The US monthly CPI report is due for release today. The headline figure is seen dropping 0.1% y/y, while the core inflation is seen remaining unchanged at 1.8%. Monthâ€onâ€month, the CPI is seen dropping 0.2% from last month’s â€0.1%.

The USD bulls are possibly at their weakest today since the March 2015 rate hike bets are on the verge of getting smoked. The rate hike bets table looks as follows –

| Fed meeting | Rate hike probability (25bps + 50bps + 75bps) |

| Oct 28, 2015 | 2.3% |

| Dec 16, 2015 | 32.6% |

| Jan 27, 2016 | 40.6% |

| Mar 16, 2016 | 49.8% |

It is quite clear that the probability of the March Fed rate hike is at risk in case the CPI falls more than expected. The markets may have already pricedâ€in a 0.1% y/y drop in the headline number and 1.8% core CPI.

It is also worth noting that a drop in the Fed rate hike bets yesterday after weak retail sales was treated as good news by the equity markets. However, the bad news may become a bad news for the risk assets in case the US equities drop. Moreover, the drop in the equities risks further drop in the Fed rate hike bets.

In case, the stock markets respond negative today, the sellâ€off in the USD/JPY pair would become more intense. Meanwhile, the rally in the GBP/USD could come to a halt, although broad based weakness in the USD would cap the downside. In case, the stock markets reposing positively after the CPI, the Sterling could witness an upside breakout.

GBP/USD†Daily Chart

Sterling has failed twice in the European session to take out offers at 1.55.

The daily chart shows, the pair is hovering around 1.5484 (100â€DMA), which is also a falling channel resistance.

A daily close above 1.5484 would expose 1.5568 (38.2% of Jul 14â€Apr 15 plunge). Above 1.5568, the pair could test offers at 1.5608 (23.6% of Aprâ€Jun rally).

In case, the US CPI surprises on the positive side, the GBP/USD could fall back to 1.5409 (38.2% of Aprâ€Jun rally)â€1.5406 (50â€DMA).

The overall outlook stays bullish so long as the pair does not see a daily close below 1.5387.

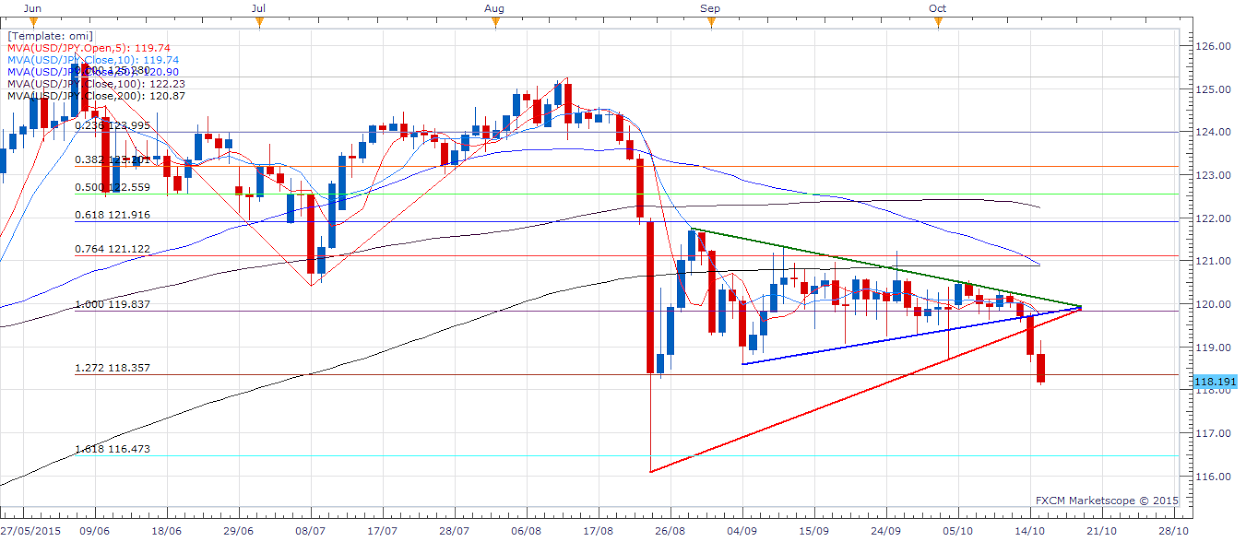

USD/JPY – Daily Chart

As anticipated yesterday (Macro Scan ), the USD/JPY pair witnessed a bearish break and fell to 118.35 (127.2% of Jun highâ€Jul lowâ€Aug high).

The bearish technical break has exposed 117.00 – 116.47 (161.8% of Jun highâ€Jul lowâ€Aug high).

A weakerâ€thanâ€expected CPI and a negative reaction from the equity markets would see the pair achieving its downside target immediately.

On the other hand, a positive surprise from the CPI could see the pair rise and consolidate around 119.30 levels, before resuming its fall.

Gold/EUR – Daily Chart

Gold/EUR daily chart is showing an inverted head and shoulder breakout. The neckline resistance at EUR 1032 was taken out earlier today. The immediate upside appears capped around EUR 1053â€1067/Oz

The breakout must be an indication of o a positive action in the equity markets and weakness in the EUR/USD pair, leading to a rally in the Gold prices in the EUR terms or o a more sharp rally in Gold (USD) prices.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.