USD/NOK

The dollar traded mixed against its G10 counterparts during the European morning Monday, in the absence of any major market moving events. It was higher against NOK and CAD, in that order, while it was lower vs CHF, EUR and AUD. The greenback was virtually unchanged against JPY, GBP, SEK and NZD.

The Norwegian krone plunged after the country’s underlying CPI rate declined to 2.1% yoy in April from 2.3% yoy in the preceding month. The figure fell below expectations of a decline to 2.2% yoy. The headline CPI rate remained unchanged at 2.0% yoy as expected and close to the Bank’s 2.5% target. However, the decline in the underlying figure strengthened the case for a rate cut at the upcoming policy meeting in June, which was first mentioned by Norges Bank at their meeting last Thursday. The soft inflation rate combined with the decline of Brent crude oil below USD 65, and the possibility of a rate cut in June, could put selling pressure on NOK, at least temporarily.

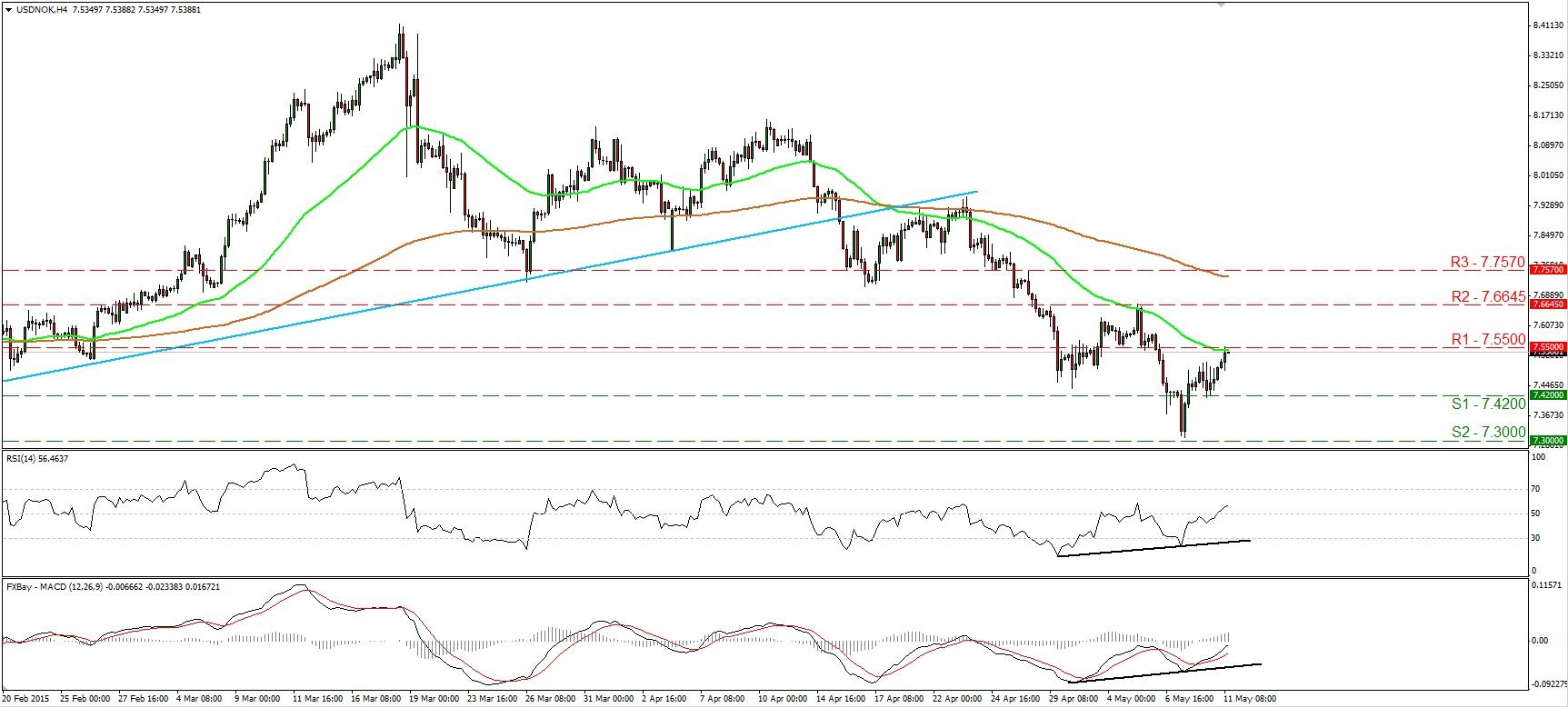

USD/NOK traded higher during the European morning Monday and is currently testing the 7.5500 (R1) line. Although the price structure suggests a short-term downtrend on the 4-hour chart, the upside corrective move may continue for a while. A break above 7.5500 (R1) is likely to trigger the continuation of the positive leg and perhaps challenge our next resistance at 7.6645 (R2). Signs of further upside correction are visible on our short-term momentum studies as well. The RSI emerged above its 50 line and now points north, while the MACD, already above its trigger line, look able to obtain a positive sign any time soon. There is also positive divergence between both these indicators and the price action. On the downside, a break below the 7.3000 (S2) zone is needed to confirm a forthcoming lower low and perhaps signal the continuation of the downtrend. Such a move is likely to open the way for the 7.1400 (S3) obstacle, which is marked by the low of the 11th of December, and also coincides with the 50% retracement level of the 8th of May 2014 – 18th of March 2015 long-term uptrend. As for the bigger picture, on the 15th of April, USD/NOK fell below the long-term uptrend line (light-blue line), something that shifted the medium term picture negative as well.

Support: 7.4200 (S1), 7.3000 (S2), 7.1400 (S3).

Resistance: 7.5500 (R1), 7.6645 (R2), 7.7570 (R3).

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.