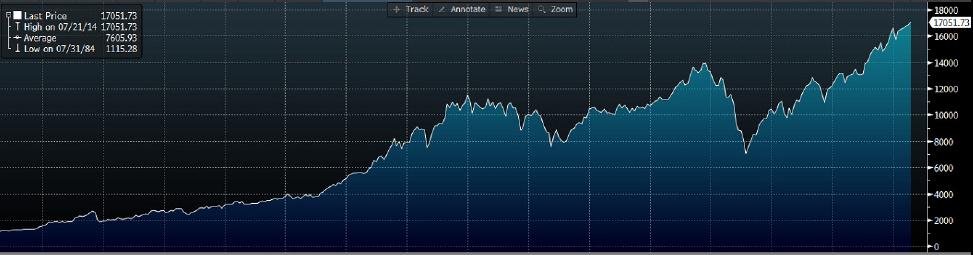

The Dow Jones has certainly been part of the bull market music procession as of late. It’s not hard to see why though either as the US economy continues to recover and as interest rates remain at record lows. On the charts we have seen a bullish run, which has extended itself on the charts since the start of 2009. So for five years we have seen a heavy upward direction in the marketplace and many are expecting/saying it will continue for some time.

The past 20 years show some interesting trends in the equity markets, especially the Dow Jones industrial average. It currently shows, markets having a correction on average every five to seven years with big dips in 1998, 2002 and 2009. It will be interesting to see if this trend has any significance in the current year, as the Dow Jones is currently looking very aggressive; in fact its growth is almost exponential on the charts in the last five years.

The daily chart is interesting to watch at present as an ascending wedge has formed at present. An ascending wedge is an interesting pattern on a bullish chart, as it can signal a bearish reversal or alternatively it can signal a continuation pattern on the charts.

Certainly the last few candles have been a little less certain in terms of direction, and the bulls and bears are trying to take control of the wedge. A breakthrough lower on the wedge will show the short term bearish direction for me, while a push upwards would be nothing more than a continuation pattern and further long term bullish sentiment.

In the event of a breakdown lower by the bears, it will likely aim for a trend line and 16500 levels should be considered when looking at opportunities for an exit strategy.

If you’re looking for it to continue to push lower and see a major retracement on the Dow Jones chart, you might have to wait some time.

At present there is a long way to go before the bullish trend line on the weekly chart is close to breaking down at all. Even with a major drop to the 15000 levels it’s unlikely to fire up any bears unless there was a clean breakthrough of the present trend line.

Summing it all up the wedge is one to watch as it could signal a bearish reversal. The Dow Jones on the charts is climbing aggressively high and is probably a little over extended, certainly there could be a decent short term short on the cards for the market, and traders will look to take advantage of such a movement of the present technical wedge.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.