Over the next two days there are many data releases that are very important to the global economy and will have a great impact on market volatility and trading direction.

To kick-off, today at 12:00 GMT the Bank of England (BoE) will announce their interest rate decision, they are expected to leave it unchanged at 0.50%. At 12:45 GMT the European Central Bank (ECB) will also release their interest rate decision and are expected to leave rates unchanged at 0.05%. The ECB press conference, to follow, is highly anticipated since details on the monetary policy and the quantitative easing (QE) will be announced.

Looking towards tomorrow, the BoE will release consumer inflation forecasts at 09:30 GMT and last but certainly not least, at 13:30 GMT we have the release of the US employment data for the month of February. The expected Non-Farm Payrolls (NFP) added in February are 240,000 versus last month’s 257,000 and unemployment is expected to be 5.6% versus last month's read of 5.7%.

Collectively all the pieces of data and announcements will leave the markets under pressure, and along with sensitive levels in some of the major currencies, this may create unexpected moves and a rise in volatility. For instance, the EUR/USD has hit 1.1026 a 14 year low and the US Dollar index hit an 11 year high!

A good way to position yourself when there is an expected rise in volatility is to buy options since buying options is also considered as buying volatility.

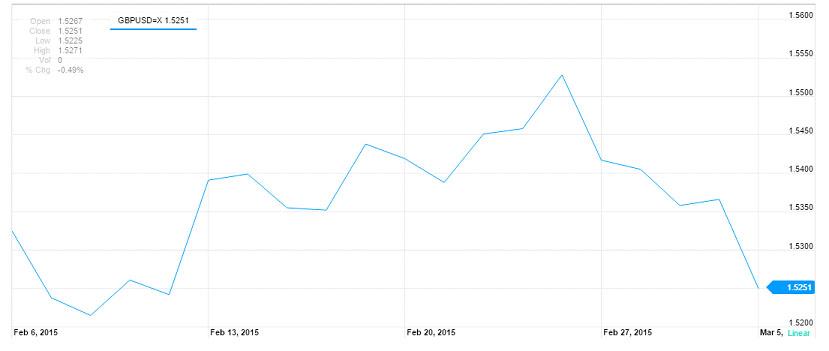

The GBP/USD is now trading around its months low at 1.5250 and the volatility of an at-the-money (ATM)) 1 week option is 7.64%. This is low relative to other currency pairs - the equivalent EUR/USD volatility is 11.60%. Thus, the GBP/USD 1 week option is relatively cheap.

Graph of the GBP/USD in the last month:

A known strategy to trade volatility in options is the straddle. You buy both a Put and a Call with the same expiry and strike and if the market is volatile enough, you will profit regardless of market direction.

Considering the flurry of economic news over the next two days and given GBP/USD is at the month’s lows, we like the straddle strategy but with an addition to the Call side. This means you will profit if the market moves in either direction but you will profit more if the pair trades to the upside. The amount on which the Call is based is higher than the Put.

The strategy in the below example involves a GBP/USD Put of amount 100,000 that will expire tomorrow at 15:00 GMT. The second leg of the strategy is a Call on the amount 150,000 with the same expiry. The Call option's amount is 50% more than the Put hence more profit will be made if GBP/USD trades back up from its lows.

Below is a graph and table showing the payout scenarios at the strategies expiry over a range of market rates. If the pair trades up to 1.5380 you will profit 125% and if it trades up to a lower level of 1.5366 you will profit 100%. On the other hand, if the pair trades down to 1.5090 you will also profit 100%.

The content provided is made available to you by ORE Tech Ltd for educational purposes only, and does not constitute any recommendation and/or proposal regarding the performance and/or avoidance of any transaction (whether financial or not), and does not provide or intend to provide any basis of assumption and/or reliance to any such transaction.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of US jobs report

EUR/USD stays in a consolidation phase above 1.0700 after closing the previous two days in positive territory. Investors eagerly await April jobs report from the US, which will include Nonfarm Payrolls and Unemployment Rate readings.

GBP/USD advances to 1.2550, all eyes on US NFP data

The GBP/USD pair trades on a stronger note around 1.2550 amid the softer US Dollar on Friday. Market participants refrain from taking large positions as focus shifts to April Nonfarm Payrolls and ISM Services PMI data from the US.

Gold remains stuck near $2,300 ahead of US NFP

Gold price struggles to gain any meaningful traction and trades in a tight channel near $2,300. The Fed’s less hawkish outlook drags the USD to a multi-week low and lends support to XAU/USD ahead of the key US NFP data.

XRP edges up after week-long decline as Ripple files letter in reply to SEC’s motion

Ripple filed a letter to the court to support its April 22 motion to strike new expert materials. The legal clash concerns whether SEC accountant Andrea Fox's testimony should be treated as a summary or expert witness.

US NFP Forecast: Nonfarm Payrolls gains expected to cool in April

The NFP report is expected to show that the US economy added 243,000 jobs last month, sharply lower than the 303,000 job creation seen in March. The Unemployment Rate is set to stay unchanged at 3.8% in the same period.