Surprisingly the Reserve Bank of Australia (RBA) left interest rates unchanged at 2.25%. The market priced in a 0.25% cut and, before the announcement, AUD/USD traded low as $0.7751. Following the RBA's no-change, the pair rallied over 1% to $0.7841.

Tomorrow, the Australian GDP will be released at 00:30 GMT and is expected to be 2.6% versus previous months 2.7%. Later this week we have the release of the employment situation in the US which leaves the US Dollar under pressure.

Currently AUD/USD is trading at 0.7820 and the 1 day ATM (at-the-money) AUD/USD option volatility is around 13.3%. This is relatively very high; the equivalent EUR/USD volatility is around 10.55%.

A positive GDP figure plus the growing pressure on US Dollar towards Friday’s employment data may cause AUD/USD to rise. If you expect Australia’s GDP to be in line with expectations or better, an interesting position to take is the Bull spread.

A Bull spread is used to profit from an increase in market rate with limited risk and no stop-out. To set-up this strategy, you buy an OTM (out-of-the-money) Put option and, at the same time, sell an ATM (at-the-money) or ITM (in-the-money) Put. As the market rises towards the sell Put's strike rate the positions payout rises.

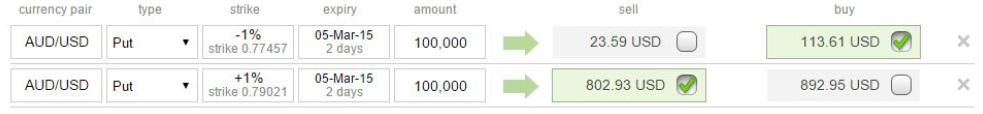

The below is an example of a Bull spread strategy:

In the top line, we buy a Put option with strike 1% below market (out-the-money) at 0.7745. In the second line, we sell a Put 1% above market (in-the-money) at 0.7902. Both options have amount 100,000 and expire in 2 days. Note that expiry is after tomorrow’s Australian GDP and before Friday’s Non-Farm Payrolls. By selling the more expensive, in-the-money option, we receive money when placing the position.

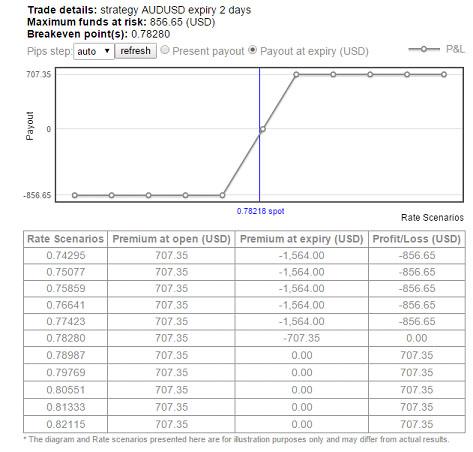

The payout scenario at expiry is shown in the chart and table below. If the AUD/USD is trading above 0.7828 there is profit which reaches its maximum return of $707 above 0.7898. If the pair trades below 0.7828 there is a loss and a maximum loss of $856 is reached below 0.7742.

The content provided is made available to you by ORE Tech Ltd for educational purposes only, and does not constitute any recommendation and/or proposal regarding the performance and/or avoidance of any transaction (whether financial or not), and does not provide or intend to provide any basis of assumption and/or reliance to any such transaction.

Recommended Content

Editors’ Picks

EUR/USD holds positive ground above 1.0750 ahead of Eurozone PMI, PPI data

EUR/USD trades in positive territory for the fourth consecutive day near 1.0765 during the early Monday. The softer US Dollar provides some support to the major pair. Traders await the HCOB Purchasing Managers’ Index (PMI) data from Germany and the Eurozone, along with the Eurozone PPI.

GBP/USD rises to near 1.2550 due to dovish sentiment surrounding Fed

GBP/USD continues its winning streak for the fourth consecutive day, trading around 1.2550 during the Asian trading hours on Monday. The appreciation of the pair could be attributed to the recalibrated expectations for the Fed's interest rate cuts in 2024 following the release of lower-than-expected US jobs data.

Gold price rebounds on downbeat NFP data, softer US Dollar

Gold price snaps the two-day losing streak during the Asian session on Monday. The weaker-than-expected US employment reports have boosted the odds of a September rate cut from the US Federal Reserve. This, in turn, has dragged the US Dollar lower and lifted the USD-denominated gold.

Bitcoin Cash could become a Cardano partnerchain as 66% of 11.3K voters say “Aye”

Bitcoin Cash is the current mania in the Cardano ecosystem following a proposal by the network’s executive inviting the public to vote on X, about a possible integration.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.