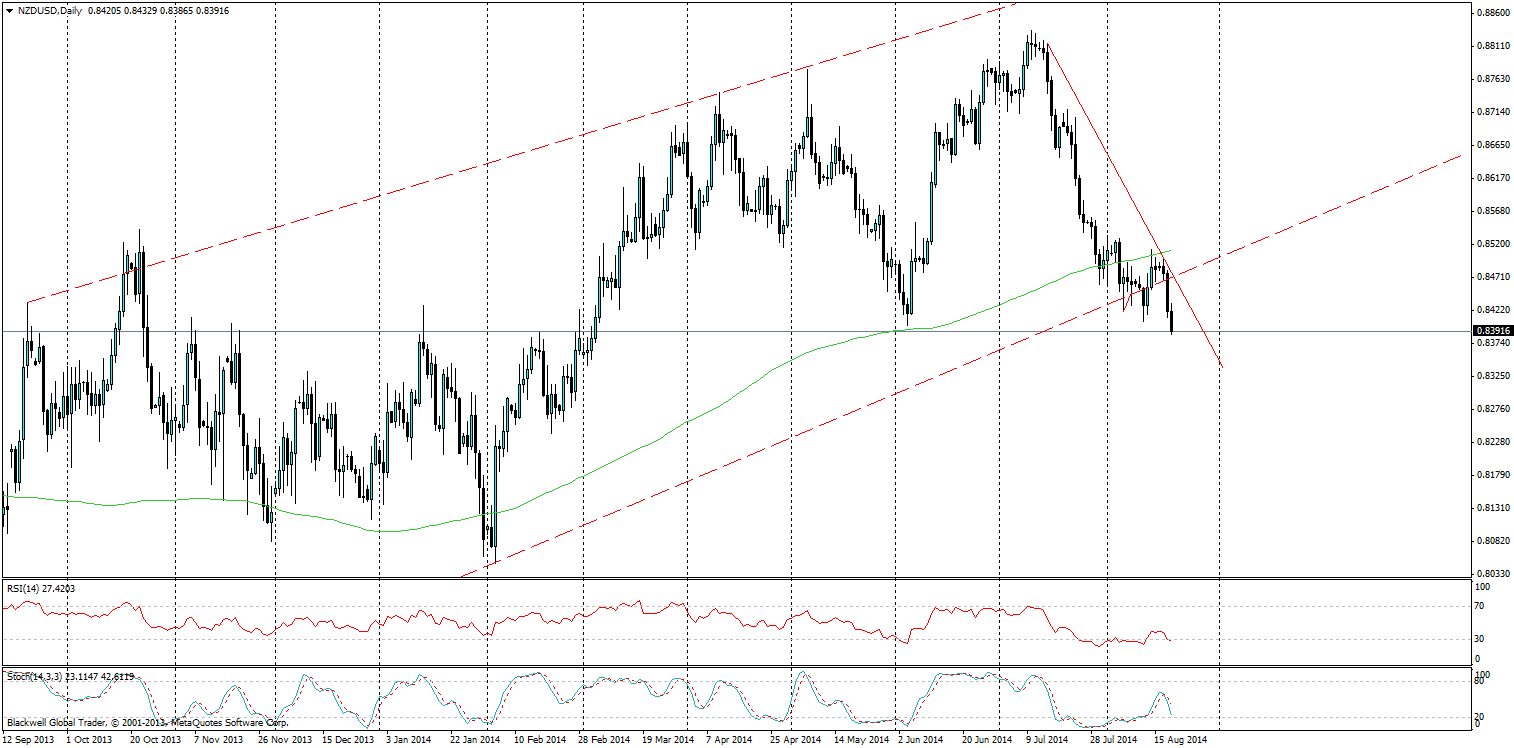

On the trading charts we can see that the bulls have exited the market for the time being.

So what this all adds up to is a falling NZDUSD cross on the charts. At present there is a strong bearish trend line in play pushing the NZDUSD down. Especially after the recent trend line breakthrough on the charts, as the bullish channel, which has been in play for some time, breaks down.

Markets will now be targeting the next support level at 0.8300 as a result, and for the most part I expect this will be where the market will find some consolidation before another move, as markets will constantly reassess the position of the NZ economy.

Overall, the bears look in for a treat with the NZDUSD, as signs point to further falls in the long run; even as the carry traders are eyeing up the yields. However, even so there will still be support and a fall to 0.8300 might be all we get in the short to medium term. So traders should be aware that the bears can quickly evaporate and the NZDUSD does like to range for extended periods of time as a result.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.