The Euro has been looking on the back foot as of late, after Mario Draghi came to the party and smashed down the markets. Slashing interest rates and threatening exotic measures in his effort to fight the Euro.

What’s next for the Euro might be of little concern for a lot of people, but I personally believe it has a lot more room to fall further, despite the recent candles showing buying pressure still being there.

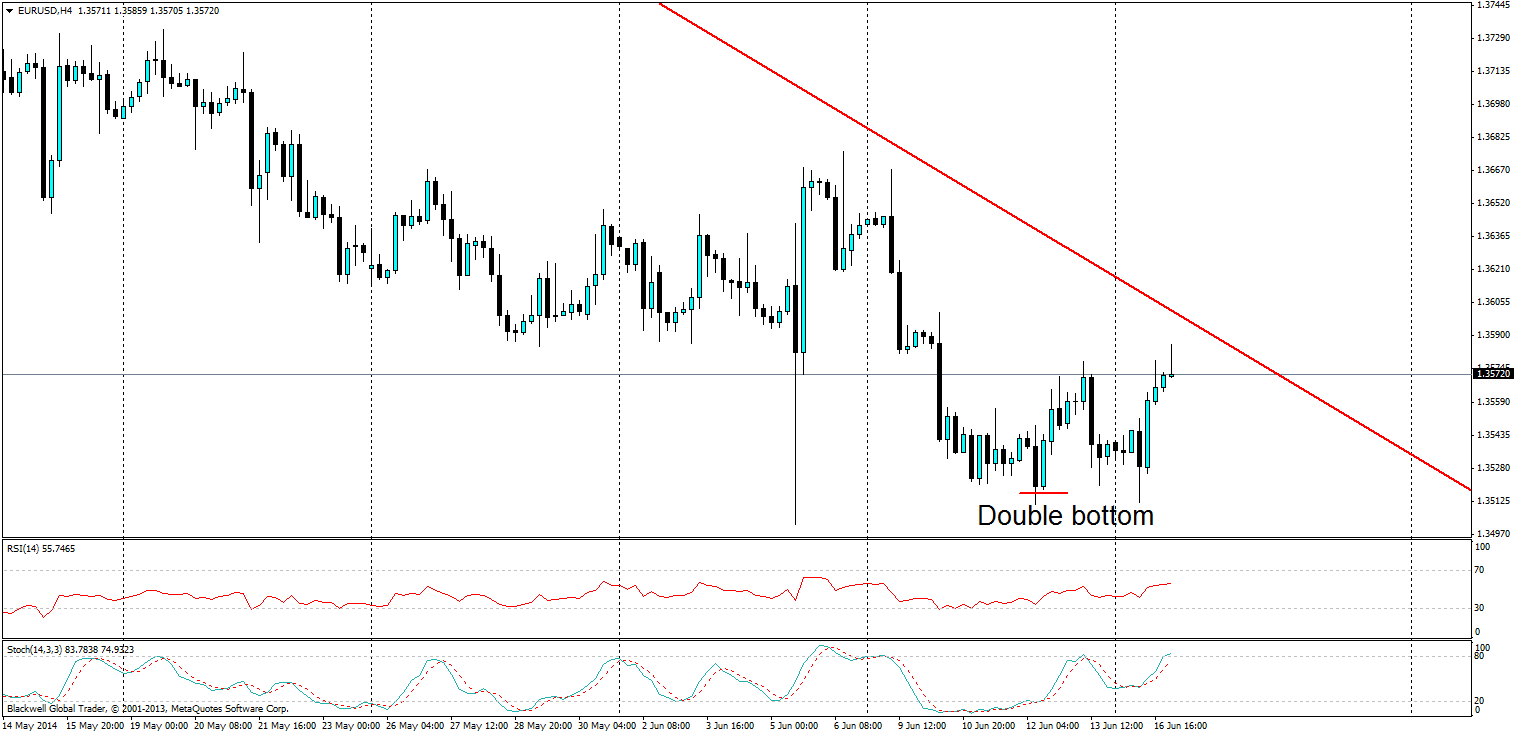

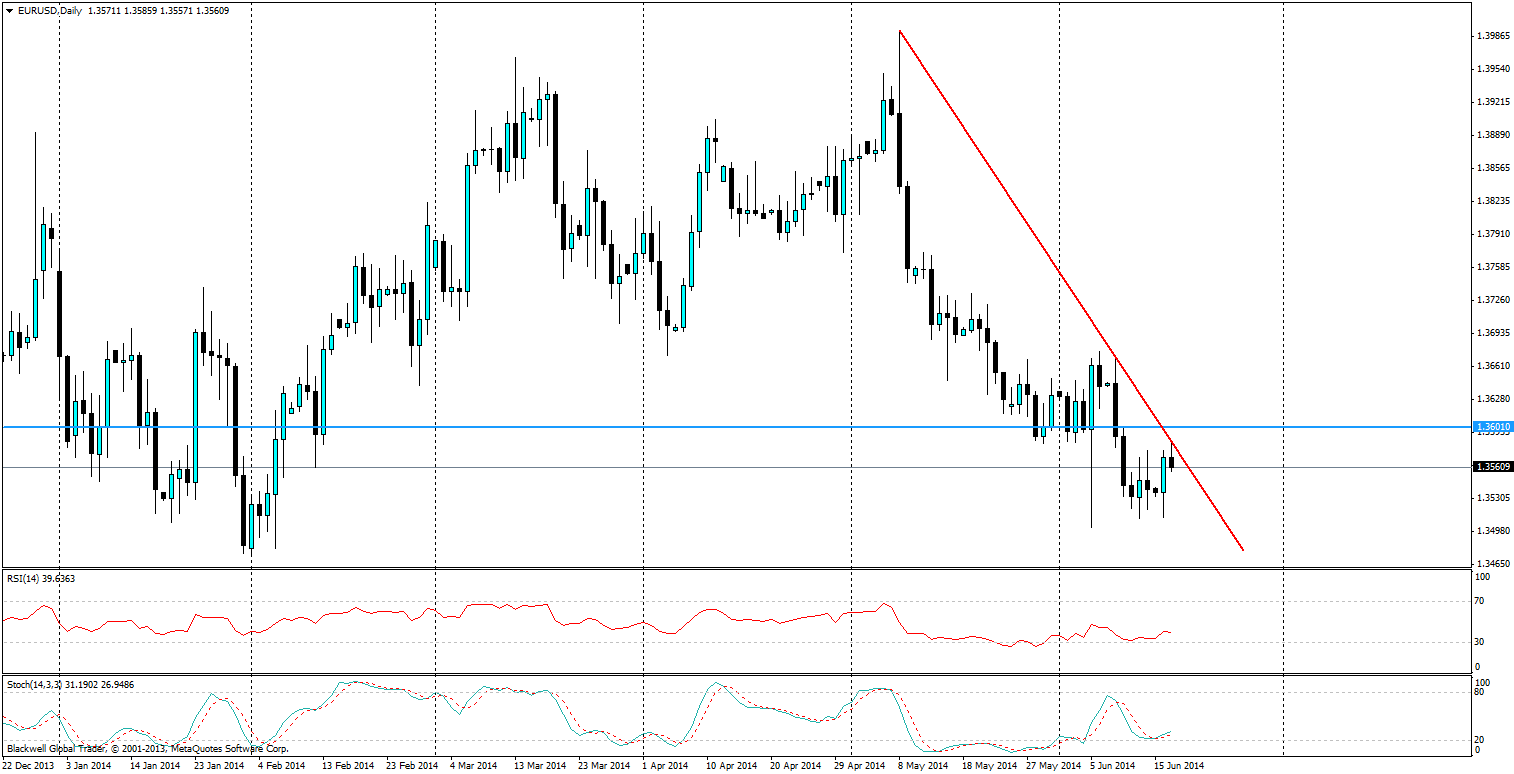

On the 4H chart (see chart above), we have seen a double bottom candlestick formation, this is generally indicative of a bull run for the pair. So far so good it has run higher, but it's stopped short of the current daily trend line, and I believe the market is cautious for the upcoming economic survey (see chart below).

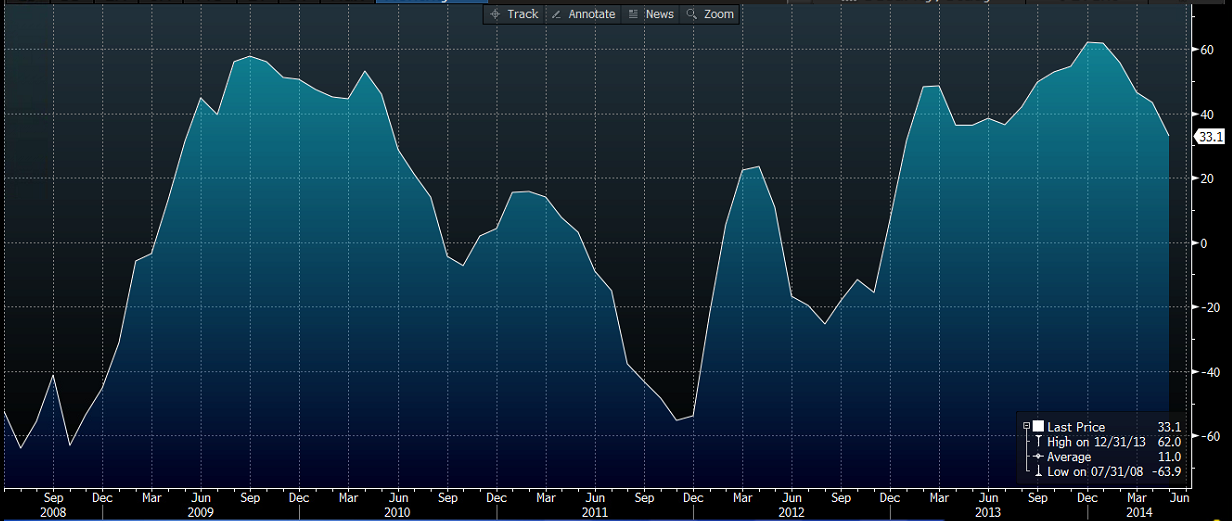

The forecast is currently for an improvement in economic sentiment, sure it’s possible. But the Germans are a very conservative people, and I strongly doubt they will be pushing for anything higher than the previous month; especially when the European Central Bank has just recently taken action to fight off deflation.

The daily chart (see chart above) shows the bears at work though, and it's looking very strong -- especially after today’s touch and pull back. For the bears to be defeated and the bulls to take charge I would have to see a breakthrough on the current trend line and a push up to at least 1.3601. However, in the short term I am very much bearish on the EURUSD cross.

It’s easy to see why, we have had a brief double bottom and now the market is starting to turn on the daily after a trend line touch, I expect to see further lows as the trend line looks to hold. Only a shockingly positive economic sentiment survey could sway the market, and the Germans are certainly not optimists.

Recommended Content

Editors’ Picks

EUR/USD rises to daily tops past 1.0800 post-NFP

The selling bias in the Greenback gathers extra pace on Friday after the US economy created fewer jobs than initially estimated in April, lifting EUR/USD to the area of fresh peaks above 1.0800.

GBP/USD surpasses 1.2600 after disheartening US Payrolls

The resumption of the downward pressure in the US Dollar motivates GBP/USD to extend its earlier advance to the area beyond 1.2600 the figure in the wake of the release of US NFP.

Gold climbs to new highs above $2,300 on poor NFP prints

The precious metal maintains its bullish stance and breaks above the $2,300 barrier on Friday after US Nonfarm Payrolls showed the economy added fewer jobs than expected during last month.

XRP edges up after week-long decline as Ripple files letter in reply to SEC’s motion

Ripple filed a letter to the court to support its April 22 motion to strike new expert materials. The legal clash concerns whether SEC accountant Andrea Fox's testimony should be treated as a summary or expert witness.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.