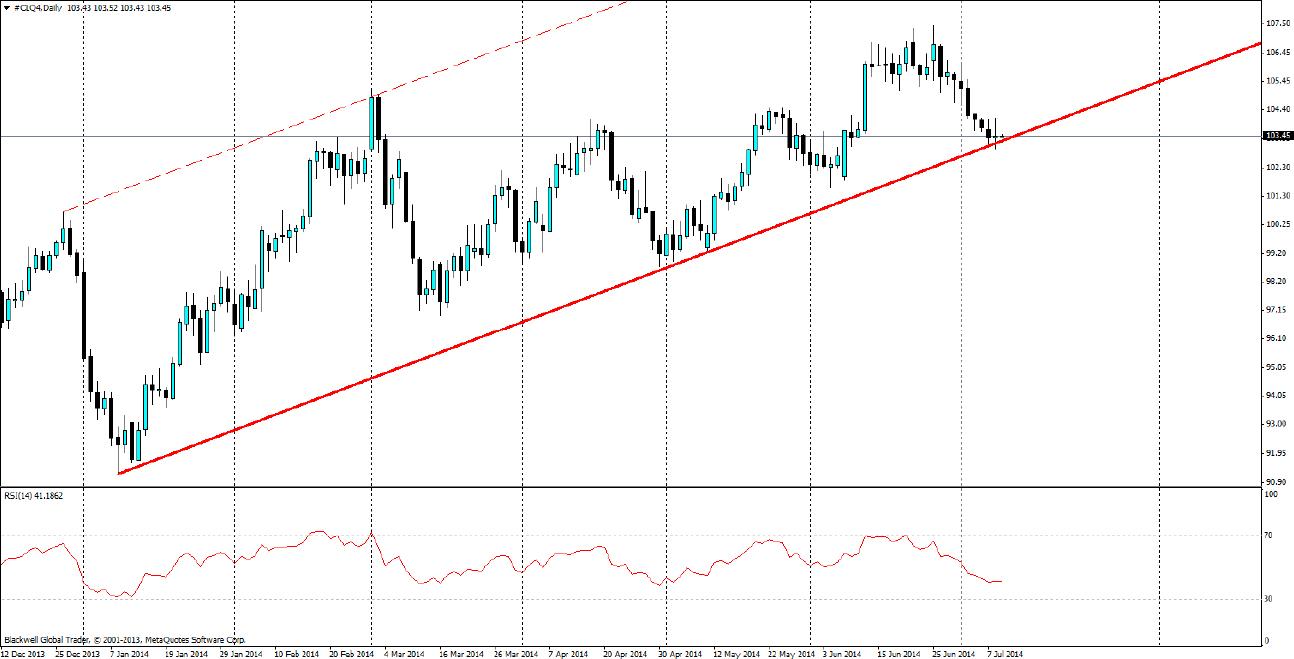

OIL

After trending down the charts as global tensions ease, oil might find some respite as of late. Currently oil has been playing of technicals and we have a strong bullish trend line in the play, which has helped to drive prices higher. Markets will look to use this trend line to push higher and long positions should be set higher to catch momentum to resistance levels at 105.50.

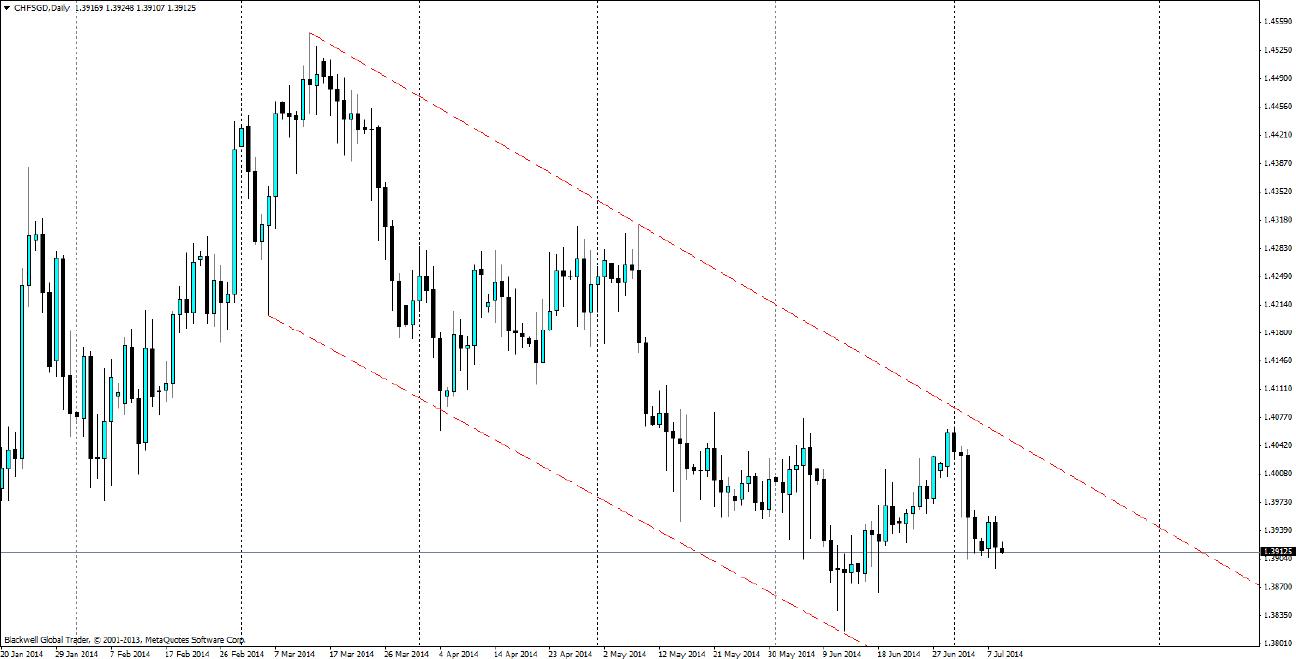

CHFSGD

The Swiss Franc has been pushed down against the Singapore Dollar as of late, and it does not look like it’s going to let up anytime soon. Monday morning saw a sharp pullback followed by a double top and the charts now point to further lows as a result of this bearish pattern.

GBPJPY

The Pound Yen has been in a bullish channel for some time, but looks to be pulling back on the charts after a spate of bad data from the UK economy, including the recent manufacturing report which showed a contraction in the economy. Either way the push downwards to the trend creates opportunities for traders looking to jump back on the charts as they climb higher. A touch of the trend line would certainly be a good opportunity to catch momentum as it climbs higher again in the short term.

Recommended Content

Editors’ Picks

AUD/USD loses ground due to the absence of a hawkish RBA

The Australian Dollar has plunged following the Reserve Bank of Australia's decision to maintain its interest rate at 4.35% on Tuesday. Investors sentiment leaned toward a potentially more hawkish stance from the RBA, particularly after last week's inflation data surpassed expectations.

EUR/USD edges lower to near 1.0750 after hawkish remarks from a Fed official

EUR/USD extends its losses for the second successive session, trading around 1.0750 during the Asian session on Wednesday. The US Dollar gains ground due to the expectations of the Federal Reserve’s prolonging higher interest rates.

Gold price remains on the defensive on a firmer US Dollar

Gold price attracts some sellers on the firmer US Dollar during the Asian trading hours on Wednesday. The hawkish remarks from Federal Reserve officials dampen hopes for potential interest rate cuts in 2024 despite weaker-than-expected US employment reports in April.

FTX files consensus-based plan of reorganization, awaits bankruptcy court approval

FTX has filed a consensus-based plan for its reorganization, coming almost two years after the now defunct FTX filed for Chapter 11 Bankruptcy Protection in the District of Delaware.

Living vicariously through rate cut expectations

U.S. stock indexes made gains on Tuesday as concerns about an overheating U.S. economy ease, particularly with incoming economic reports showing data surprises at their most negative levels since February of last year.