Cable has been in a protracted bear trend since it broke the psychological barrier of 1.5000 last December. More recently however it has been showing signs of a correction after having been driven to extremely oversold levels. Since it reached a recent low of 1.41245 on 20th December it has managed to gain back some ground to current levels above 1.44500.

Sterling’s demise came as the Bank of England (BoE) made a U‐turn in the possibility of raising interest rates while the US went ahead and raised rates in December. This created a scissor effect given the higher interest rate scenario in the US and the now continued low interest rate scenario for the UK.

The outlook for the UK economy however does not seem to be as strong as once thought.

Manufacturing production figures released in December and January both came in with negative numbers ‐0.1% & ‐1.2% respectively. Industrial production released in January was also negative and lower than expected at ‐0.7%.

Whilst PPI (Producer Price Index) which is a measure of inflationary pressure, has been negative since the summer of 2014. Inflation has in fact stayed low throughout 2015, often reaching negative levels. There could be an increase in volatility tomorrow as the BoE holds its scheduled monetary policy meeting. They will also be voting on whether to raise interest rates, but most importantly there will be a press conference by the Governor of the BoE Mike Carney at 12:45 p.m. which should give tips as to what to expect from the BoE going forward.

The US economy doesn’t look as expansive as it did a few months ago; adding to concerns is the slowdown in China which is showing signs of being larger than expected. There are also fears that the state controlled statistics may be manipulated and not showing the true extent of the contraction.

However job creation although not as strong as in 2014 has still been high and was one of the main factors in the Federal Reserve’s decision to raise interest rates. This Friday at 1:30 p.m. Non‐Farm Payrolls will be released with an expected 190k addition to the job market, the previous data was an increase of 292k. If the actual number released differs greatly from the expected we can expect higher levels of volatility.

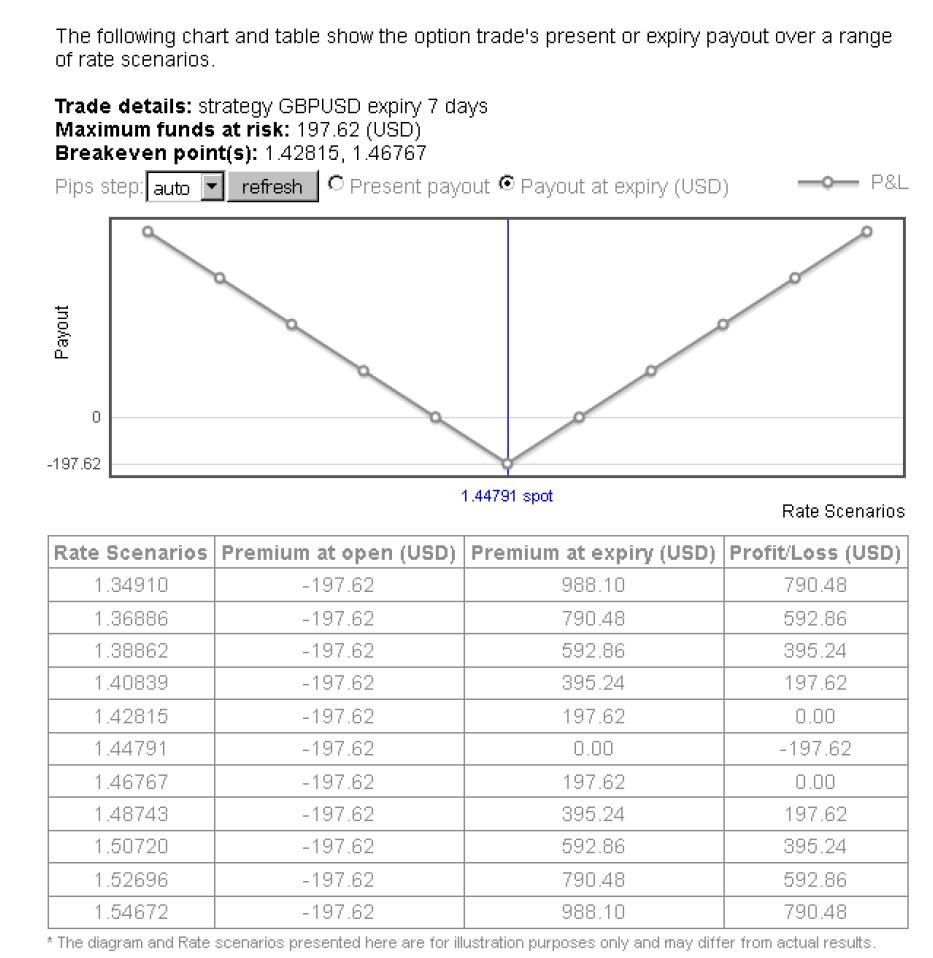

If you think the volatility of Cable will increase over the next week then you may buy a Straddle which consists of simultaneously buying Call and Put options with the same strike and the same expiry. The screenshot below shows that a Straddle with 1.44813 strike, expiry 7 days and for £10,000 would cost $197.64, which is also the maximum possible loss.

This screenshot shows the Profit and Loss profile of the above long Straddle.

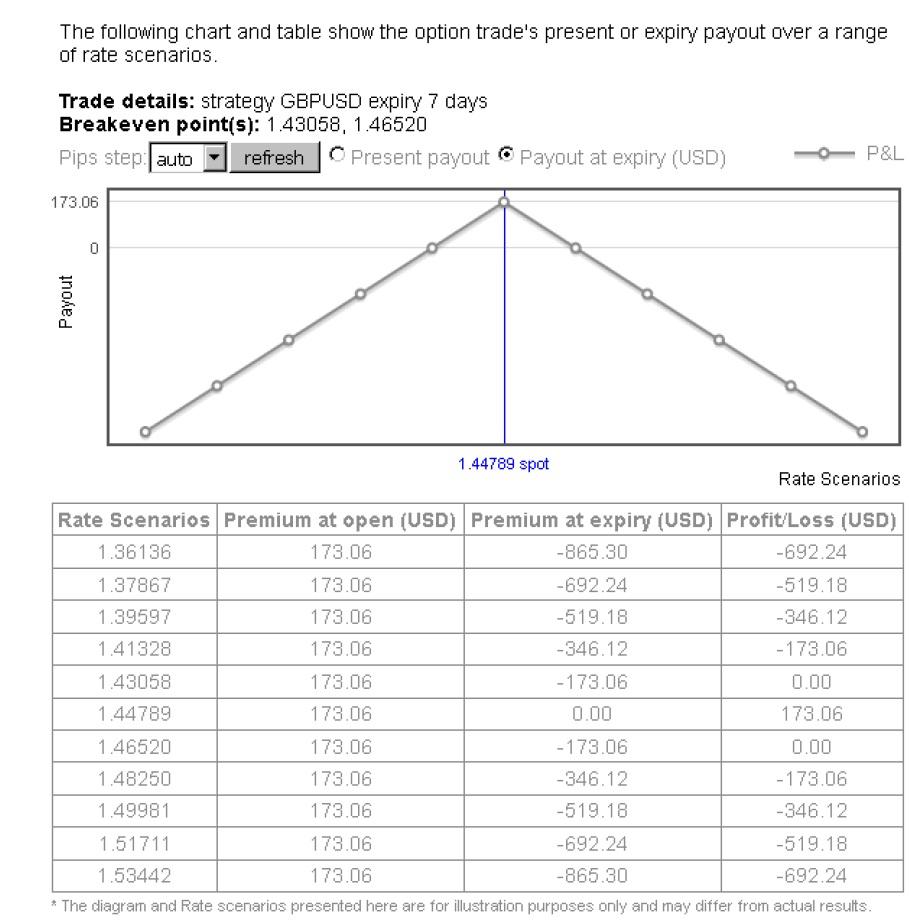

If on the other hand you feel that volatility will remain flat or fall then you may sell a Straddle which consists of simultaneously selling Call and Put options with the same strike and the same expiry. The screenshot below shows that a Straddle with 1.44721 strike, expiry 7 day and for £10,000 would allow you to pocket $173.00, the total risk of this position would be $462.44.

This screenshot shows the Profit and Loss profile of the above short Straddle position.

The content provided is made available to you by ORE Tech Ltd for educational purposes only, and does not constitute any recommendation and/or proposal regarding the performance and/or avoidance of any transaction (whether financial or not), and does not provide or intend to provide any basis of assumption and/or reliance to any such transaction.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.