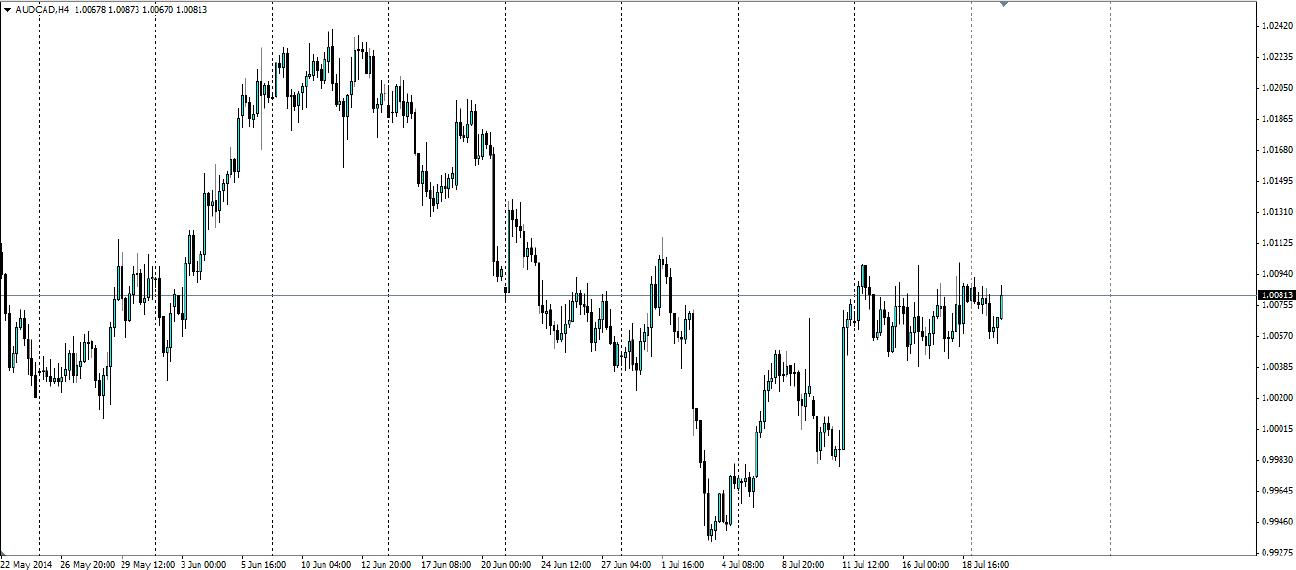

June was a month that definitely favoured the Canadian Dollar. The Aussie depreciated from a high of 1.024 on 6th June to a low of 0.9935 on the 3rd July. June saw Canadian CPI reported at 2.3% year on year, which fuelled speculation that the Bank of Canada will raise interest rates sooner than expected to combat this.

Early in July BoC Governor Stephen Poloz said this is unlikely to happen as the economy is not strong enough and they see the risk of inflation as balanced. He also said “they see the Canadian economy returning to full capacity” in Mid-2016 and interest rates are not likely to rise until then, leading to a pullback. The Ivey PMI, a report of the whole Canadian economy, gives more cause for concern with the latest reading at 46.9, down from 48.2. The Unemployment rate has not helped, unexpectedly rising to 7.1%. This week only Retail Sales figures are released for the CAD, and these should be watched as they could add to volatility.

Australia on the other hand suffered when the trade balance shocked the market at -$1.91b from -$0.12b in early July and the RBA is refusing to speak about raising interest rates any time soon. It has, however, benefited from Chinese data that is coming back towards the positive side and this is expected to continue this week with the HSBC Chinese Manufacturing PMI. If it remains above 50.0, the AUD will benefit due to Australia’s reliance on China for trade. Also keep an eye on Australian CPI later this week.

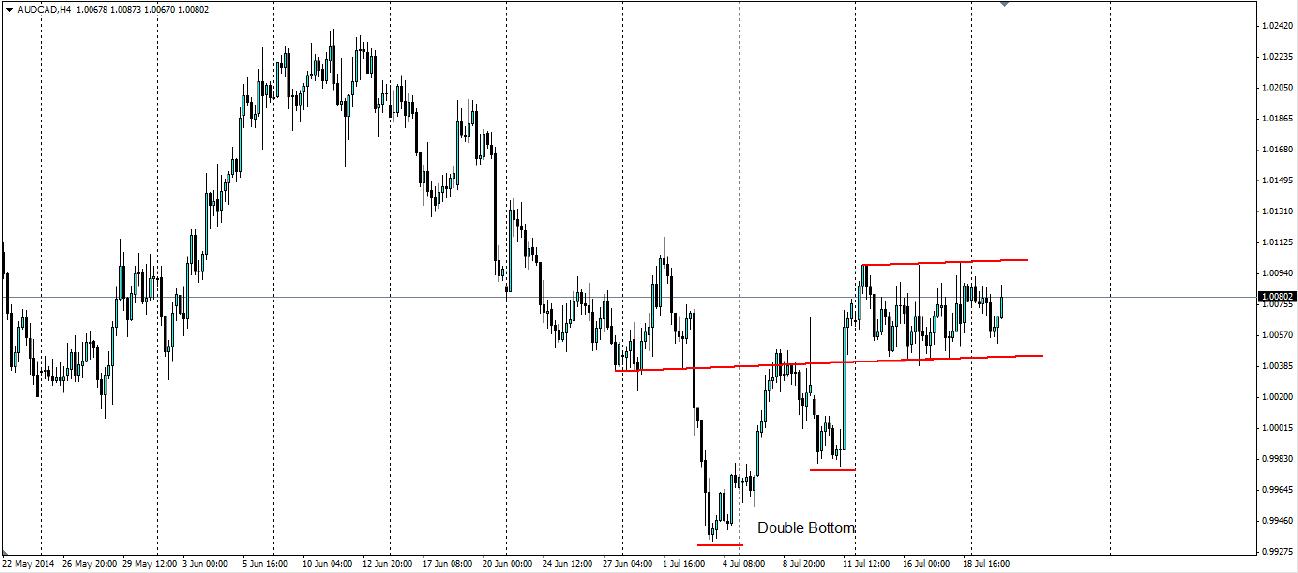

The pull back from the low in early July resulted in the formation of a double bottom, a bullish reversal signal. This led into the tight ranging pattern that we currently find ourselves in and a breakout to the upside is the likely result. Technically speaking, the double bottom confirms the reversal of the bearish trend and the beginning of a bullish one, the ranging pattern is merely a pause in the movement. The fundamentals are there to back up a movement higher for the Aussie, however the Chinese data this week will need to agree.

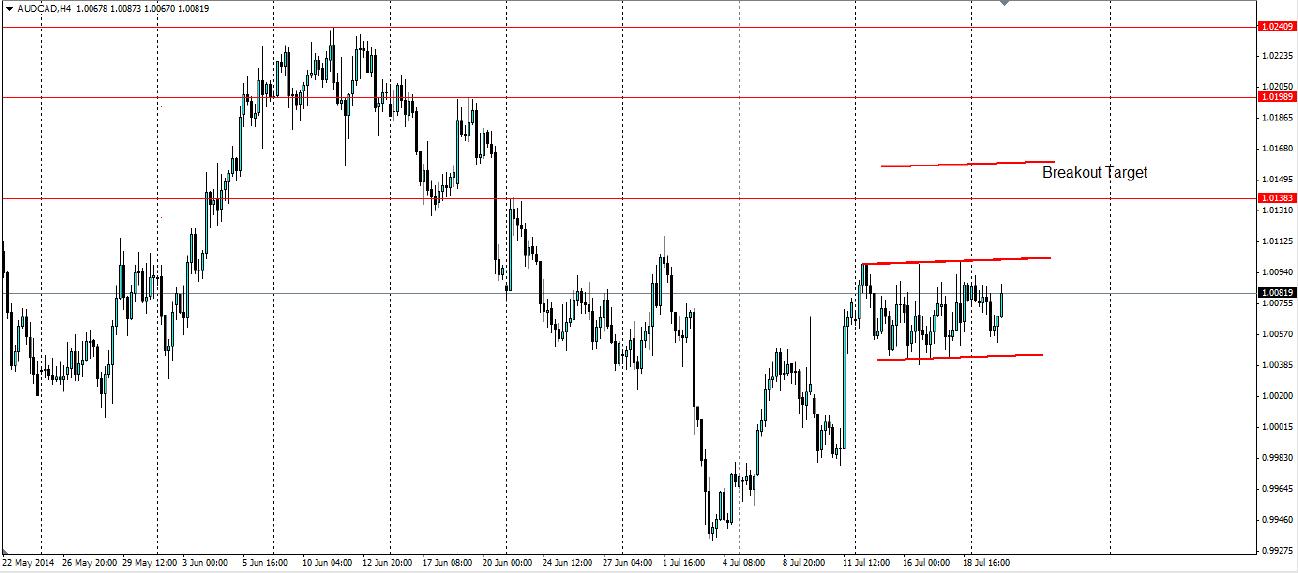

Look for the confirmation of a breakout once the resistance at 1.0101 has broken. A target for the breakout will be the width of the current ranging pattern, i.e. 56 pips or at 1.0157. Previous levels of support will act as resistance, such as 1.1038, 1.0199 and 1.0241.

A double bottom pattern on the AUDCAD H4 chart points to a reversal of the down trend and a breakout to the upside of the current ranging pattern is likely, but will depend on economic news this week.

Forex and CFDs are leveraged financial instruments. Trading on such leveraged products carries a high level of risk and may not be suitable for all investors. Please ensure that you read and fully understand the Risk Disclosure Policy before entering any transaction with Blackwell Global Investments Limited.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.