The Cable has had a difficult week so far as it continues its bear trend. The open on Monday was 1.42980, and today marks three successive trading sessions to the downside. The worry weighing on the Pound is the possibility of Britain leaving the EU. Although it has been an issue that has had various moments in the headlines since Britain first joined, it has been an ever growing issue of late.

The National referendum set to be held on June 23rd, on the decision to stay or leave the EU, is creating a lot of uncertainty for the markets. When there is doubt the inevitable is for investors to sell. Some economists and businessmen have argued that leaving the EU can only benefit Britain and just as many of course have argued that a Brexit would be an absolute disaster.

Setting patriotic issues and migration quotas aside, there are many reasons to be weary of Britain leaving the EU, at least initially. HSBC issued a report today saying that the pound could lose 20% in value in the face of referendum turmoil. The pound has already hit the 1.3900 mark, the first time in seven years. A sharp fall in the currency of that dimension could cause inflation to rise, as all imports would also be 20% more expensive. This would cause inflation to rise and may dampen GDP growth.

If you think that there will be an increase in volatility of the next week then you may buy a Straddle, which consists of buying a Call and Put option with the same strike and expiry simultaneously.

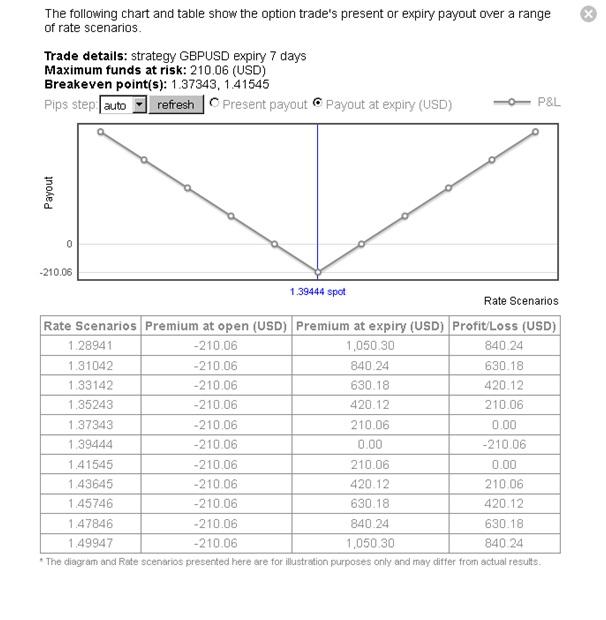

The screenshot below shows that a straddle with 1.39461 strike, 7 day expiry and for £10,000 would cost $210.09, which would also be the maximum risk.

This screenshot shows the profit and loss profile of the above Long straddle strategy.

If on the other hand you think Cable will stabilize and volatility will fall over the next week then you may sell a Straddle, which consists of selling a Call and a Put option, with same strikes and expiry simultaneously.

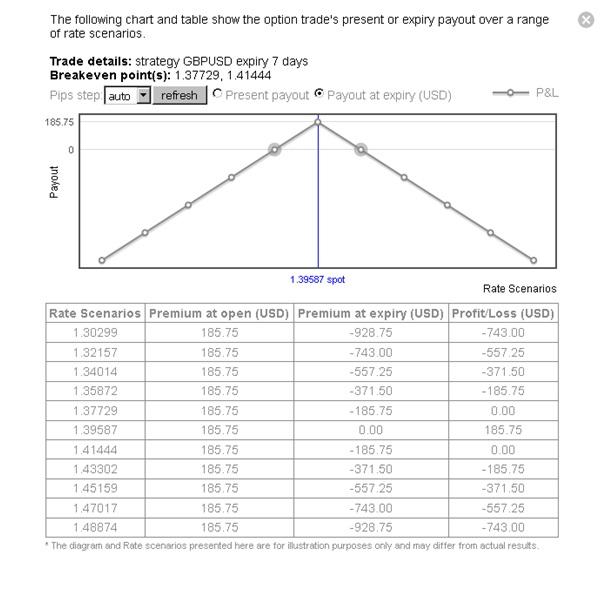

The screenshot below shows that a short straddle with strike 1.39407, 7 day expiry and for £10,000 would generate revenue of $185.51, while the maximum risk would be $464.33.

The following screenshot shows the profit and loss profile of the above short straddle.

The content provided is made available to you by ORE Tech Ltd for educational purposes only, and does not constitute any recommendation and/or proposal regarding the performance and/or avoidance of any transaction (whether financial or not), and does not provide or intend to provide any basis of assumption and/or reliance to any such transaction.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.