The chatter in the financial markets today is about Greece crisis, and whether Greece shall exit the Eurozone or the officials become successful in kicking the can down the road once again. In my opinion, too much focus is on Greece and too little on the monetary policy path in the US.

Widespread belief - US on a rate hike path

The speculation regarding a rate hike in 2015 began in mid-to-late 2014. The initial speculation was a June rate hike, which eventually got pushed to end 2015/early 2015 after a sharp slowdown witnessed in the first quarter economic growth in the US. However, the labour market remained resilient except a sharp weakness in March.

The September rate hike was back on the table after the non-farm payrolls for May printed higher than expected with strong growth in the average hourly earnings. The personal spending also rose 0.9% in May, its fastest since 2009. The Fed policy statement of June also indicated two rate hikes this year, while stressing that too much emphasis is being put on the first rate hike. What was more important is another downward revision of the median interest rate forecast for end 2016.

So the widespread belief is that the US Fed shall hike rates twice this year and shall begin the process of policy normalization.

Economy won’t withstand rate hikes

In my opinion the Fed shall raise rates this year at least once - which will be a symbolic move. However, that would do it and further policy normalization is unlikely to happen. In fact, the Fed may undo the rate hike and could launch QE 4 in late 2016.

I present very simple rationale for my view. But before let us look at simple economics –

The elementary demand/supply laws are subject to an exception - speculation. When consumers will anticipate a price rise in the future, they may be willing to buy more even if prices are already on the rise (and vice versa). On similar lines, if the sellers anticipate a rise in price, they would restrict supply even though prices have already started rising.

On similar lines interest rate expectations influence – business investment and consumption in the economy.

So the simple logic says consumption and business investment should have picked up with rate hike expectations. In fact, the pick up should have been super fast in light of the following facts –

Rates have been at record lows since 2007-08. After having kept rates at record lows for so long, the rate hike talks should have led to a sharp spike consumption and business investment.

Labour market strength – With sharp job gains since late 2014 amid increasing rate hike expectations, again consumption should have picked up faster.

Equities at record highs – Where is the so called wealth effect? With stocks near record highs amid expectations of a rate hike, consumption should have spiked.

What can be concluded is despite all three factors amid rate hike speculation, the consumption and business investment is anaemic.

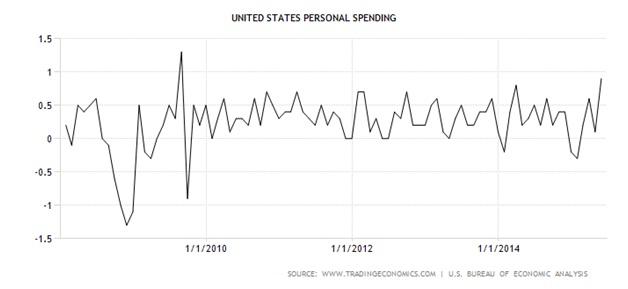

- Personal spending – range bound - 0% to 0.9% - since 2010. No signs of a sharp uptick despite rate hike speculation, wealth effect, stellar job gains.

- Retail sales – growth slowing down since 2010. Weak growth despite rate hike speculation, wealth effect, stellar job gains, low energy prices.

So the obvious conclusion is both the consumption and the business investment shall take a hit in case rates are hiked.

Still, one or two rate hikes possible..

Symbolic move – With so much Fed chatter about rate hikes in mid-end 2014, a complete U-turn would question the credibility of a central bank that has always refrained from providing SNB like surprises to the markets.

Rate hike positive for US and world economy – For almost a year now, the possibility of an interest rate hike is being sold as a net positive for the US economy as well as the global economy. The idea is being pushed harder not only by the Fed, but also by other major central bankers. Consequently, the rate hike chatter has not led to a sharp correction in the US equities. Given this scenario, a complete U-turn would burst the equity bubble. Thus, policymakers at the Fed appear stuck due to the way the rate hike story has been sold.

Symbolic rate hikes enough to hurt US economy

As discussed earlier, the consumption and the business investment is already weak. With two rate hikes, it is quite clear to expect a further dip in consumption as –

Borrowing costs rise, leverage driven consumption (already weak) takes further hit

Equities correct or may even fall sharp as job gains start to disappear. Consequently, whatever little “wealth effect” existed, is erased.

Exports side is hit too. The markets may price-in two rate hikes in advance, leading to the appreciation of the USD against majors. But the USD is likely to continue its uptrend against EM and Asian currencies with huge external debt and dependence on hot money inflows.

The net result could be sharp slowdown and probably a recession. The only way out would be quick unwinding of one or two rate hikes, followed by QE 4.

Why QE 4?

US rate hikes could trigger another wave of currency wars across the globe, adding to further bullishness in the USD.

Rate cuts won’t be enough to drive the USD lower.

Sharp fall in stocks and USD strength likely to push inflation back to near zero levels (crash/ major correction in stocks would be deflationary). Thus, more room for Fed to once again to initiate QE.

Why QE 4 in mid/end 2016

The ECB is expected to end its QE program in September 2016. The program could be ended all at once or slowly tapered or extended. That depends on how Grexit affects the Eurozone economy.

If the ECB QE is extended, the Fed QE 4 could come in late 2016. In case, there are signs that the ECB’s QE shall end in Septmeber as expected, the US QE 4 could hit the markets in mid 2016.

The BOJ is expected to begin tapering next year. Hence, it won’t be available for fresh printing exercise. The BOE could come out with its own QE, depending on the EUR/GBP exchange rate. But that won’t be as effective as Fed’s QE or ECB QE from the financial markets perspective.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.