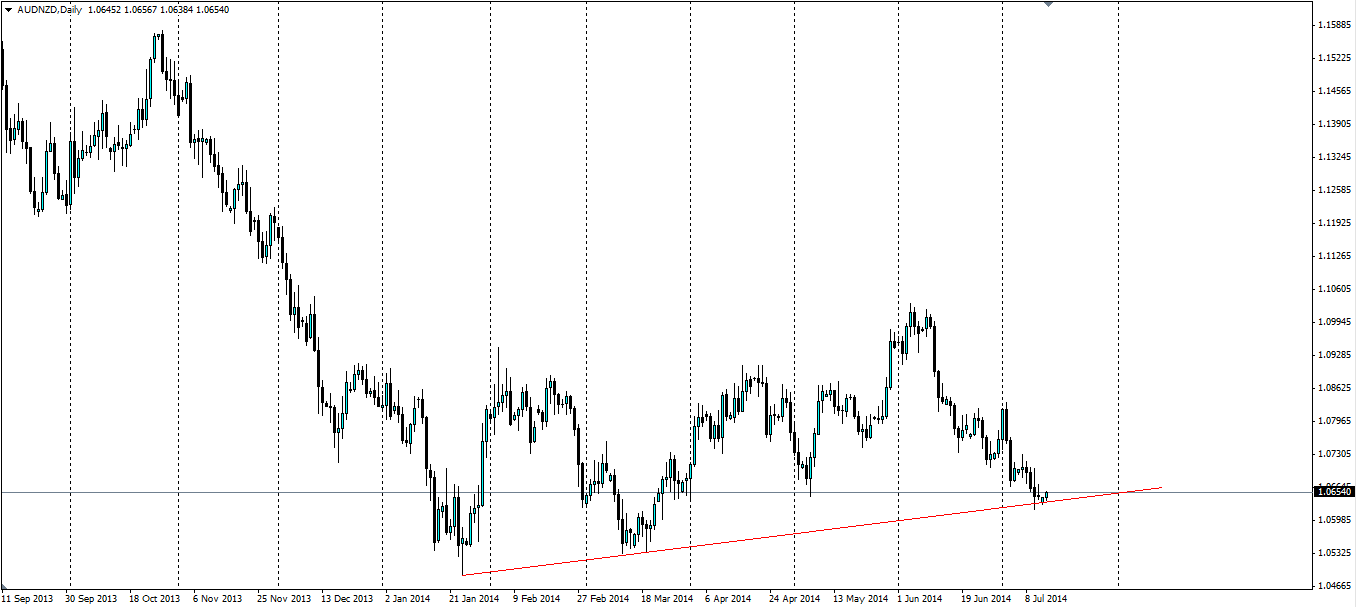

The AUDNZD pair is testing the current trend line, which is so far holding firm. In the absence of any shocks to the market, the bulls should return and a bounce off the trend line will be the likely outcome.

The long term trend has been something of a feature of the AUDNZD chart. The Kiwi has certainly been a favourite of the market, but as all of the future interest rate increases have been priced in, it has run out of steam somewhat. The Aussie on the other hand, has not fared as badly as many had dreaded. China’s slowdown has not materialised in the way many in the market anticipated, so the Aussie dollar has looked oversold, and many have returned to it.

This has pushed the AUD up against the kiwi dollar, but it has maintained a ranging pattern. Both currencies have seen positive and negative news lately, but the RBNZ’s stance on maintaining its original policy of 4.5% interest rates by the end of next year has led the AUDNZD pair to the current lows. It has been helped along by the Australian unemployment rate, which unexpectedly climbed back to 6.0%. But again, all of these factors are now priced in.

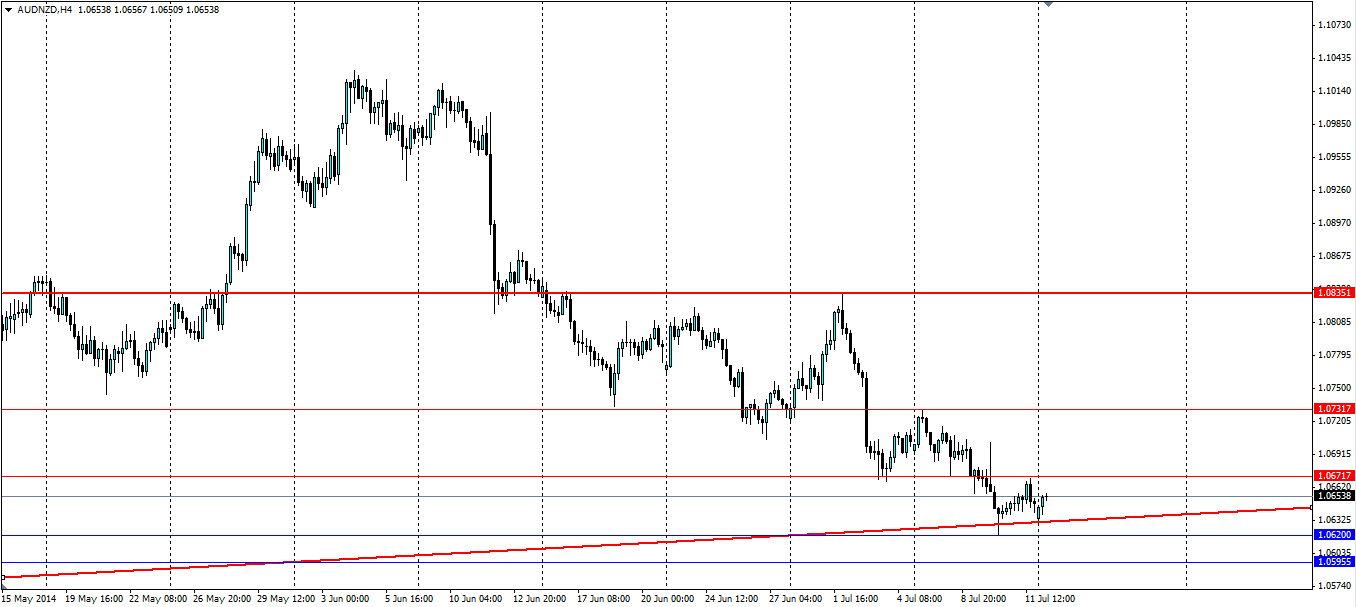

There is little news out for the Australian dollar this week, apart from Chinese GDP figures on Wednesday (16 Jul 02:00 GMT). If these are positive, the Aussie will benefit, otherwise it will trade largely off technicals this week. For the Kiwi, CPI figures are due on Tuesday (15 Jul 22:45, Wed morning NZ time). Inflation has been steady around the 1.5-2% level. A drop will weigh heavily on the Kiwi as it may prompt the RBNZ to rethink the 4.5% interest rate target.

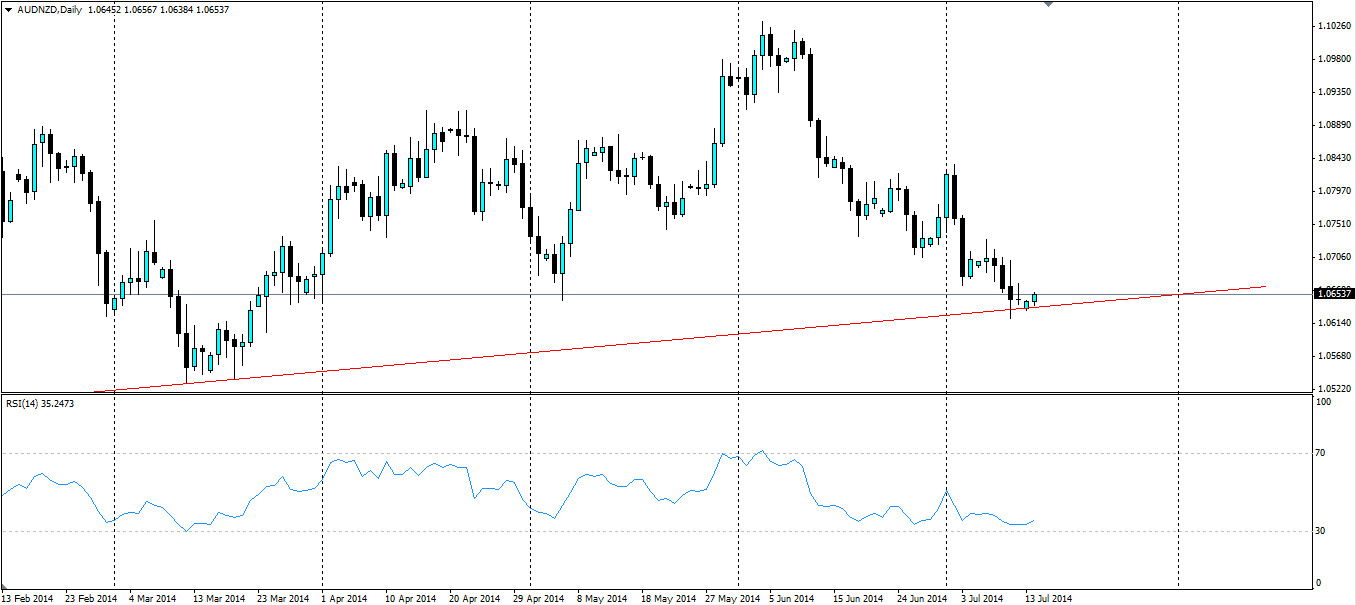

The end result is a pair that should lean on technical signals for direction, and the most obvious one is the bullish trend that has acted as dynamic support in the last couple of days. Furthermore the RSI is beginning to show a turnaround as it moves up from close to oversold. The RSI posted a figure of 33.595 when the price made a false breakout of the trend line and has moved up to a current level of 35.247

The trend line has, and is likely to hold and the price should bounce higher as a result, enticing the bulls back to the market. Previous levels of support/resistance are likely to again act as resistance for the movement higher. These can be found at 1.0672, 1.0732 and 1.0835. If the trend line breaks, the levels of support are not likely to hold up for long, nevertheless, these can be found at 1.0620, 1.0595 and 1.05317 and could act as points for the price to bounce off if the breakout is a false one.

The AUDNZD pair is following a steady bullish trend line that has been tested over the last couple of days and has held so far. In a week without too much big news, this should provide a level for the price to bounce off and move higher as bulls return.

Forex and CFDs are leveraged financial instruments. Trading on such leveraged products carries a high level of risk and may not be suitable for all investors. Please ensure that you read and fully understand the Risk Disclosure Policy before entering any transaction with Blackwell Global Investments Limited.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.