Default risk and an economy in the throes of an intense recession justified this significant realignment of value. However, it seems that the country might be turning a new page in the wake of the support lent by both the EU and IMF. It is fair to say that default risk for Greece has been moved to the backburner. 2013 is expected to be the last year of recession. The economy has been compressed to such levels that the probability of further contraction is minimal. The Hellenic Ministry of Finance forecasts a return to growth next year after six painful years of recession and an operating surplus that Athens hopes will allow it to return to bond markets for the first time since the debt crisis began. At the same time, Greece is forecasting a primary budget surplus—before counting debt payments—of €2.8 billion, or 1.6% of gross domestic product. For this year, Greece believes it can achieve a small primary surplus of €340 million, its first since the crisis began in late 2009.

In the next five years it’s more likely that the standard of living of Greeks will improve, signaling a rise in domestic demand. Probably not to the pre-crisis levels; however, it’s expected that growth can be sustainable over time. Still there are problems. Unemployment is at record high levels. However, the reorganization of the economy will help a large percentage of them to develop their entrepreneurship capabilities. Consequently it is expected that in the coming years private sector growth could provide leverage to the Greek economy. Further it is expected that the Government sector will become more efficient, and therefore provide improved supervision of the economy and the banking system. Significant changes in Europe are also expected. These include primarily the strict supervision and implementation of the budgets of the Euro-Members. The looming banking union and low interest rates will also contribute significantly to the liquidity of the economy in Euro Zone for the next couple of years.

The Hellenic Stock Exchange will be demoted as measured by the MSCI market indices to the emerging countries. It is important to note however, that compared to other emerging economies Greece has two significant advantages: it is the only emerging market which maintains one of the strongest and most stable currencies in the world, the euro currency. It is also the only emerging economy where listed companies are subject to European laws.

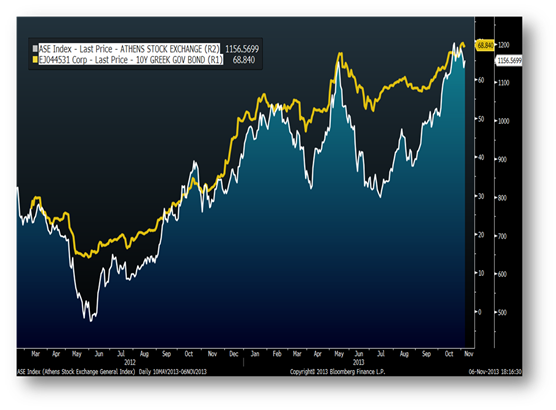

As a result, Greece can be considered an interesting investment opportunity. It is not coincidental that there has been a steady influx of capital to the Athens Stock Exchange during the last month. Trading volume has now tripled. Stock prices have appreciated noticeably in the same time span. The country’s stock index has staged a strong comeback, from the region of 500 units to almost 1200 units, an increase of 140%.

Based on the above, the trend of the Athens Stock Exchange in the coming period is expected to remain positive, despite occasionally periods of turbulence. The shares of the companies joining the MSCI Emerging Markets Index on 26 November will play a leading role. These are the National Bank of Greece [ETE GA], Piraeus Bank [TPEIR GA], Alpha Bank [ALPHA GA], Public Power Corporation [PPC GA], Hellenic Telecommunications Organization [HTO GA], Greek Organization of Football Prognostics [OPAP GA], Folli Follie Group [FFGRP GA], Hellenic Petroleum [ELPE GA], Jumbo [BELA GA] and Titan Cement Company [TITK GA].

The conditions that finally confirm the so-called "Greek Success Story" are very real. Markets see the possible recovery of the Greek economy as an opportunity. Investors seem to concur.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.