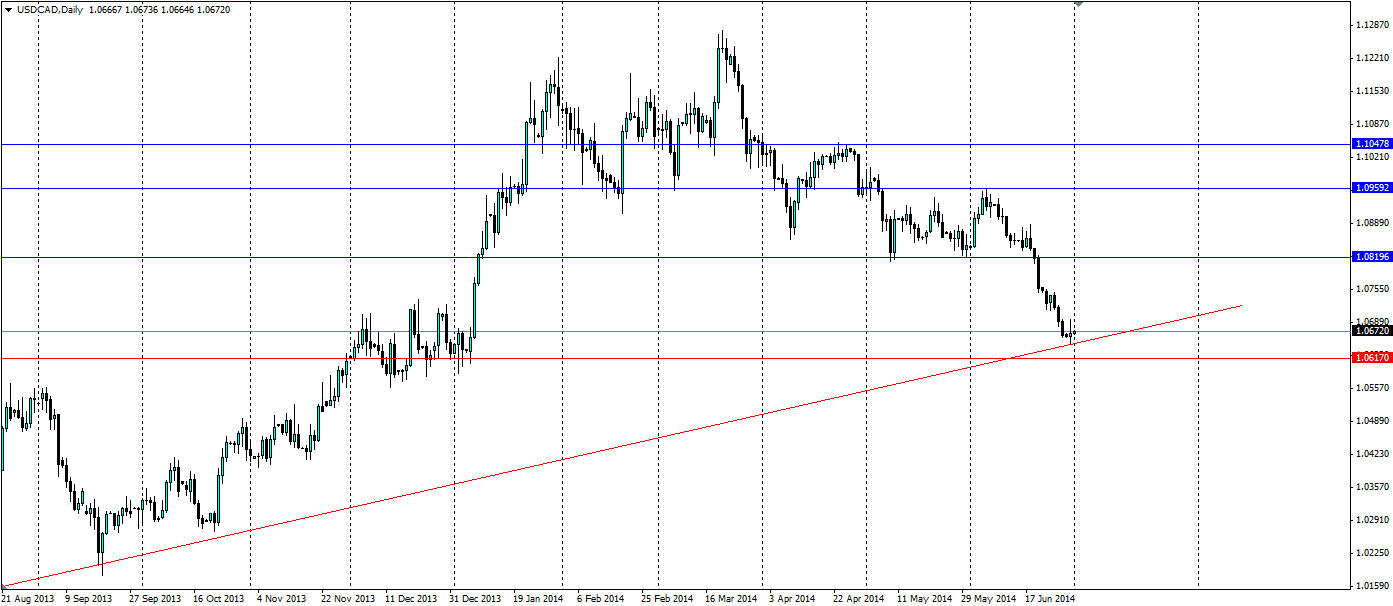

The USDCAD pair touched a long term trend line which will provide traders a good entry spot in a long USD position.

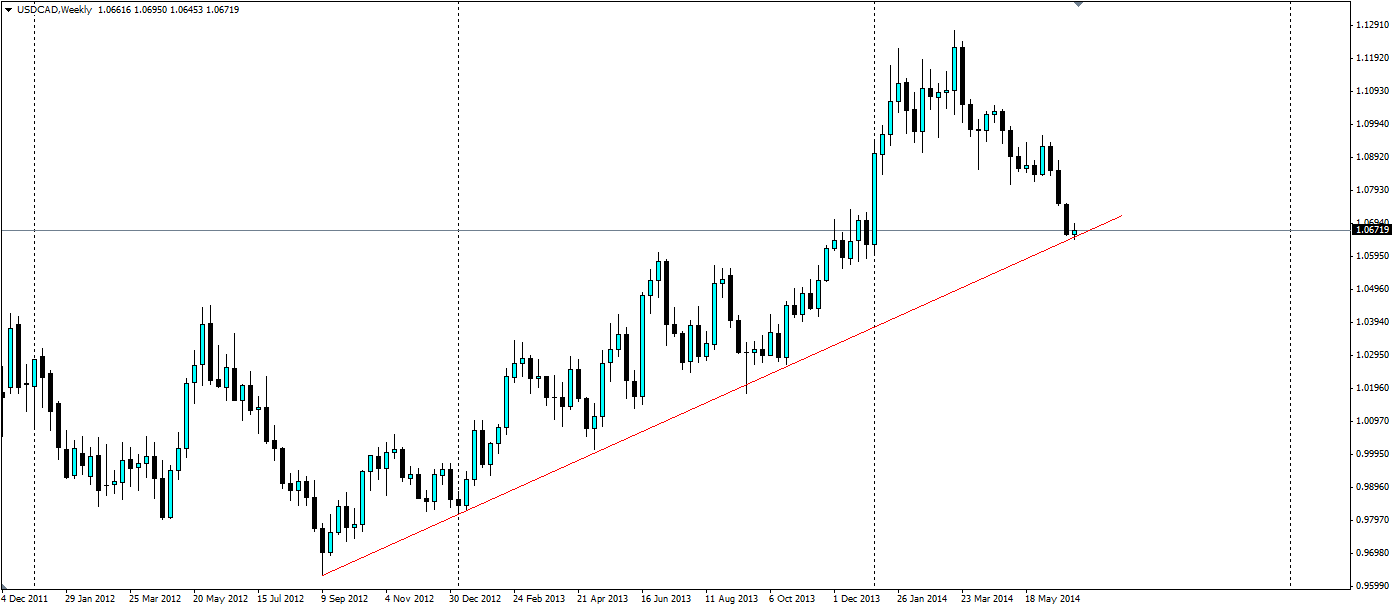

September 2012 signalled the beginning of an uptrend for the US dollar versus the Canadian dollar. Since then the uptrend has been tested 5 times and held firm so far. The signals over the last couple of years have been looking more positive for the US over Canada, however, recently the wheels may have come off with the latest US GDP figure at -2.9% (annualised) for the quarter.

Canada on the other hand is facing increasing inflation that does not correlate with GDP growth. The Band of Canada will have a tough year as it will be reluctant to increase interest rates while GDP lags. The market has begun to speculate an increase in interest rates may be coming, hence the reversal in the USDCAD pair, however this may be some time off.

The result has been a touch of the long term trend line which has held firm so far. Will we see a bounce off the trend or a breakdown completely? For now a bounce is looking the likely option, especially with nonfarm payroll data due out on Thursday. The US has been adding over 200,000 jobs per month recently and the GDP data was a lagging indicator from Q1, so the upcoming nonfarm data should stay around the 200k mark.

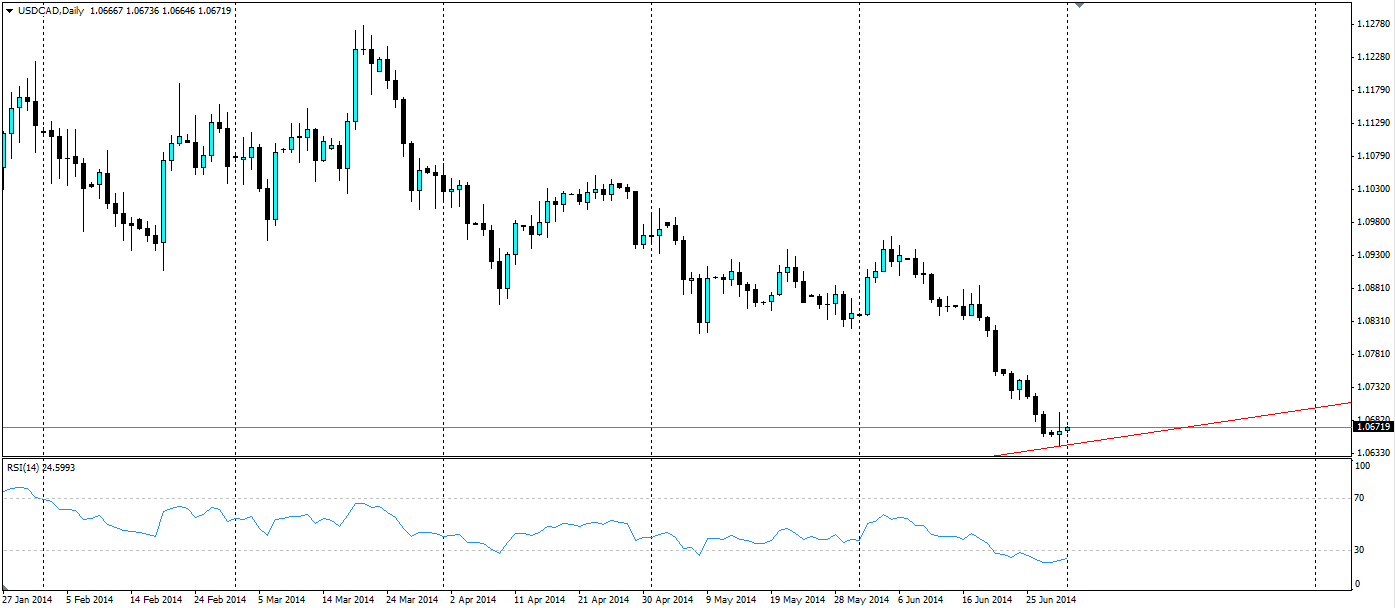

The USDCAD D1 chart shows the price has already rejected off the trend line, and indeed the RSI confirms this. We can see the RSI hit a low of 21.22, which is extremely oversold, and is now heading back to a more neutral position.

Any traders looking for an entry can wait for the current resistance at 1.0696 to break as the price moves upwards. Ensure a stop loss is set below the trend line to minimise losses in the event the trend breaks down. Previous levels of support/resistance will act as targets for a movement higher. 1.0819 will be relatively tough to break, with 1.0959 and 1.1048 further beyond likely to act as sticking points.

The USDCAD pair has tracked back down to the long term trend line and a bounce higher off it could provide an opportunity for traders to follow the pair back up.

Forex and CFDs are leveraged financial instruments. Trading on such leveraged products carries a high level of risk and may not be suitable for all investors. Please ensure that you read and fully understand the Risk Disclosure Policy before entering any transaction with Blackwell Global Investments Limited.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.