The USD/JPY pair rose to a high of 121.76 On Monday, before falling back to 121.50 levels amid thin trading volumes on account of a trading holiday in the US and Europe. This is the third occasion since November 2014 when the pair has closed-in on 122.00 levels.

The first attempt was made in the end-Nov 2014, early Dec-2.14 when the pair clocked a high of 121.67 and 121.83 before turning lower to print a cyclical low of 115.55 in mid-December 2014. The first attempt was the result of the Bank of Japan’s (BOJ) surprise expansion of QE on Oct 21st 2014.

The second attempt was made in the early part of March 2015, when the pair clocked a high of 122.00, before turning lower to set a cyclical low at 118.31 in the second half of March 2015. Since then, the pair was restricted largely in the range of 118.50-120.80, before it broke higher last week.

The third attempt at 122.00, was/is being made at the moment, mainly on the back of a broad based USD strength and a better-than-expected inflation data released in the US on Friday.

Durable goods and US GDP expected to contract..

The USD made a strong recovery across the board last week after Fed minutes failed to alter the interest rate hike expectations in the market. However, Friday’s inflation report that showed core CPI rising at the fastest rate since early 2013 triggered expectations that the rate hike could happen in 2015. Furthermore, Fed chairwoman Yellens also said quite clearly for the first time on Friday that the central bank is poised to hike rates sometime this year.

Ahead in the week, the US durable goods report, and revision to US first quarter GDP are likely to influence the USD/JPY pair. Durable goods orders in April are expected to contract, while the US first quarter GDP is widely expected to be revised lower – into negative territory. With USD/JPY around 122.00 levels, a weak data as expected could trigger a correction in the USD/JPY pair.

On the other hand, a positive surprise could lead to a break above 122.00 levels and push the pair higher to 124.12 (June 2007 high).

Yen may find support from Greek uncertainty

The Japanese Yen or for that matter most of the safe haven assets, including Gold have repeatedly failed to strengthen significantly amid the Greek uncertainty since last couple of months. Moreover, each time markets were convinced about a last minute “kicking the can down the road” deal.

However, Greece once again faces the real risk of default if the deal is not reached before its payments to IMF become due in early June. Greece is scheduled to repay EUR 1.6 billion (USD 1.76 billion) to the IMF between June 5-19, but the payments may not be met as the country runs out of cash.

Markets may remain calm on hopes of last minute deal once again, however, there is plenty of scope for safe haven bond yields to drop. German 10-year bond yield trades between 0.5% to 0.6%, compared to its record low of 0.049%. Meanwhile, US 10-year yield trades at 2.21%. Consequently, Greece issue could see markets once again have a go at safe haven trade – buy German bonds, Sell periphery Eurozone bonds. A drop in the German yields would also pull the Treasury yields lower, thereby strengthening the Japanese Yen.

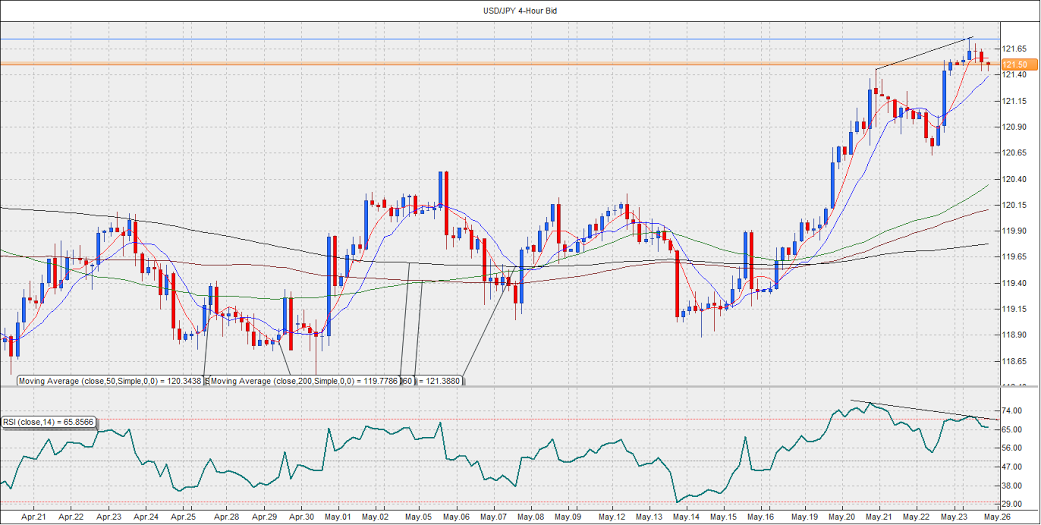

USD/JPY pair technicals – 4-hour chart

- The pair ran into offers close to 121.80 levels today, after the 4-hour chart showed negative RSI divergence.

A break below 121.46 could open doors for a test of 120.62.

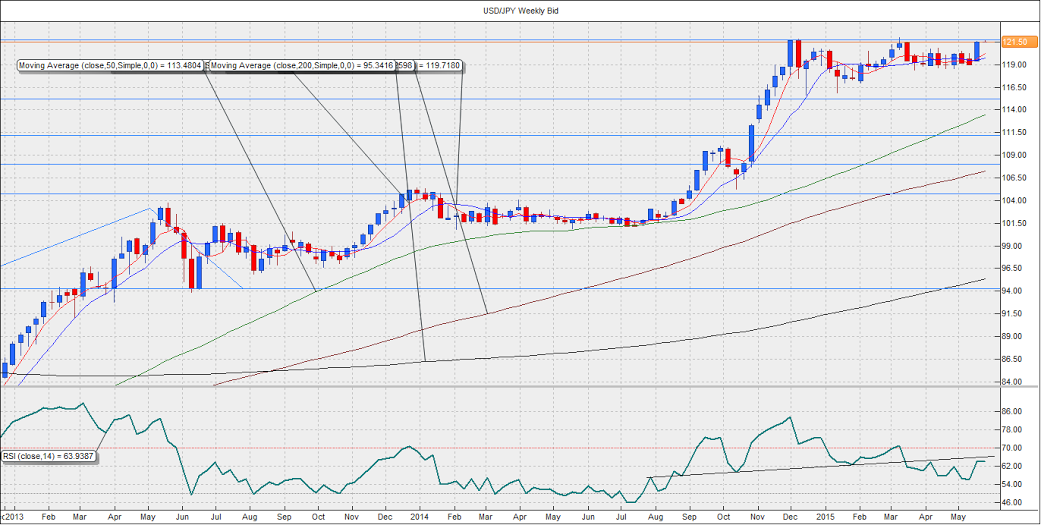

Weekly chart

Pair stuck at 121.75 (100% Fib Expansion of 75.56-103.18-94.15).

Since November 2014, the pair has failed to see a weekly close above 121.75 on twice occasions.

Failure to end the current week above the same could bring in fresh offers.

A close above 122.00 opens doors for 124.12 (Nov 2007 high).

Overall, the pair appears more likely to witness another failure to rise above 122.00 levels. For the next-two weeks the US durable goods orders, US GDP and Greece issue are likely to be the main driving forces. The non-farm payrolls for the month of May could single handedly change the trend in the USD/JPY pair.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.