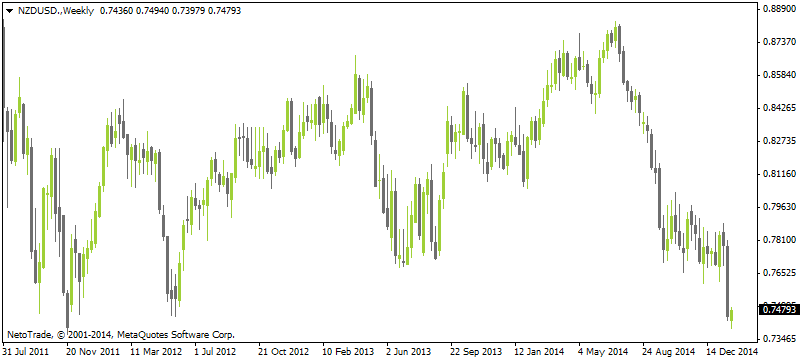

The New Zealand Dollar is Weakening

The New Zealand Dollar is trending just off of lows not seen since 2011, in the sharpest move lower in years. As recently as November, RBNZ Governor Wheeler was busy jawboning the currency lower, stating the currency was “over-valued” and “unjustified” at those levels. The word unsustainable was also tossed around casually. Since making those comments in November, further remarks have been largely absent meaning that either the RBNZ is comfortable with the level of the New Zealand Dollar or conversely they are nervous about the risks to the outlook and uneasy with the growing threat of a global slowdown.

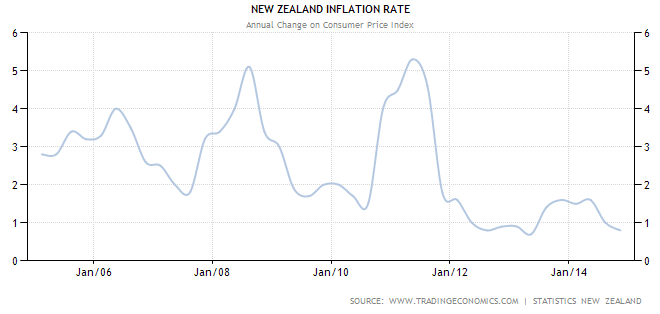

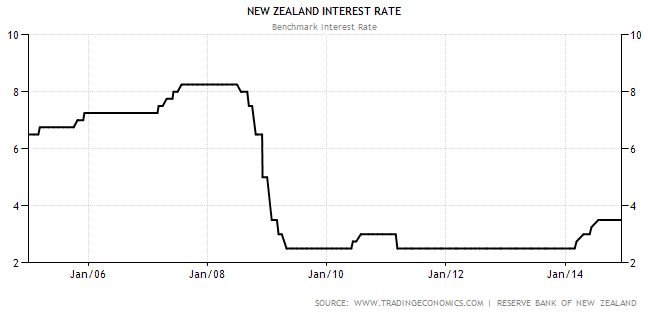

Applying Interest Rates to Combat Deflation

New Zealand has proved staunchly opposed to monetary easing as evidenced by the rising interest rate environment witnessed in 2014 after the Central Bank hiked rates 100 basis points. The country has generally tried to avoid tossing its hat into the ring of the global currency war, mainly sitting on the sidelines and observing. However, those actions might prove inconsequential as deflation circles the globe, impacting developed economies. Although GDP growth in New Zealand remains robust, reported at a 3.20% expansion annualized in the latest release, tumbling inflation is possible foreshadowing of encroaching deflation. The CPI trend has been broadly biased to the downside since 2011, meaning the most potent tool to combat this factor is cutting the key interest rate.

The RBNZ has prototypically proved one of the more nimble Central Banking operations based on its size and scale. The Central Bank’s policies are far more proactive relative to the reactive nature of Central Banks in other developed economies. Keeping the export economy competitive is another strong rationale for dropping rates. While most analysts have cited lower inflation and strong growth as a reason for keeping rates on hold despite expectations of another 25 basis point hike in the pipeline, the time has never been clearer to drop rates in order to keep weakening NZD. If not now, then when?

Sustaining Growth

The RBNZ under the stewardship of Governor Wheeler has not been the type of Central Bank to just sit idly on its hands and do nothing. As such, taking no action right now would not be in the nation’s best interest. Although considered highly unlikely, a rate cut might prove just the right medicine to keep the economy stable and growing sustainably in the near-term as the headwinds to the global economy accelerate.

Recommended Content

Editors’ Picks

AUD/USD stalls ahead of Reserve Bank of Australia’s decision

The Australian Dollar registered minuscule gains compared to the US Dollar as traders braced for the Reserve Bank of Australia monetary policy meeting. A scarce economic docket in the United States and a bank holiday in the UK were the main drivers behind the “anemic” AUD/USD price action. The pair trades around 0.6624.

USD/JPY extends recovery above 154.00, focus on Fedspeak

The USD/JPY pair trades on a stronger note around 154.10 on Tuesday during the Asian trading hours. The recovery of the pair is supported by the modest rebound of US Dollar to 105.10 after bouncing off three-week lows.

Gold rises as US job slowdown dampens Treasury yields

Gold price rallied close to 1% on Monday, late in the North American session, bolstered by an improvement in risk appetite due to increased bets that the US Federal Reserve might begin to ease policy sooner than foreseen. The XAU/USD trades at around $2,320 after bouncing off daily lows of $2,291.

TON crosses $200 million in Total Value Locked as its network integration continues to scale

In a recent development, the TON network surpassed $200 million in total value locked on Monday after seeing a major boost through The Open League reward program.

RBA expected to leave key interest rate on hold as inflation lingers

Interest rate in Australia will likely stay unchanged at 4.35%. Reserve Bank of Australia Governor Michele Bullock to keep her options open. Australian Dollar bullish case to be supported by a hawkish RBA.