The oil markets are interesting to watch at present given the global circumstances, and the threat of war on a day to day basis between Russia and the Ukraine. You would think, or perhaps even safely assume, that it would in turn lead to a rise in oil prices globally. That has not happened at all, in fact, we have even seen a decrease in the markets.

The reason for this is not a lack of demand, which some may attribute a drop to, but instead the fact that oil markets are awash with oil at present. Despite the global crisis and conflicts many war torn nations like Libya are turning on the taps in an effort to prop up their economy. Coupled with fracking it is helping to turn the oil shortage from 5 years ago into the oil surplus which in effect will drive prices down.

What this looks like on the markets is something quite interesting.

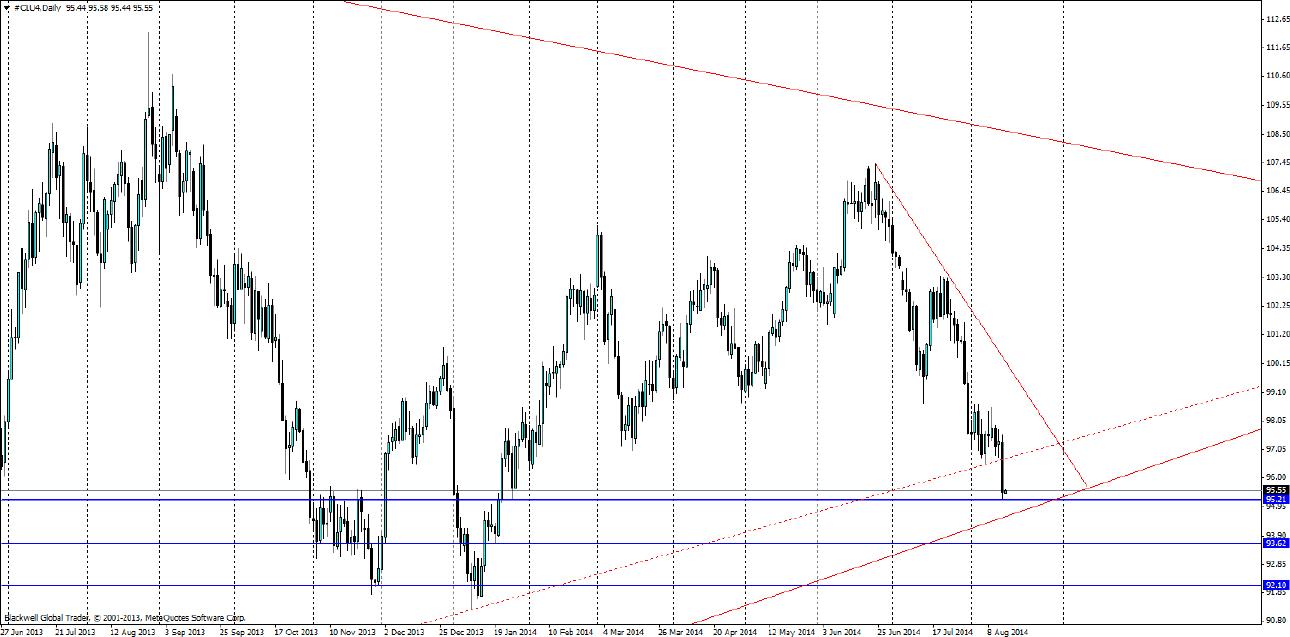

At present the oil markets are plunging lower and when we look at the charts, it looks like a steep bearish trend that might hang around for the short term at least. What is interesting to notice is the attitude of the bears in the market. The second that there is a sniff of breaking through support levels the market plunges strongly. A good sign of a bearish market.

After yesterday’s massive drop, we have a broken trend line from previous touches. So markets will now be focused on the new support levels in play. Currently we can find support at 95.21, 93.62 and 92.10; with 95.21 the support line which stopped the market overnight. This will hold in the short term I feel, but the bears are at work and the fundamentals are backing them up.

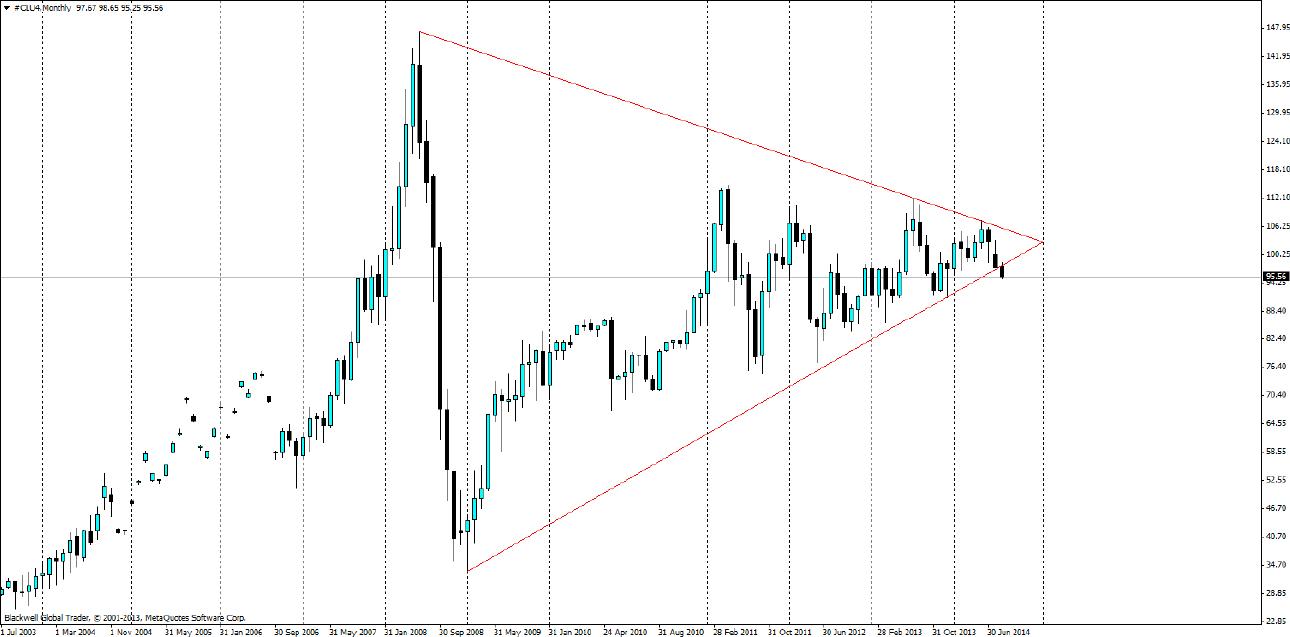

When we switch over to the monthly chart, we see that the pennant pattern which has come together has now dipped and is looking to shift lower, a strong bearish candle closing would signal to the markets that the bears are in control and only long term support levels can stem the tide as oil prices drop.

So with fundamentals pointing to a decrease in the price of oil (as seen in the chart above), and markets now sliding over the technical cliff, we could soon see oil return to $80 dollars a barrel. Certainly this would put pressure on supply, and we could see some pullback out of the market, but it could take some time for those sorts of changes come through. And most certainly renewable technology investment is breathing down the neck of oil markets as well further adding pressure. Long term, oil is going to stay with us for some time, at what price though many are unsure. But for now prices are looking south as a result of the massive shifts in supply.

Forex and CFDs are leveraged financial instruments. Trading on such leveraged products carries a high level of risk and may not be suitable for all investors. Please ensure that you read and fully understand the Risk Disclosure Policy before entering any transaction with Blackwell Global Investments Limited.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.