The US officially blamed Iran for this weekend’s attack on the world’s largest oil facility in Saudi Arabia. Trump tweeted that the US was “locked and loaded”, hinting at a potential response over the attack. Oil prices are back below $60 after gapping higher over 12% today.

China data came in weaker than expected, with urban investments slowing to 5.5% YoY (weakest in 12 months), industrial output falling to 4.4% (weakest since 2002) and retail sales felling to 7.5% versus 7.9% expected. This is all despite further stimulus earlier this year, which will no doubt spur further calls for yet more stimulus.

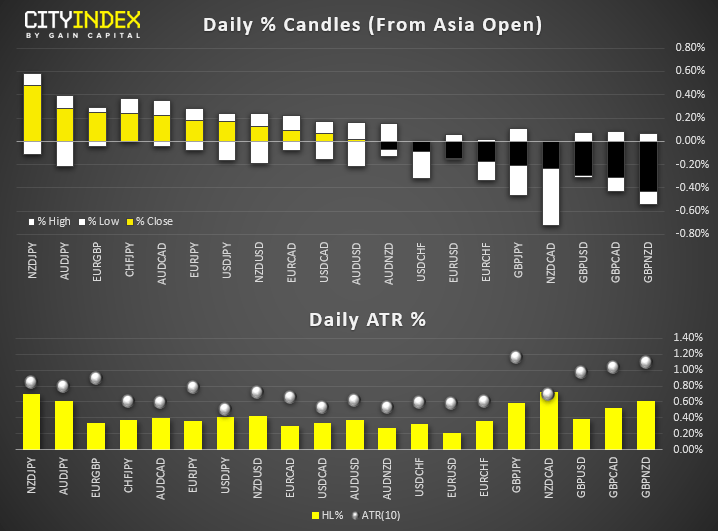

CAD is the strongest major, supported by higher oil prices. JPY is the second strongest major from safe-haven flows, seeing USD/JPY gap to a 2-day low and trade back beneath April’s bearish trendline. GBP is today’s weakest major, although remains near Friday’s highs.

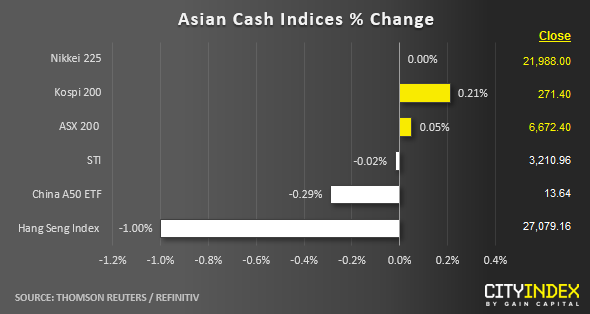

Despite the weekend drones’ attack on Saud Arabia’s oil production that has sent the WTI crude oil futures to spike close to 10% in today’s Asian session, the overall performance seen so far on Asian stock markets have appeared to be quite muted despite an increase in Middle East’s geopolitical risk. U.S. has put the blame on Iran for the attacks and President Trump tweeted with a “lock and loaded” response that hinted a potential retaliation towards Iran.

Also, industrial production from China for Aug came in below expectation at 4.4% y/y versus consensus of 5.2% y/y. It has continued to decline from Jul data of 4.8% y/y that has led to a 3rd consecutive month of slower growth from the negative effects of the on-going U.S-China trade tension.

The worst performer so far as at today’s Asia mid-session is Hong Kong’s Hang Seng Index where it has dropped by -1.00%. The weaker sentiment seen in the Hang Seng Index versus its Asian peers is likely due to localised factors. Firstly, the negative spill-over effect from another bout of violent weekend clashes between police and anti-government protestors where mass protests have entered the 15th week. Secondly, London Stock Exchange (LSE) has rejected Hong Kong Stock Exchange (HKSE) US$39 billion takeover bid. Despite HKSE’s refusal to give up on its bid for LSE, shares of HKSE has dropped by -2.7% to hit a 4-week low of 234.40 as seen today.

S&P 500 E-mini has gapped down in today’s Asian open session and traded lower to print a current intraday low of 2983; a drop of -0.86%. Right now, as at today’s Asian mid-session, it has recouped some of its earlier losses to trade at 2990; a current intraday drop of -0.61%.

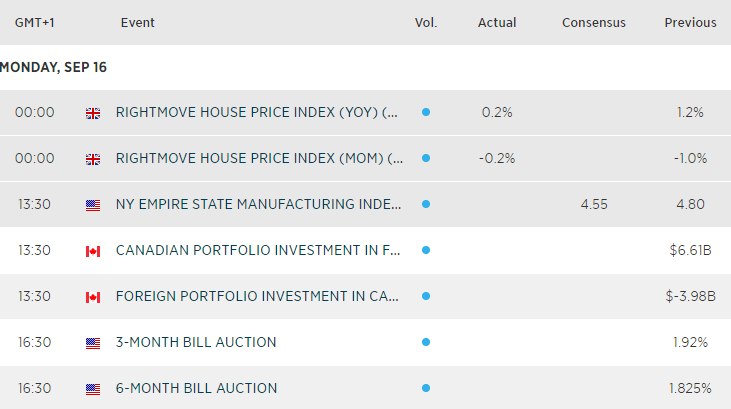

Up Next:

Data is light for the US session (and non-existent for the European). And with trade tensions taking a back seat, it’s any update or knock-on effect from the weekends oil plant attack which could be a key driver for markets.

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.