EUR/JPY

The dollar traded mixed against its G10 peers during the European morning Friday, in the absence of any major market-moving events. It was higher against NZD, AUD and CAD, in that order, while it was lower against CHF, NOK and EUR. The greenback was virtually unchanged vs GBP, JPY and SEK.

Eurozone's M3 money supply decelerated unexpectedly in May, while loans to the private sector rose from the previous month. The money supply grew 5.0% yoy in May vs +5.3% yoy previously, missing expectations of 5.4% yoy. Meanwhile, loans to private sector increased 0.2% yoy after a flat reading in April. This adds to the evidence that the ECB's QE and targeted LTRO programs may have started to work.

EUR/USD continued its choppy price action and gyrated around 1.1200 with no clear trending structure. Driven by the uncertainty over the Greek debt crisis, the pair reflects the restrained mood of investors before the "make or break" talks during the weekend.

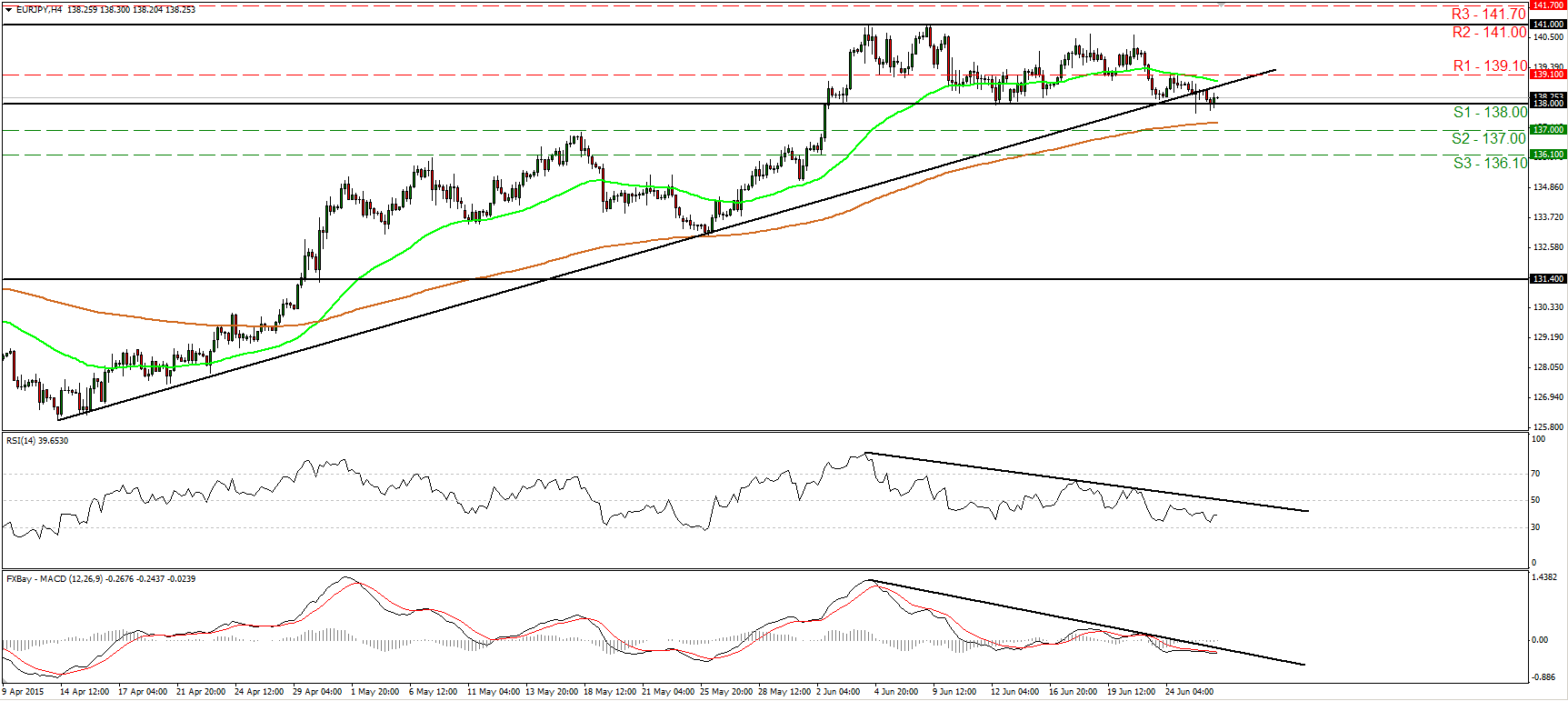

EUR/JPY continued to trade lower during the European morning Friday, and fell below the uptrend line taken from the low of the 14th of April. Now the rate oscillates around the support zone of 138.00 (S1), where a break is likely to open the way for our next support of 137.00 (S2), defined by the inside swing high of the 18th of May. Our short-term oscillators reveal negative momentum and corroborate my view. The RSI, already below its 50 line, shows signs that it could turn down, while the MACD stays below both its zero and signal lines. On the daily chart, the break above 131.40 on the 29th of April signaled a medium-term trend reversal in my view. As a result, I would consider the medium-term trend of EUR/JPY to be positive. I would consider any future near-term declines as a corrective phase of that uptrend.

Support: 138.00 (S1), 137.00 (S2), 136.10 (S3)

Resistance: 139.10 (R1), 141.00 (R2), 141.70 (R3)

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.