February Non-farm payrolls report is due for release tomorrow is expected to show the economy added 205K jobs, compared to the December figure of 242K. The unemployment rate is seen unchanged at 4.9%, while the average hourly earnings are seen rebounding 0.2% from last month’s 0.1% drop.

USD on a backfoot

US dollar is heading on a backfoot as Fed’s “confuse if you cannot convince†stance has killed Fed rate hike bets. The central bank began the year on hawkish tone, given the background of the first rate hike in December. This was followed by a dovish March statement that triggered a sell-off in USD. But, policymakers immediately came out on wires talking rate hike bets, which were killed once again by dovish Yellen this week.

Overall, it appears the policymakers are looking for reasons to delay the rate hike but do not want markets to believe the tightening is over. The confusion has led to a sell-off in the US dollar.

Only strong hourly earnings would support USD

Labor market strength is well known and a better-than-expected headline payrolls figure or a drop in the unemployment rate would do little to support to USD. This is because, NFP number has stayed resilient post December rate hike, stock markets are back to December highs, and unemployment rate is lower compared to what was seen in December. Still, the Fed has titled on the dovish side.

Read: Nonfarm Payrolls: who cares?

Consequently, USD bulls would need a super strong average hourly earnings figure. On the other hand, USD bears would love to see a weak payrolls figure along with not so impressive hourly earnings.

Gold risks falling to $1200 on strong NFP/wage growth data

Action in gold has caught many by surprise. Usually the metal is the best performer whenever there is a sharp fall in Fed rate hike bets (and USD). However, despite dovish FOMC statement released earlier this month, dovish comments from Yellen this week and the resulting sell-off in the USD, the metal remains in a falling channel on the technical charts.

This means the metal may take a dip even if the payrolls figure is strong; given it is heading into the event on a slightly weaker footing.

Gold daily chart

•Falling channel is seen on the daily chart, daily RSI stays in downtrend

Prices could drop to $1200 (falling channel support) and may even break lower if NFP and average hourly earnings print higher than estimates

On the contrary, weaker data could see prices run into resistance at $1270 (rising wedge – extended level).

GBP/USD – weak data could trigger inverse head and shoulder breakout

The recent dollar sell-off has also helped GBP/USD stage a recovery from the multi-year low of 1.3835. From the UK side of the story, Brexit remains a major threat, plus data is not doing so well either. Sure, the Q4 GDP was revised higher today, but it carried an alarming figure – current account deficit hit 7% of GDP.

Nevertheless, weaker US wage growth figures could trigger an inverse head and shoulder breakout in the pair.

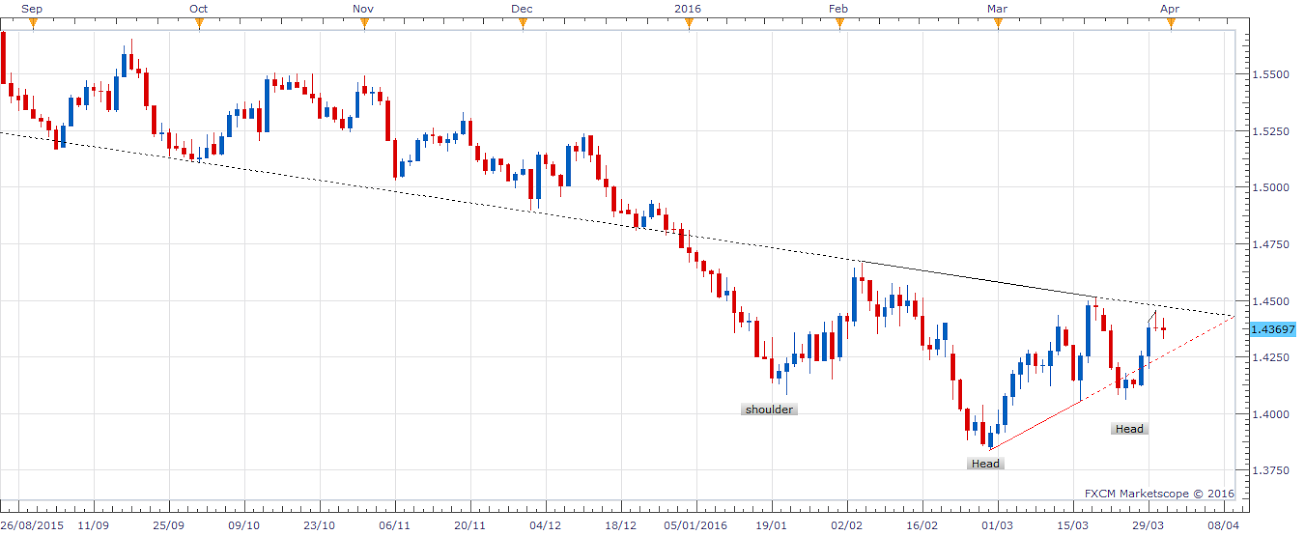

GBP/USD daily Chart

Inverse head and shoulder neckline is seen around 1.4475.

A bullish break in case of a weak US data could open doors for a 1.4514-1.4578 -1.46 levels. Daily RSI remains in favor of bulls, hence a re-test of 1.4668 on weak data should not be difficult.

However, bulls should remain cautious about Brexit related news flow.

In case, the data is strong, a fresh sell-off to 1.41 in the next few days cannot be ruled out in

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD dips below 0.6600 following RBA’s decision

The Australian Dollar registered losses of around 0.42% against the US Dollar on Tuesday, following the RBA's monetary policy decision to keep rates unchanged. However, it was perceived as a dovish decision. As Wednesday's Asian session began, the AUD/USD trades near 0.6591.

EUR/USD lacks momentum, churns near 1.0750

EUR/USD cycled familiar levels again on Tuesday, testing the waters near 1.0750 as broader markets look for signals to push in either direction. Risk appetite was crimped on Tuesday after Fedspeak from key US Federal Reserve officials threw caution on hopes for approaching rate cuts from the Fed.

Gold wanes as US Dollar soars, unfazed by lower US yields

Gold price slipped during the North American session, dropping around 0.4% amid a strong US Dollar and falling US Treasury bond yields. A scarce economic docket in the United States would keep investors focused on Federal Reserve officials during the week after last Friday’s US employment report.

Democrats to introduce bill targeting crypto mixing services

Rep. Sean Casten revealed in a House hearing on Tuesday that Democrats are planning to issue a bill this week that would target crypto-mixing protocols. Democrats and Republicans also clashed over the SEC's recent action against crypto companies.

Living vicariously through rate cut expectations

U.S. stock indexes made gains on Tuesday as concerns about an overheating U.S. economy ease, particularly with incoming economic reports showing data surprises at their most negative levels since February of last year.